I definitely knew shit like Tesla and bitcoin was going to tank, I just held out hope it wouldn’t take everything else down with it. Whoops.

I’m sorry, but does anyone actually believe that shutting off autopilot a second before a crash actually means something legally? Seems pretty much like saying you signed a contract with your fingers crossed so it doesn’t count.

Stripe co founder and one of the goat investors. They discuss previous predictions, predictions for the future, advice for young investors and old stories. Best interview of any sort I’ve listened to in a long time

ToC with timestamps in description

Notes here https://twitter.com/JSCCapital/status/1535606430983766016

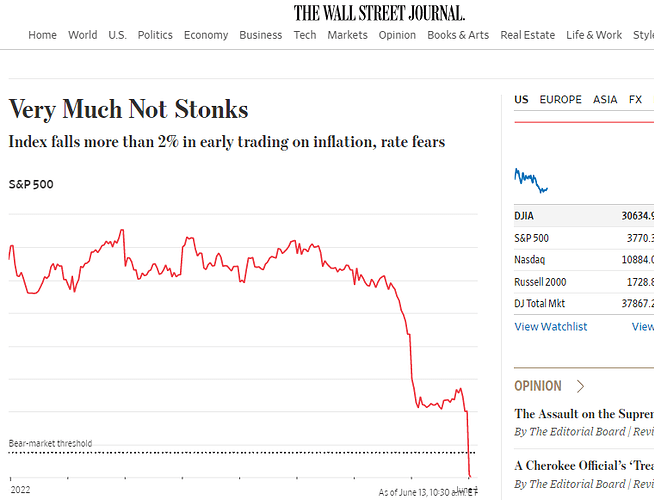

Is crypto tanking the stock market or is the stock market tanking crypto?

This seems like the kind of thing Musk would believe. Tech bros tend to think that every thought that enters their head is an innovation.

The latter. There are 10373818 things that could/should tank equities apart from crypto

QT is crashing both (just like QE pumped both). One reason it’s not crashing real estate too (yet?) is transactions take so much longer.

Would be lol if so but then again bankers are dumb and greedy enough so wouldn’t put it past them.

Yikes. Not a stonking morning I see.

Mr. Biden, tear down these ibond purchase limit walls.

In their self-reported Autopilot numbers, they say “To ensure our statistics are conservative, we count any crash in which Autopilot was deactivated within 5 seconds before impact.” The idea that Tesla derives some kind of legal protection from liability because autopilot causes a crash but then disengages before it happens isn’t sourced to anything, it’s just editorializing by the reporter.

It seems pretty normal that a big chunk of the times AP navigates itself into a crash, it’s going to have an “oh shit” moment and SOS the driver. What else is it supposed to do? AP disengagement isn’t some sinister plot, it just means that AP realized there was a critical situation before the crash happened, but without enough confidence to avoid the hazard or enough time to just stop.

The consequences of an asset price collapse (which we are well into at this point) across the board is going to be so much worse than the consequences of inflation both from a political and a real world perspective. The next dominos to fall will be the housing market and the job markets.

I think Josh posted an article either here or in the discord that mentioned food/gas subsidies would be a much more effective and less painful way to deal with post-covid inflation and that they would be nearly inevitable if the Dems were competent with an election coming up in less than 5 months. The whole lets drive the entire economy into a recession to cure inflation thing is a truly insane aspect of Keynesian economics when you really stop to think about it.

It’s interesting to think how this issue would be playing out with a Trump trifecta. Trump would be howling at Powell by now to reverse course. Trump mostly staved off interest rate hikes through Twitter which is absurd but pretty much reality. As near as I can tell Biden hasn’t made a peep about interest rates rising which is going to have all the obvious direct and indirect negative effects.

Raising interest rates also won’t solve some of the key drivers of the problem. Most notably it won’t end the war or solve some of the post-covid supply chain issues.

I don’t agree. We’re seeing a collapse in speculative crap which is owned by a small % of the population. Housing isn’t going to crash. The broader market is down 20%, which hurts but happens regularly. 8% inflation seems like it has worse consequences.

We have only seen the tip of the iceberg of the knock on effects of this. We are what 2-3 hikes into a series of unlimited hikes? We aren’t even to the painful part yet which is coming once companies start laying people off and the housing bubble collapses again.

I am not aware of a really explanatory model for inflation (causes and treatments). But I am partial to the idea that we are in a wage-price spiral that could be worse than your standard ‘hard landing’ recession that lasts for a handful of quarters.

To me that looks like a lot of speculative assets go down 80%, broader markets go down 20%, and the job market loosens up.

Inflation is bad i don’t disagree there. I just don’t think the current Fed route is likely to work as intended.

Almost every asset class is in a bubble (or was) which yes is part of the inflation problem. The consequences of that isn’t going to be to just laugh at Tesla, crypto and the like. When you unwind these bubbles at hyper speed bad things happen like Bear Stearns/Luna/MBS etc.

I would imagine we also haven’t seen the start of the damage that is going to occur to the normie part of the stock market and the related job market from a 5% fed funds rate or whatever. Companies aren’t going to twiddle their thumbs as their borrowing costs triple. They will need to find the savings elsewhere and as always that will come from the labor market. We have a very fragile economy here imo. It isn’t your typical booming economy it’s mostly built on BS and the Covid free money train which is over.

I’m just not sure that for your average middle class 50-60 year old who has worked their entire life and has their entire net worth in their 401k and their home this is going to end well at all. Seeing those values plummet and the inevitable job losses that are coming are going to be a lot more painful than $6 ground beef and $5 gas. You also run the risk of not coming back out of the other side of this for a long time. It could be a late-70s/80s scenario or a Japan much more easily than a few 50bp hikes will magically fix this.

Crashing the economy will also make the US government deficit even more massive. Raising rates makes government borrowing more expensive. That is both an impending problem and it means there won’t be stimulus coming if we do head into dark times.

yeah it looks like they’re going to have to pick the market or the dollar and they’re struggling with which one because most people yelling at them aren’t in the market but their friends all are.