So they should just let him steal the truck?

Lol some guy started an ETF to bet on the exact opposite of whatever Cathie Wood’s fund buys and it’s already 2x’d

So he’s just shorting whatever she buys? Link to info?

Recession is canceled, let us continue stonking

This is sort of a cross post from another thread but I could use some help.

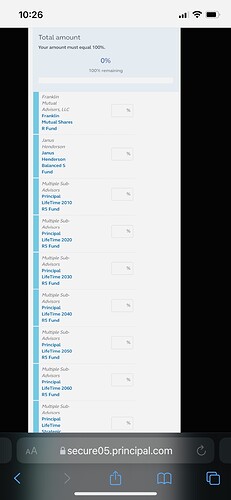

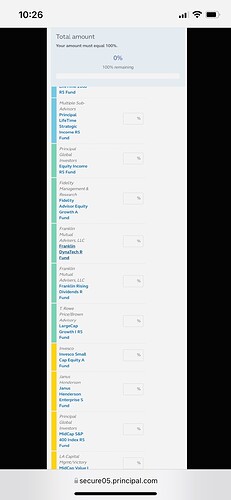

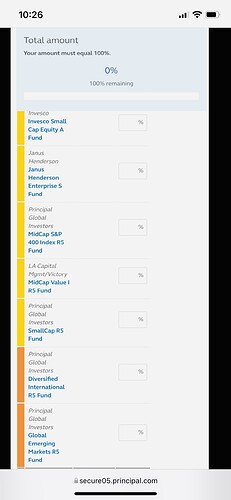

I received a retention bonus that equates to something like 25% of my net worth. It’s vests equally over 3 years but I can’t withdrawal until 2024. I have to pay back nonvested amounts if I leave. The funds I have available to choose from all seem relatively bleh (I love you vanguard).

Part of me thinks I should be more conservative with this due to its vest schedule and it’s lump sum payment to help with a future house purchase but the other part of me is saying STONKS.

Here are my options. All have higher fees than I am used to.

If you plan to buy a house in 3 years or so, it’s not unreasonable to set aside most or part of a down payment in a fairly low risk allocation.

What’s going on today?

- Pandemic is over!

- Recession fears are over!

- Inflation is over!

- The blow on Wall Street is extra good today!

- Stonks are back!

0 voters

Gonna wait for the close to see if the market is up or down.

What if this entire bubble is fueled by cocaine? Where’s Michael Lewis when you need him?

What is the tax treatment of the plan? If it’s an unfunded plan where you get taxed when you get paid, you probably want to rebalance so that you have something conservative in the plan and things likely to produce big gains are elsewhere. Of course, if there’s a real risk that you won’t get the cash, then it’s not really appropriate to put something that’s supposed to be a low risk part of your allocation in the account.

You left out option 6 - people with a choice of where to put their money have not options better than the overheating stock market.

If inflation was -1% or if bond yields were +5% or something, these sell offs would be more sustained.

Correct - the amount will be payed to me via payroll with normal income tax and deductions in 3 years. The risk of my leaving or getting fired is incredibly low.

I mean this has to blow up in everyone’s face sooner or later, doesn’t it?

Valuations aren’t completely stupid for everything, just a lot of stuff that gets a lot of attention. GM currently trades below a P/E ratio of 7:1. JP Morgan is under 10:1. There are lots of not ridiculously priced companies earning lots of money.

They have a lot of debt and declining earnings, so even at a P/E below 7, they don’t meet the requirements for a Ben Graham value stock.

As for JPM, I have a built-in lack of trust in the financial sector’s bookkeeping since 2008-09.

Every week I consider that I’m just an idiot and I should just pile it all into the S&P and ride it out, but it seems insane to me that there is not a better investment than an overvalued stock market that most people seem to agree is overvalued. Like most of the stuff I expected to happen over the last couple years has happened economically, but the stock market gives but a few fucks.

Of course these things can take time, the tech bubble took a long time to unwind. The problem remains that inflation is going to continue to wreck me, and I can’t figure out a proper hedge. I put 5% of my portfolio into GLD anticipating inflation, and GLD is DOWN in an inflationary environment. So is BTC, which I expected to be like digital gold.

It seems like the market has decided that the only inflation hedge is STONKS STONKS STONKS.

Surely there is. What it will be, I have no idea.

The better investment is going to be jumping out if the market right before The Big One and then buying back in at the bottom. This isn’t really an executable investment strategy but people will try.

It has to blow up in someone’s face. Will the power brokers let it take down their rich friends or will they let the anonymous lower class bear the brunt of the pain. Only time will tell!

These are all hard questions. Im plenty invested because I dont see better alternatives, but expect negative real returns through retirement on everything Ive invested in over the last several years and am sort of life planning accordingly, just assuming a dollar of savings translates into 90 cents or w/e of purchasing power in 15-20 years.