Maybe they think 10-20% of the consumer base will be dead by year’s end?

Bought stocks for first time in my life on Friday. So of course it tanks today. I know it will be fine long term. Just think it’s funny.

I flinched and sold most of my recovery stonks today. I’m still up good money off them, but lost a ton the last two weeks.

I think back to school + delta is going to be a chaotic mess. I still have CCL because I can’t sell or short term cap gains (at least until it drops another 20%). And Delta because I think airlines will be fine. But some kind of inflection point has hit the price of oil, and I’ve never believed in Cinemark or cruise lines long term.

So now I have some dry powder if this thing falls more. Most of my money is still in index funds which I’m not selling.

I may be missing something here, but from that chart it looks like the finding is less about Social Security than other pensions (DB)? The only middle aged people I know with pensions are public employees - is that who they are talking about or is there something I don’t understand? Seems like this is a pretty harsh indictment of savings imo.

They included both SS and employer DB pensions.

If you look at the chart on page 10 of the full report you get a better graphic on the relative size of the pieces. For 40-49 year olds in 2019 the mean retirement wealth is split pretty evenly among SS, DB, and DC. Although the mean is not representative of any particular group.

One thing that might factor in here is that many 45 year old private sector workers have some frozen legacy DB promise from early in their career. Although the pension promised at retirement is frozen, its present value increases as interest rates fall. So 45 year old that was owed $1 of pension in 1999 had a lot less “wealth” than a 45 year old owed $1 of pension in 2019.

It’s a harsh indictment of the capitalist choice heuristic that pretends that you can always get good outcomes by offering lots and lots of consumer options in a for profit competitive market.

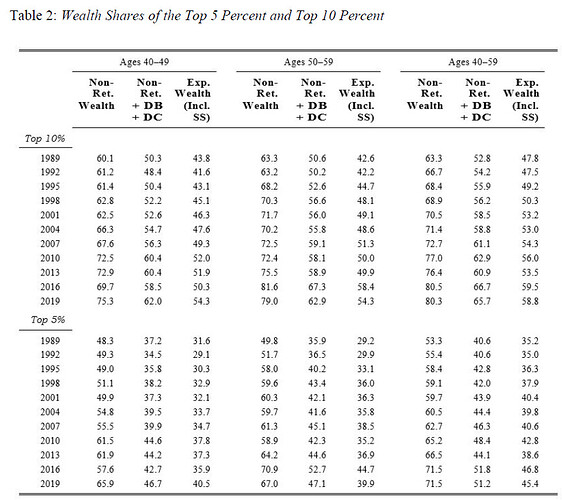

I think there are a lot of different conclusions you could draw from teh report. One interesting table is this one, which shows wealth share of the top 5%/10% over time, and by wealth bucket:

Regardless of whether you include retirement/SS wealth, the top 5%/10% have accumulated a larger and larger share of aggregate wealth over the last 30 years. (That pattern is maybe dampened a little if you include SS, but that point seems so obvious that it’s not worth talking about.)

To me, the more interesting issue is how changes in compensation (namely the decline in defined benefit plans) have changed the way people should be thinking about net worth. Like, it used to be the case that hitting a million dollars was a big deal because it gave you enough money for a very comfortable retirement. But that was implicit on the fairly-high likelihood of having a decent defined benefit plan for one of the family members, even if nobody actually tried to quantify the value of that plan. Now that people are substantially less likely to have a defined benefit plan (see the median values in Table 1 on page 13), that same one million of net worth (even if inflation adjusted) doesn’t provide close to the same amount of financial security because of the drop in implicit pension wealth.

So I think this is causing people to under appreciate how much they need to save in their easily-quantified vehicles (i.e., non-taxable accounts and defined contribution accounts) compared to what people used to save.

This is a salient issue for me because, as an Ohio teacher, I don’t pay in to social security. Which is great, but it also means that my Ohio earnings don’t generate any SS benefits. So I’m constantly aware that when I look at my retirement accounts, the dollar amounts need to be much higher than I would think because there’s no SS backing it up.

Do you not have a DB pension as a teacher?

State pension management in Ohio doesn’t exactly have the greatest reputation. A few years ago they lost a ton of money speculating in rare coins, some of which they misplaced.

This is probably of interest to no one, but I am procrastinating. So you get the ugly details:

When I started, I had the irrevocable option to join the state’s defined benefit plan or a defined contribution plan. So the school would contribute a stated % of my salary to either the DB plan or the DC plan, (and I would contribute a different stated %). I started without tenure, so I thought that (given the probability I would be leaving within a few years) it made more sense to accrue benefits in the DC plan. That all sounds normal, although I think it’s a little weird to exclude people from the federal SS program based only on their participation in a DC plan - it’s semi-privatizing SS!

