So far I think the one counter to the financing problems is that nominal interest rates are increasing but because inflation is running so hot the real interest rates are actually not climbing. This may be all transitory but at least in the short term the increasing finance costs are being offset by being able to charge higher rents. I guess that probably the death blow to these projects will be if inflation goes back to “normal” but interest rates stay high, and commercial real estate renters stop renewing leases or even start going bankrupt and defaulting on rent payment.

There’s so much fraud in this industry too. I swear, if they bail these assholes out…

Developers almost always have to put their equity in before the construction lender advances any money, so they usually want to finish the project once construction starts. The half built projects happen when the construction lender stops funding the construction loan. Usually they will allege some borrower default to justify this. Sometimes that’s legitimate (the project is out of balance because the budget went up and the developer doesn’t have or refuses to put in additional equity), but often the bank just sees that it will be cheaper to stop funding than pay for the building to get built and foreclose.

For a wild example of how this can play out (and you’re probably familiar with this project), look at what happened to the Fontainebleau in Vegas. Construction began in 2007 and the bank group stopped funding in April, 2009 when the project was 70% complete (and the loan balance was over $1 billion), I believe citing a MAC clause. Carl Icahn then bought it for $106 million and later sold it for $600 million.

Most of the long term debt is off the banks’ balance sheets. It is generally securitized via CMBS or held on the books of big insurance companies. The biggest systemic risk is the maturing construction loans, though underwriting has generally been less ridiculous (but still aggressive) relative to past cycles.

One issue is that there’s somewhat of a cap on how much renters can afford and their salary increases are unlikely to keep full pace with inflation.

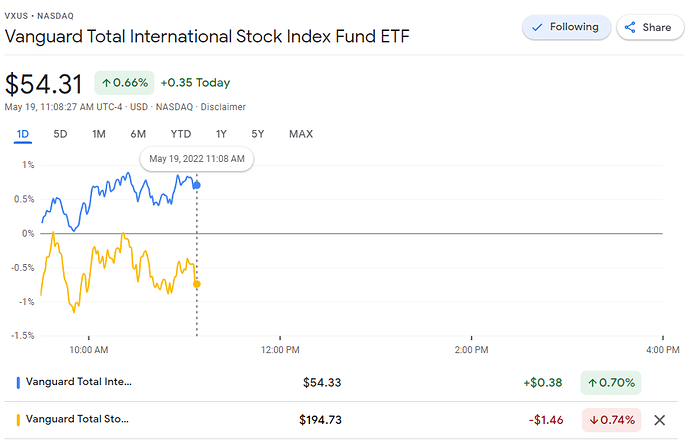

If you were the S&P would you want to be a bear market?

Just bought BVNRY, Bavarian Nordic A/S. They’re the only company with an approved monkeypox vaccine.

They were trading at $6.25 yesterday, I got in at $10.09. The book value was $34.97, tangible book $7.48, NCAV $5.22. But they were losing money. They probably won’t be any more.

Their market cap at $10.09 is $1.42B USD. If we end up having to vaccinate the world for monkeypox, even if only half the western world gets the vaccine that’s still around 750M people. It’s a two dose vaccine, so that’s 1.5B doses. They recently sold doses to the US at $23 a dose. If they can’t produce that much (likely), they’re going to have to cut a deal like BNTX and let a major pharma company produce it. BNTX got 50% of the revenue. Say it’s a little less and they make $10 a dose. That’s potentially $15B USD. That’s $106.58 per share.

Add that to the book value and the current share price, you get $137.81.

The catch: they lost about $9 per share over the last 12 months, or $1.26B USD. If they vaccinated half of all five year olds each year in the developed world on an ongoing basis, that’d be in the ballpark of 15M doses per year, or $150M to $300M in profit depending on whether they were still selling distribution rights.

So this could very well be a one time massive windfall situation, but it still has the potential to be a 10-15 bagger.

On the other end of the spectrum, the US exercised options for $300M worth of doses, but that’s only enough to vaccinate 6M people. If you just see western countries stockpiling enough to do ring vaccination of say 10% of their populations and replenish those stockpiles, the company would turn profitable and at the very least I’d expect them to pop to around their book value of $35. And the downside should only be around $5-6 per share, so this is a pretty good asymmetric bet IMO.

What level do you envision the market trading at in the case of a monkeypox pandemic requiring mass vaccination?

I actually like this Monkeypox play. What’s your exit strat?

Just chatted with my buddy on the phone bouncing ideas on that. I don’t think we’re doing lockdowns again in the US or sending any stimulus, so there won’t be a lockdown related crash on most domestic stocks, with some exceptions like travel stocks. But I do think it could wreak havoc on our supply chain if it spreads widely. I don’t know how to quantify how widely it would need to spread or how quickly, and we don’t yet have an estimate on the R0.

I do think if the R0 ends up being north of 2, that’s original covid territory (2-3 for the original strain), and we’re probably fucked on the supply chains. I think that’s somewhat unlikely, though, and I don’t know how bad it would be at say 1.2 or 1.5.

I could see the market not pulling back much at all, or I could see like a 50% to 75% drop from here.

If this is a false alarm SELL SELL SELL SELL cause it’s going back to like $6. If there are a lot of orders for the vaccine coming in, I’ll be tracking the revenue and trying to keep projecting the numbers. Assuming they sign a distribution contract and we have to vaccinate as many people as possible, $100-140 would be my target, subject to change based on the situation. If it looks like we’re just going to do ring vaccination, then I’m just spitballing here but maybe $35-55.

My hope is that this is a false alarm, BVNRY pumps for a couple days, and I find out it’s a false alarm fast enough to sell for a profit. At the end of the day it’s a good hedge, anyway, so I’m not going to be too results oriented. If monkeypox fucks us and the market drops 20-50%, but 1/15th of my exposure 10x’s, I come out ahead and get to liquidate BVNRY and move it into the market at very cheap prices.

Having another pandemic would cost me way more money in income lost than this trade would make me, so the hope is that it doesn’t happen.

Big Q1 beat for them, they… broke even! Lol

Man, when you’re short a super-overpriced stock, the worst thing you can see is the company monetizing that overvaluation by issuing stock. This is bonkers - do they actually believe they’re worth this much? LOL at me for covering at like $185 or whatever.

I just thought of something. Instead of saving a bunch of money over the last few months and putting it into stonks, I spent it on my trip to Europe. Hooray! Maximum value.

Added SIGA at $10.75, monkeypox treatment stock.