Why are I-bonds dropping? I thought they were pegged to inflation? Has inflation dropped that much?

yes

Contagion I guess. I’m confused too but that’s the narrative.

The process is opaque, as far as I can tell, and posted about previously. The TSLA Market / Economy - #9600 by freddbird

From the I Bonds site:

We base the inflation rate on changes in the non-seasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U)> for all items, including food and energy.

I also found this FAQ pdf that further explains it like this:

The inflation rate is the percent change in the CPI-U over a six-month period ending prior to May 1 and November 1 of each year. For example, the earnings rate announced on May 1 reflects an inflation rate from the previous October through March.

I’m trying to understand the previous calculations and failing. If I look at the 2021 October CPI-U of 6.2 and the 2022 March CPI-U of 8.5 , I’m somehow supposed to come up with 9.62% but the math isn’t shaking out for me currently. What does percentage change here mean? Like am I comparing going from 6.2 to 8.5 which is a 37% increase in the CPI-U over the 6 months? Or since 6.2 and 8.5 are both percentages already, am I just subtracting endCPIU - beginningCPIU for 2.3? Either way, I’m a little confused at how either approach arrives at 9.62% and am probably reading something wrong.

Anyone able throw me a life raft here?

I’ll admit, I saw this question, bookmarked it, and expected to come back with a snotty “Oh, this is actually very easy to understand” comment. But they definitely don’t make it easy!

The 2021 October CPI-U of 6.2% that you linked isn’t relevant - that’s the 12-month change in prices, in percentage terms. But I-Bonds are based on semiannual rates, which is not something that’s typically a headline number. So the first thing you need to do is immediately think in terms of price levels, and how they’ve changed over the relevant 6-month period.

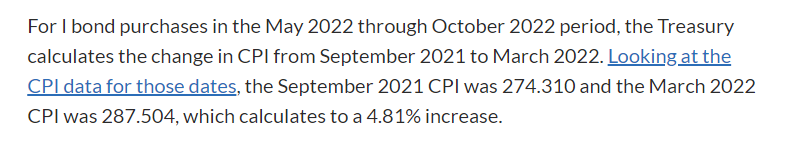

For the May 1st rate setting date, what you want to know is the change in price levels over the most recent known 6-month period. Since you don’t know the April price levels as of May 1, that means you’re comparing the March 2022 price levels with the September 2021 price level. This was stupidly difficult to uncover. If you dig around enough in the BLS website, you get this table:

https://www.bls.gov/web/cpi/cpi-u.xlsx

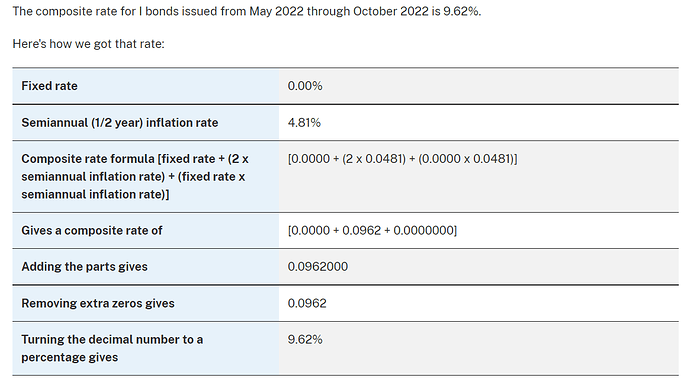

where you’ll see that the September 2021 price level was 274.31 (relative to a baseline of 100 for 1982-1984), and the March 2022 price level was 287.504. So 287.504/274.31 - 1 = 4.81% price change for that 6-month period, which is what the I-bond example website uses to show exactly how the 9.62% rate is calculated.