But that’s not where it ends. It turns out that, unsurprisingly, the state’s DB plan is woefully underfunded. So every month what actually happens is that the school contributes the stated % of my salary in two pieces:

- part of it goes to my DC plan/accont

- the remainder goes to the underfunded DB plan, which I will never benefit from

This generated some controversy a few years ago when the school increased the amount/proportion of “DC” contributions they were sending to the underfunded DB plan. It was very shady - they would tell an incoming employee, “Hey, here’s what we contribute to your retirement account” and have some trivial footnote that’s like, “Of course, you only get half of that amount because the other half is sent to the DB plan. But it’s in your name!”. And it’s doubly shady when that diversion (which you probably didn’t know about in the first place) increases over time. There was a lawsuit over this and I ended up getting about a thousand bucks last year, but that’s a very small percentage of the diverted-to-DB funds I’ve “contributed”.

The most rage-inducing event was when we got an email saying something like this:

This email is to inform you that, starting in June, the school’s contribution to the state DB plan was increase from 3.5% to 4%. As a result, the school’s contribution to your DC plan will decrease from 9% to 8.5% (or whatever, the point being the school was lowering the amount actually contributed to my account by 0.5% because they had to increase the funding to the DB). Although this may sound negative, the school is also increasing your mandatory DC contribution from 5% to 5.5% (or whatever). As a result, you should not be concerned about this change, as your total DC contribution will remain unchanged.

Just absolutely infuriating. I am not generally a punitive person, but I kind of hope whoever came up with that messaging got fired.

LOL that’s absurd. Boomers always win.

Not long ago I had the opportunity to pursue a position at what I imagine is the same institution. This was really tempting because I have family in the area and the department is appealing. One of the hang ups I had was trying to parse the retirement options there, just infuriating. Especially as someone who is already long vested in SS but still plans to work for a couple decades. They apparently claw back your SS benefits somehow if you retire under the state pension although the details on that are a little obscure. I got too aggravated trying to figure everything out and took my name out of the pool early lol.

Yes, at some point I’m going to have to understand how this works, as I accrued a lot of SS benefits prior to moving to Ohio. One of the now-retired guys here used to spend hours talking to me about exactly how the clawback formula worked and whether or not you could game the system. I thought he was a lunatic for investing that much time into something that I didn’t understand at all. But I’m certain to become exactly that same lunatic 10 years or so from now.

Hmm, I feel like there may be a miscommunication here because this makes it sound much worse than it is. How it works, using made up numbers:

School says, “We will pay you $100,000 per year. You will have a DC retirement plan. We will contribute 9% of your salary to that plan, you will contribute an additional 4% to that plan, for a total of 13%. [Super-small text with the DB diversion I described above.]”

What I would expect to happen: I contribute $4,000 (4%) of my salary, school contributes $9,000 (9%) of my salary. So a total of $13,000 is deposited in my self-directed DC plan.

What actually happens: I contribute $4,000. The school’s $9,000 contribution is split so that $6,000 actually goes to my account and the remaining $3,000 is sent to the state DB fund. So net, my account goes up by $10,000. None of my actual contribution (the 4%) goes to the state fund.

I want to be clear that absolutely no one should be feeling sorry for my job situation. Even though I often feel a lot of stress and job irritation, being a tenured professor is comparable to being a federal judge in terms of job security and flexibility. People like me complain a lot about our jobs at conferences, but that’s because if we tried to complain about our job to normal people we’d get rightly mocked for how cushy they are.

It’s like major league baseball players complaining that room service at the Ritz closes at 11pm and why can’t they stay at the St. Regis?

Even so its hard to read this as anything other than subsidy from DC plan members to DB members. Is there any upside to you? Like if the DB plan has 1 in a 1000 luck and fund returns 20% for 10 years and all the boomers die at 80, do you get any of those gains?

Still sounds pretty terrible.

Well, on the other hand you’re subsidizing people that are in an even better position. Fuck that. They’re not giving part of your DC plan to the homeless, they’re giving it to the older DB people that surprise surprise kicked the can down the road in their own DB plan and now want someone else to underwrite it.

I had to make a pretty similar choice but it was pretty easy for me to pick DC since I was starting at age 50. I put in 7%. They match 8%. As far as I know they could be paying more on top of that 8% into the DB plan “in my name”. But they never told me about it, which is clearly the right play. Also they can’t ever lower their match (I think).