Well a lot of that money came from hedge funds that got short squeezed right?

AMC was going to need to restructure/bond holders take a haircut until the money fairy came in with people just handing the money cash for close to worthless equity. Bonds rallied like 30-40 points and negotiations between company and lender over having to put in more money went away because instead of the company having to raise expensive superpriority debt or debt holders having to dilute their claims or w/e (which is where it was headed) the company could just sell overvalued equity to idiots in secondary offerings.

Not as brazen as when Jefferies and Hertz tried to sell equity in a company in chapter 11 proceedings, but regulators should have honestly stepped in and killed it, these kind of things are worse then any of these pump and dump bag holding games IMO.

Also, a big chunk of AMC’s debt was convertible, so the increase in stock price resulted in that conversion being in the money, and it didn’t have to be repaid at all.

It should probably be lower than that. Their modern vehicles are hot garbage, cheaply made with zero quality control. As more consumers (and Scotty Kilmer subscribers) learn never to buy another GM product, their stock might suffer.

Just trying to follow TSLA’s example on the future of autos IYAM.

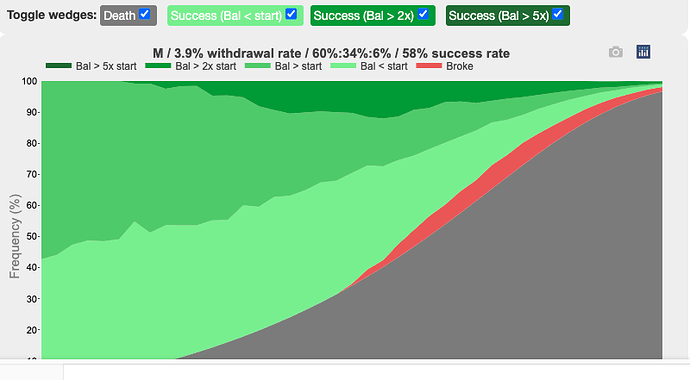

There’s also the high likelihood that you will be dead before you run out of money:

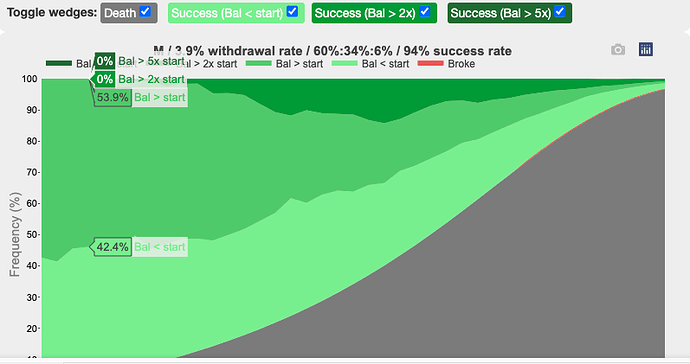

If I add in 20% flexibility in spending, the red wedge disappears:

Both graphs are for a 40-year retirement (I should be so lucky!) not including Social Security.

The top 2 brands for initial quality are gm brands. 4 of their 6 brands are above average

https://www.jdpower.com/business/press-releases/2021-us-initial-quality-study-iqs

You mean buying shitty overpriced stocks didn’t stick it to the man?

Sure, they’re good for the first 90 days according to that survey. Ask those same people 3 years from now. Some of their engines will have already gone to shit. Some people might have oil leaking all over their driveway after only driving 300 miles.

Edit: and I wonder how satisfied the Bolt owners were lol

GM brands do well in those types of rankings too, and cars as a whole are ludicrously more reliable than they’ve been in the past. I really don’t care about the valuation of GM, but the stuff about reliability isn’t based in fact.

edit to add: and I grew up hating GM.

I’m still pretty happy with my 5 year old Chevy truck and if I were in the market for a new one I’d probably buy the exact same thing.

Yes I agree with all that. I am a pension actuary by training so I do a lot of modeling like this.

In practice, the probably distributions don’t help an individual that much. No one gets to run their retirement 1,000 times so the fact that tail events probably won’t happen to you is of little value to the people that get exposed to tail events. One of the most basic observations that is useful is:

Age 65 life expectancy is (ball park) 20ish years (probably more like 22 for relatively affluent people) but the standard deviation of age 65 life expectancy is about 8 years. That’s a pretty big range and even though the distribution is not normal, it does give you a clue that you need to plan for a wide range of possible life expectancies. I think it’s probably more useful and practical for someone to have a plan for what happens if you live to 70, 75, 80, 85, or 90+ than it is to know you are X% likely to not run out of money. Even if you know that, you should still plan on what to do in the 1-X% scenario, rather than hoping it won’t happen.

The remaining bagholders are just the stonks equivalent of q-anon, in fact there might be a large overlap. They’re true believers. When it comes to GME, some believe in the fundamentals–something something Ryan Cohen is a supergenius who will transform the company from a dying brick and mortar chain to “the Amazon of gaming” by harnessing the power of NFT’s. Others just think the MOASS is coming, one that will make the previous squeeze look like a blip. Both hold the conspiracy theory that the price has been going down because of naked/synthetic shorts and that shareholders haven’t been selling. Yet they also claim to buy every dip. If no one is selling shares, then from whom are they buying? If you ask them that, you’ll get banned from their sub.

A while ago, Ryan Cohen tweeted a four emojis in this order: cone, poop, tear, chair. The GME gang interpreted that as code for Computershare, a message to apes that they should direct register their shares using that service. That’s when the whole DRS thing started. GME apes think the catalyst for MOASS will be when 100% of shares are direct registered, allowing apes to name any price they want when short-sellers are forced to cover their suddenly exposed fraudulent positions.

I may be missing a few details; it’s hard to keep up because I can actually feel my brain cells dying when I try to read their drivel.

I haven’t ventured into the amc bagholder sub to read the AMC thesis, but I imagine it’s similarly dumb.

Making your shares less liquid to own the shorts, smart, man that thing is gonna get ugly if it collapses.

Scotty Kilmer says all those rankings are bullshit, that JD Power etc are advertising firms. He knows people who were called up for a survey, and when they said bad things about their car, the interviewer simply hung up. Scotty is a mechanic and actually sees the cars people bring to his shop and the problems they have. He sees a lot of young GM cars in his shop having problems that such young cars shouldn’t have, problems that a Toyota or Honda wouldn’t have at that age and mileage.

IRL I’m friends with a mechanic who says the same things as Scotty about the various brands. Take all this for what it’s worth. Personally I trust mechanics’ opinions over some surveys featured in car commercials.

So much for the Jan recession, tech crushing, Google up 7% AH and announced 20-1 split

lol, its up $400+ since the low last week

SPx going to 5000 rofl. Rate hikes mean nothing the Ponzi goes on

There was never a doubt. Recall this article from years back when they say the quiet part out loud. Even if the market starts to drop too much, the fed can print more money and buy stonks to keep the Ponzi going. It’s going up forever, just gotta accept that and keep piling in, or be left behind if you’re holding cash.

https://twitter.com/wallstmemes/status/1488626162494488577

PYPL is the one I sold recently but really wish I look more often cause it hit 300 and I had no idea would’ve been a turbo dump sad

7 days ago

VOO 416