I smell a back to the office push from government!

That would be an extremely low leverage ratio, lower than I’ve ever encountered.

Most office buildings are financed at 50-65% LTV. They’re about to get hammered two ways. Cap rates are going up (if cap rates double, assets are worth half - it’s not that bad but it’s pretty ugly). On top of that, rental rates are going down and vacancy is going up so the cash flow will disappear. This is what drives defaults. It’s going to be a blood bath.

15% leverage is pretty weird! I’ve seen 0% leverage and I’ve seen lots of leverage, but setting up what is doubtless a really complicated legal structure for 15% leverage is definitely strange. What would make sense is either:

- Most of the assets are unlevered and there’s one asset class where they use leverage. But apparently this isn’t the case.

- The fund has a credit facility of some sort that’s secured by everything, has effectively 0% default risk, and they’re supposed to use it as a cash flow mechanism (e.g., when they want to buy an asset, they just put it on the credit card rather than calling capital from investors, then they can do one capital call a year to pay down the balance). But it would be strange for a facility like that to get up to 15%. I guess one possibility is that it’s supposed to work like that, but the investment manager has realized they can juice returns a little bit by carrying a perpetual balance and the LPs (ahem) aren’t paying close enough attention to put a stop to it…

That’s a good point, I’ve worked on deals for REITs where they just go get a line of credit secured by all their assets, with a prohibition on project level debt. That seems totally plausible here.

In Atlanta there have been some high profile office-to-apartment conversions (mainly Class B office to Class A rental, lol), and office-to-hotel as well.

Of course, there have also been multiple high profile Class A office projects started since March 2020, much larger in scale than office-to-apartment conversions.

Lol Cramer always

https://twitter.com/cramertracker/status/1582762767517650949?s=46&t=kAobJ7AkVJI17mX3x7KSLw

It’s generally not a good idea to take investing advice from someone whose style is indistinguishable from a sports pregame talking head. THE RAIDERS ARE MY LOCK OF THE WEEK!

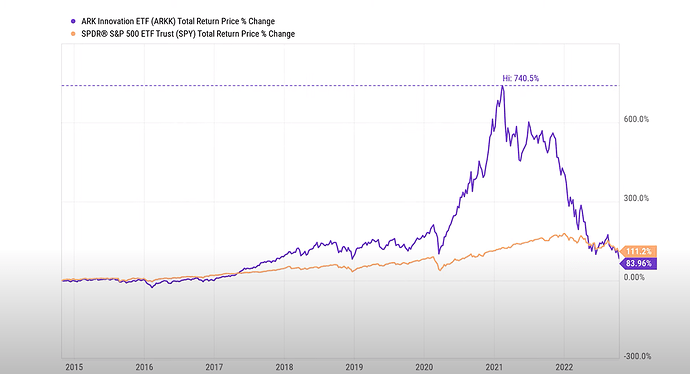

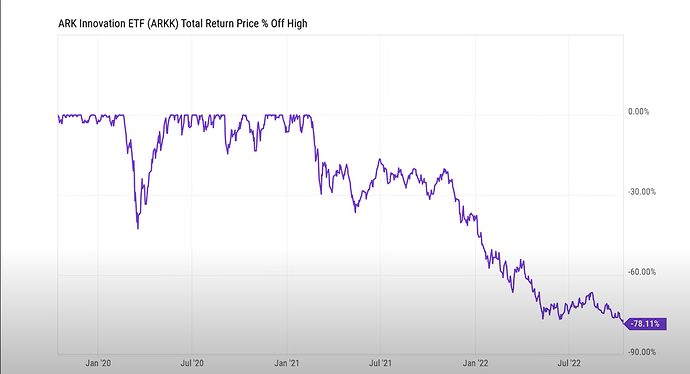

ARKK is now under-performing vs SPY if we track since its inception

https://twitter.com/EricBalchunas/status/1579918192096743425

US Government 10-year yield at 4.24%

Serious question: Over the next 10 years, do we expect the rate of return on the S&P 500 to be higher or lower than 4.24%?

In total or annually?

Man are floating rate borrowers in a world of hurt.

Annually

No guarantees but my instinct is that the market is still likely to outperform. The S&P 500 dividend yield is ballpark 2%, so you really only need modest capital gains to beat 4-5% interest.

I do expect higher, despite my affiliation with WAAF. Especially when we consider that this is a lull. The next year off the bottom (whenever that happens) is going to slap.

it would be easier to accept a guaranteed 4.24% if the market wasn’t down 25% this year. knowing it will take you 6 years to gain back this years losses would be tough to swallow

this is why im not even thinking about selling a penny, the second i do the market will shoot back up 20% and i will be stuck with my measly 4% bonds.