Counterpoint

Didn’t get there yesterday but we might today! I can’t believe this is taking off a second time but I’m here for the ride.

Where the hell are you guys buying CATV? I can’t find it on either of my brokers.

TD Ameritrade. you know it’s a good stock when most platforms won’t let you trade it. That’s the man trying to keep us down.

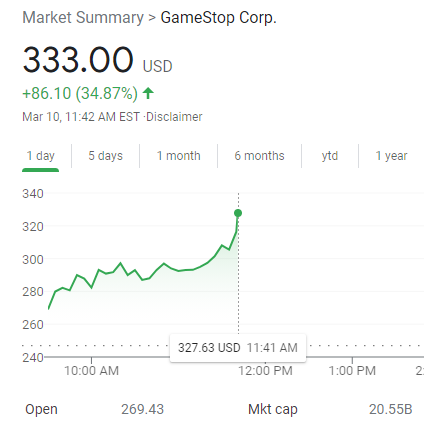

GME now over 300 because reasons.

Td, etrade, IB all should be fine. You would have to use a limit order and prolly pay a stupid commission fee. But that probably won’t stop folks if they are interested in buying it.

Fidelity

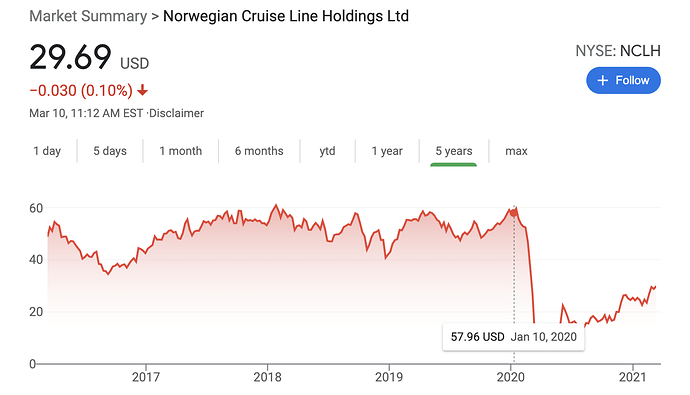

General idea with my recovery stonk basket is to sell around pre-covid level, during the “covid is over euphoria”. But NCLH was at an all time high right before covid. So I might not hold out quite that long with it.

The oil stonks are getting back close to pre-covid levels. I’m hoping the covid is over euphoria hits in the summer and drives gas prices up even more than they usually go up in the summer. Then I’ll sell before fall.

I use IB. The commission for catv wasn’t bad. If you set up an account, you have to click the penny stocks permissions box separately; clicking “all US stocks” won’t select that box. Chart data for catv is on a 10-minute delay, at least with a free account.

GME absolutely ripping.

Over $20B market cap lol

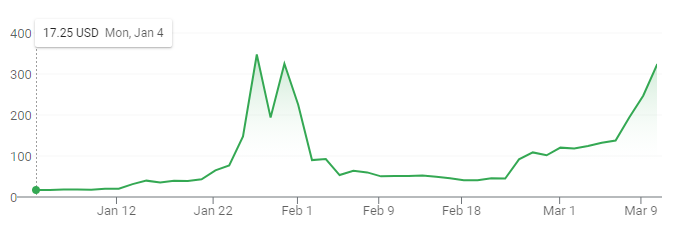

Update on my degen buddy. He ended up selling it all at 135 for a 4 figure gain. Then he bought back in yesterday at 215 and sold today at 285 for about a 10k gain. Now he is waiting to get back in and told me that people are saying it is going to 1000.

Maybe he is right and I am the dumb one but imagine getting out of being down 60-70% or whatever he was at the bottom and doing the exact same thing over again. Insane.

the YTD chart is wild considering this is Gamestop, a store that sells videogames lol

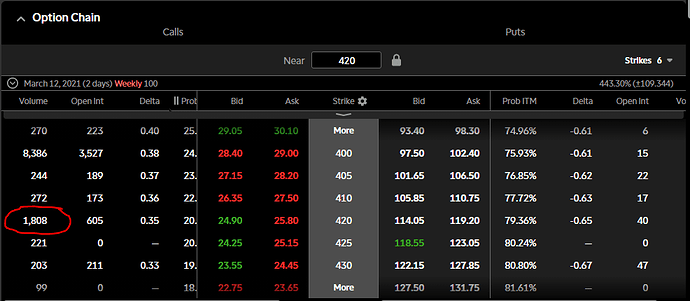

I’m biased as I currently have a position but I think this one could rip higher than the previous squeeze. There hasn’t even been media attention on it yet. There is also an insane number of open call options expiring this week and next that are at risk of getting exercised as this thing rises higher and higher–which could fuel it even more.

My sell price on my current option will get triggered if the price hits ~$420 (for the memes, obv). If it does hit that I’ll probably roll most of the money into an even higher strike just for shits and giggles.

Edit: also lol, lots of people buying meme strikes

Wtf, Gamestop is back at 300? Why is this happening?

because they’ll be on the internet now and people are fucking idiots

Oh my god what the fuck just happened with GME lololol it dropped from 340 to 250 in less than 10 minutes

Live degen update:

(Deleted bc it had my buddies picture in it)

Cliffs are he rebought for his whole account at 300.8

What the actual fuck just happened, though? Like 1000 apes decided to sell at the same time?