$20k loan at 11% interest… dear god.

Clearly they need to take out another loan, twice as big as their first one. Pay off the first loan and use the rest to buy more GME to reduce their cost basis. Meme stonk martingale

lmao even wsb is “dude you’re a fucking moron” for that

could be a troll tho but even if so, you know multiple people did something that stupid so

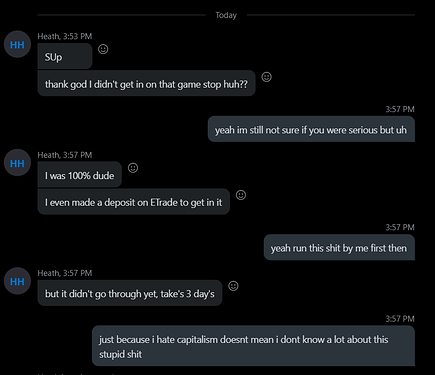

The whole “little guys taking on the suits!” narrative surrounding this episode is looking more and more dubious.

This will probably be what finally pushes TSLA over 1 trillion market cap. If they do another 5 for 1 split on top of this they will easily pass AAPL for most valuable company by market cap this year.

I made a crypto containment thread -

It seems to make all the sense in the world for Apple to make a car, especially an autonomous car. They will sell so much shit on the App Store, not to mention all the data they will collect.

Mr. Gill, you made a preposterous bet that a failing business would experience an unprecedented recovery. Then you made millions of dollars when hordes of redditors inexplicably started buying shares of that stock. Explain yourself.

Congresswoman, my client would prefer to be referred to as Mr FuckingValue.

He should wear a tie with diamond hands emojis on it

They could have a Steve subscription box, with a new Apple car every 6 months (so you don’t need a license plate, just like Steve). The Kardashians will do their unboxing videos and make enough money to pay for the cars.

Rockets IMO.

Show up in a space suit costume

completely forgot about SAVA after that post and its at 122 AH, like 4x since yesterday morning and another 2x since this morning

This is normally @goofyballer’s bailiwick, but Matt Levine continues to kill it with GameStop. (He also has a good discussion of securities litigation, which I am very personally interested in, but it isn’t that funny.)

what I want to read is a detailed oral history of how hedge funds decided to play the meme stocks last week. It was a wild time, and an unbelievably rich test case for investment processes. Like, here is how it’s supposed to go, at a hedge fund:

Analyst: I think the market [undervalues]/[overvalues] XYZ and we should [buy]/[short] it.

Portfolio manager: Why?

Analyst: [Gives cogent reasons relating to the business and market environment.]

PM: Okay but what’s the catalyst for the market to realize that we’re right?

Analyst: [Lays out compelling story about what will change and when.]

PM: Great, but why do you think we have any edge here? Why are we smarter than anyone else?

Analyst: [Points to the fund’s proprietary data sources, advanced analytics, industry relationships or some other source of edge.]

PM: Good job, let’s do it.

Here is how, I assume, GameStop went:[7]

Analyst: I think the market overvalues GameStop.

PM: Ahahahahahahahaha come on man, of course.

Analyst: So we should sell some out-of-the-money call options.

PM: This is the most nightmarish thing I’ve ever seen, the stock doubles every day, why would we sell calls? What is the catalyst for it to settle down?

Analyst: I’ve been reading Reddit and I think a lot of them have poop hands.

PM: I don’t know what that means but it sounds bad. But you are just reading Reddit, right? Anyone can do that, and everyone does right now. What is our edge here?

Analyst: Our edge is that no one else is dumb enough to be in this trade.

That’s my edge dammit. FU hedge funds.