Edit: goddammit @anon10387340

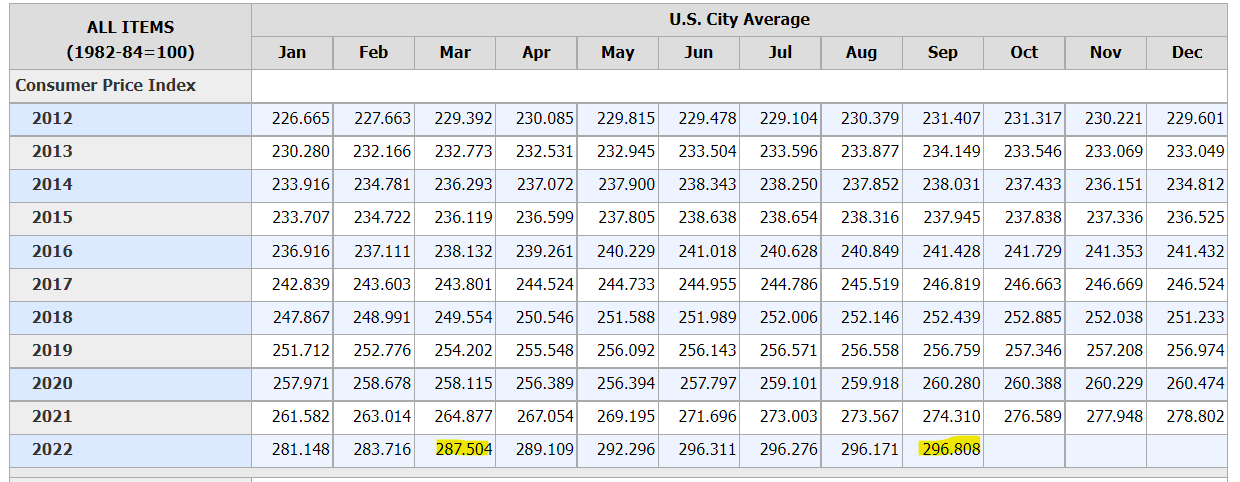

So to answer jman’s question about why they are projected to drop to 6.4 percent, the highlighted are the relevant numbers. Doing the math it comes out to a 3.2 percent semiannual rate, which adjusts to a 6.4 percent annual rate. (And the fixed rate must be assumed to be staying at 0, which is likely a safe assumption.)

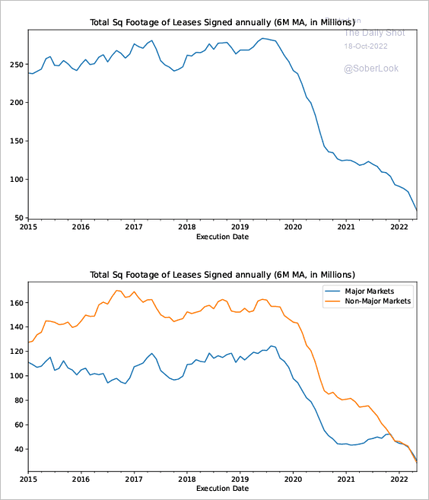

Maybe they should rezone and convert some of those offices into affordable housing. Lol @ me.

I think there will be some of that, but not until current owners default on their debt. With the current debt loads it’s too expensive to convert to residential because the floor plates don’t work. Will probably take several years to play out.

Disclaimer - I don’t really know much about this.

How much of office real estate is owned by people that only own commercial real estate and are going to default on their debt? Here are my two direct experiences with office real estate.

-

My company’s pension fund owns units in a private real estate fund. That fund is a big institutional fund with billions of dollars, it’s our money pooled with a bunch more institutional investor money. The fund owns a bunch of office space, but also a bunch of industrial real estate, retail real estate, and multi-family residential real estate. The office real estate performance has been poor since 2020 and is expected to drag as leases lapse without renewal in the next few years, but the industrial and residential portfolios have had outstanding performance with rents rising. The outlook for the fund is a lot more positive than just the office sleeve, and even if the office real estate does really badly the fund is not likely to default on it’s borrowing because of the diversification.

-

The office building that my company occupies is owned by my company. They certainly would have borrowed a lot of money to build the building, which just opened in the Toronto financial district in 2016, but it’s not like my company needs to collect the rent from that building to repay the loans on that building. We’re a global financial company $CAD 33 billion market cap.

TFW when you yearn for the halcyon days of summer 2020

It depends a bit, but RE loans are not normally recourse to anyone other than the property owner. There might be pools of assets that collateralize CMBS loans or something like that, but normally the owner can default on one building while retaining others. Certainly you wouldn’t expect the industrial portfolio of a fund to subsidize the commercial assets (in part because they probably have slightly different ownership).

Our fund definitely has this cross subsidization. It is designed that way - the fund pools capital, and fund acquires 100% interests in buildings. All of the investors own units in the fund, and we all share equally in the ups and downs of all the constituent buildings in the portfolio. The fund itself as a legal entity is the owner of the buildings - the fund itself borrows money to buy or build new buildings, and it’s not clear to me how the fund could default on one building only. The fund doesn’t borrow against a single property, they borrow against the collective assets of the fund.

Institutional funds don’t often cross collateralize properties. If an office building tanks, they can just give the keys to the lender without any adverse effect on their other assets.

Thanks for this, I am out of my depths here!

Anyway, our fund has only a 15% leverage ratio, which I have always read as meaning that across all the properties in the fund collectively the fund owns 85% of the properties outright and 15% is funded with debt. This is a layman’s way of understanding in the context of, say, my house which has a market value of (guessing) about $CAD X and I have a mortgage balance of something like $X/2 so I’d say I have a “leverage ratio” on my house of 50%. Now, in the fund I guess it’s possible that the fund owns exactly 85% of each building with a mortgage of 15% on each building, OR it could own 85% of the buildings outright and be totally financed on the other 15%. OR somewhere in between.

I’ll ask the fund manager, we pay them hundreds of thousands of dollars in fees each year so they’ll take my call.