Sounds like crash is the most efficient way to get there.

Are you telling me the Nazi coffee company isn’t actually worth seven billion dollars?

https://twitter.com/dohobob/status/1528024012084887553?s=21&t=cQywbqdqe5bDVysdk5YfEw

Man I really don’t like losing money but seeing the worst of the worst lose even more brings me a shameful amount of solace.

Heck of a closer to that letter. Now I’m not sure who the bad guys are.

If you don’t plan on responding to my letter and/or promptly preparing an “action plan,” then I believe it’s best you wind down Black Rifle Coffee, return what public money is left on the Company’s balance sheet, and retreat to whatever bunker you came out of to do what you do best – donate money to the Democratic Party and smear conservatives as racists.

In Australia it’s impossible to own a home or have kids without significant parental help single or not! Crazy

Looks like the classic leopard investor shocked to find their face being eaten by leopards, but now with leopard judges having decided that face eating regulations should no longer be enforced. That’s a real shame.

It’s hard for me to look at the graph of the 30 year treasury over the past 45 years and say that the rate has tended to revert to some kind of mean of 4-5%. Furthermore, I don’t believe that the long term cost of borrowing US dollars “should be” 4-5% like some kind of law of nature. I accept many of the arguments as to why the cost of long term borrowing should be lower today than it was 25 years ago.

Stonks are back on the menu?

every time we’ve had a green day the gains have been gone by the next day

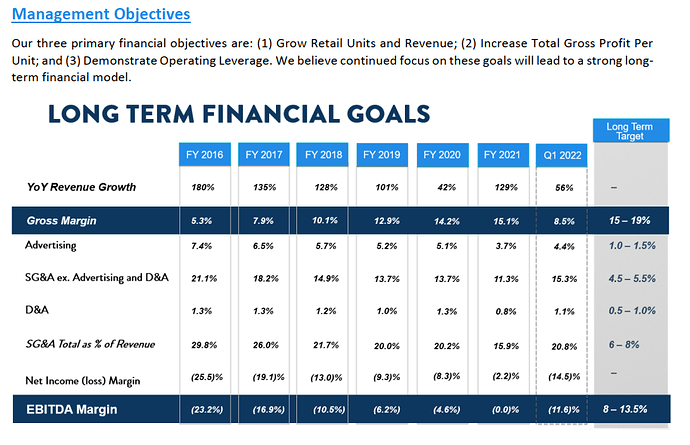

Just noticed @Riverman mentioning Carvana in the Musk thread. It’s not quite as terrible as I thought (I thought they were negative gross profit per car, but they’re just losing a bunch of money per car), but it’s still quite bad.

The thing that I think is hilarious, though, is their long term targets:

Yes, all signs point to gross margins at the 15-19% range while advertising and SG&A drop from 15-20% of revenues to 5-7%. Good thing they didn’t call these estimates!

Correct. Wake me up when the S&P is at 1500-2000.

I’m sure there is a price, but I don’t know what it is. Sometimes you have a company like Google or Apple or Amazon where you’re pretty confident you know what their next 3-5 years are going to look like, and you can come up with a reasonably good price that you’d be willing to pay.

But other times you’ve got a DoorDash or Carvana, where they’re losing bunches of money and where you have absolutely no idea what the next 3-5 years are going to look like, so it almost doesn’t matter what you pay right now. Like with Carvana, if you believe they’ll grow revenues by 100% over the next 1-2 years and come close to those long-term targets, you could easily talk yourself into the company being worth 2-5 times what it’s trading at right now.

Of course, I don’t believe they’ll come anywhere close to those targets and I probably wouldn’t invest it in at any price.

One thing I don’t understand is sophisticated parties buying debt issued by these companies at par. They’re so incredibly volatile and presumably don’t have much collateral. Like if Uber goes busto, what are you seizing to get repaid?

One thing about fixed income and mortgages is that it is so mathematical that traders can get themselves all tied up in math models and fail to see the forest for the trees. This is how you get CDOs and 2008.

It’s not their money, fuck do they care?

You don’t see Bain Capital loaning those dummies money at favorable terms for precisely that reason (in B4 wrong).

Rocket Mortgage spamming my email about “Did you know about our 3% mortgage downpayments?”

International is quietly outperforming US by ~6% this year, thus justifying decades of consistent underperformance.

You may be the only one more pessimistic than me.

They are indeed an Uber lender.

To the other question, you’d own the equity in the business in theory although the docs are so bad that you dont really have the claim you’d want to have (see Envision and Acosta for examples of 1st-lien lenders getting wreckt in part due to bad docs and aggressive investor behavior)