how bad does unemployment have to be before they put interest rates back at zero, at which point everyone will be loading back up on real estate since everyone now knows there is a huge shortage? the slowing of housing starts now is just going to exasperate that shortage in the future.

Rates back to zero in the near term? Like 10%+

It’s working, it just takes awhile. Fed is doing a great job of destroying the economy

Market gapped down 2% and the VIX moved DOWN. I think this indicates that positions where well hedged and there are no sellers left. Interest rate risk is fully priced in and the next leg down comes if earnings estimates come down. We could be a very short time bottom at least until earnings season gets in full swing over the next 4 weeks.

The 30 year paying 4% might be a once in multi-decade high to get a risk free 4%.

Jam all in here?

I’m definitely buying 20 year Treasuries instead of EE bonds next year if rates remain at this level.

Mortgage rates are well over 7%.

Where do I sign up to be a lender?

You could probably find a private fund type of investment where you throw in your capital and it is loaned directly to borrowers. These are called MIEs in Canada, I think, but I have always avoided them. They seem a bit sketchy to me, they’re always issued in the “exempt” market, i.e. to invest you sign the papers that say you are a sophisticated investor that waives a lot of the protections that are provided to investors in normal securities like ETFs and common shares. No thanks.

I guess another option is to invest in some kind of mortgage backed ETF but those still after all these years have the same slice-and-dice securitization problems that they did in 2007. What could go wrong?

S+P Futures green on the day.

Impressive short squeeze over the last 90 minutes!

5% intraday swing, very normal stuff

The US has regular listed mortgage REITs.

They usually invest in mortgage backed securities, not direct lending.

Once the fed gets house prices down, buying houses is gonna be free money, since they can only go back up due to structural shortages in housing supply. How are we ever going to get caught up on housing supply?

There will never be a match of housing supply to housing demand in the US. America always chooses policy to benefit the wealthy few at the expense of the many. US housing policy will be designed to create a surplus of unsustainable McMansions for people that can afford them, and the neglected poorer classes will be expected to make do with shabby rentals, multi generational families sharing living spaces, etc. This is the American way.

Ok boomer!

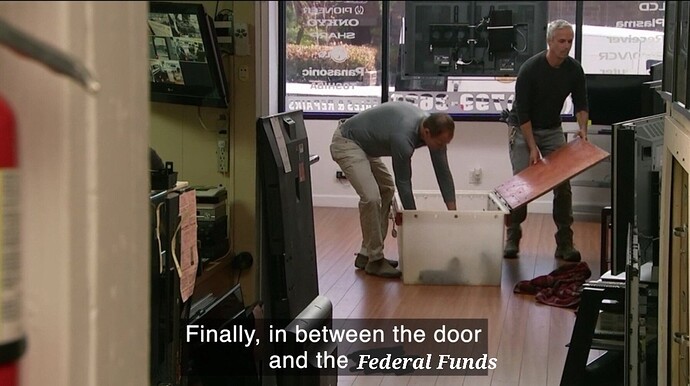

https://twitter.com/washingtonpost/status/1580543915220160512?t=XH9e9kjs7BSkOJs96t9E4g&s=19

There should be more multi-generational families sharing living spaces.

I don’t think anyone invests in whole residential mortgages in the US, at least not agency-guaranteed ones. There’s not a lot of overlap between people who want to own Treasury-equivalent date and people who want to be short weird embedded interest-rate derivatives.

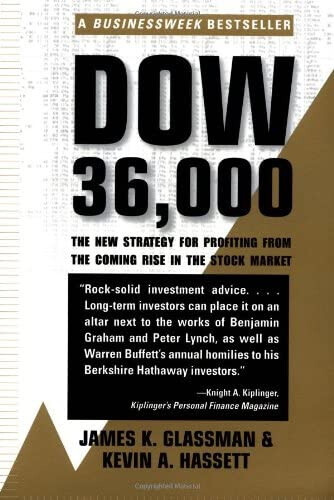

Nothing has ever gone wrong investing in mortgage backed securities.