If you want to put a sunny spin on this, the good news is that consumption usually does tail off in retirement according to the research I’ve read.

Mine sure as shit won’t, assuming I make it to retirement.

Yeah spin zone, eventually COVID mutation and climate change initiatives end international/long-distance travel for pleasure so dont have to save up as much.

I’m talking about aging. The overall trend is spending is highest (in real terms) early in retirement then lower later. So people get whacked with long term care costs late in retirement, but generally when people get older they spend less. Its harder to live it up at 85 than 65.

You’ll be too decrepit to travel anyway.

This is actually a good thing to understand for retirement planning. You don’t want to spend too little in your best retirement years and leave a big inheritance to your terrible ingrate children.

I’m went for jumping mostly out (to 50-50 instead of 90-10) way before the big one, and I want to jump back in at reasonable valuations instead of timing the bottom.

Right so they’re hoping inflation solves this for them, but I’m a lot less confident than @boredsocial that it will.

Can anyone explain to me why FXF is down in the last year? I thought the Swiss Franc was nearly inflation proof, shouldn’t it be a safe hedge against inflation? But somehow it’s -4.7% in the last year despite inflation of right around 4.7%.

Same for GLD. -3.7% in the last year, despite inflation. How does that make sense?

Is the only inflation hedge stonks?

gold is more about fear than inflation and we’re not at the fear stage

crypto is tech stonks

I’d say swiss franc would go up in a world war tho

the whole inflation proof thing is a myth, people aren’t going to go OMG buy gold or the swiss franc if prices of food go up.

maybe food is tho so you can buy that, though even my wheat is down a little. Corn is up slightly last I looked.

I hate all the red in the moment, when it’s happening, even if it’s just paper losses. But then when everything turns bigly green for a couple days, I am also bothered because I wish I was still accumulating stocks on sale.

I should implement some type of self-punishment for checking the market daily, or intra-daily.

My wife checks literally never and I am so jealous.

SPY ATH within a couple weeks prob, lol stonks

Maybe they’ll short your pony.

I even thought of making a Riverman joke in their somewhere when I made the post.

gogogo

I mean, in the case of the Swiss Franc that’s not really what I’d need to happen, right? Like if one Swiss Franc buys 1 loaf of bread, and a dollar buys 1 loaf of bread, but in a year it’s 1 Swiss Franc for a loaf but two dollars for a loaf, the Swiss Franc hasn’t gone up in value, the dollar has gone down, but now 1 Swiss Franc = $2.

Am I missing part of this?

(Obviously that’s a pretty extreme example and not reflective of the actual price of bread, but I think it illustrates the concept I’m imagining.)

Now here’s a value opportunity. US Steel (X):

I got in at $21.28 this morning.

P/E ratio TTM 1.45

P/E ratio forward 2.3 (even if they miss big it should be below 10)

Book Value is over $33

Tangible Book is over $28

They have a tiny dividend, but they’ve got $600M allocated for share buybacks this year, up against a market cap below $6B.

They benefit from the following likely events in 2022-23:

- Car manufacturing ramping back up (but won’t get back to full capacity til 2023)

- Reshoring for supply chain stability

- Rising Chinese wages → reduced cost-benefit of offshoring → another cycle of reshoring

- Sustained high levels of new housing being built

- Infrastructure spending (spread over several years)

But not a “Ben Graham” value opportunity?

His definition changed over time, by some of his definitions, yes. By the one I use, it hits 5/10 criteria and 7/10 triggers an automatic buy. It’s very close on an additional 3/10, though, so that combined with the outlook for 2022-23 is why I moved on it.

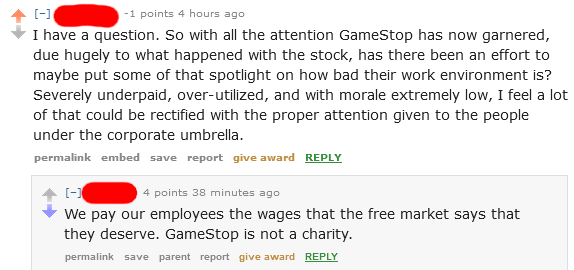

Behold, the maximum amount of cringe that can fit into 4 words:

The guy saying “we pay our employees” isn’t a GameStop exec, just a GME bagholder. His ~5 shares technically makes him a part owner of the company, therefore he’s going around talking like he’s the one paying the employees’ wages. He’s being dead-ass serious and this is common behavior in the GME cult sub.

GME/AMC is probably the straight-up dumbest bubble I’ve witnessed. It’s right out there in the open that Reddit is pumping the stock for lols and yet idiots still held on to their bags all the way down.

The AMC piece probably saved the business but was also just a straight transfer of value from whoever bought those secondary offerings or those buying in the secondary soon after directly to institutional investors who owned AMC corporate bonds. Congrats on democratizing finance by funneling joe sixpacks money directly to Apollo or Bain Capital or whoever was in those bonds.