You’re thinking of Betfair. They are still around, but there is a reason they’re not taking US action.

They disabled it a while ago but you could connect a bluetooth cadence sensor and even a heartbeat monitor to whatever device was streaming peloton and peleton would display it.

Thank you for this. That was fun.

Tradesports was the one I was thinking of. I had to dig through old emails to find it.

At minus 1-2% every day we could be at those dire predictions in a few weeks.

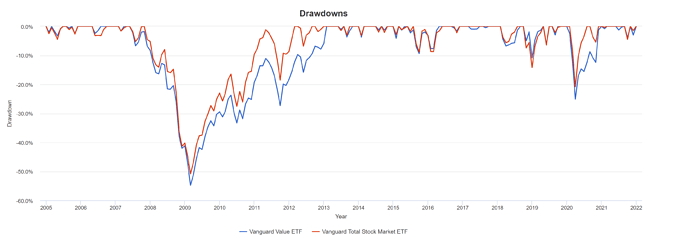

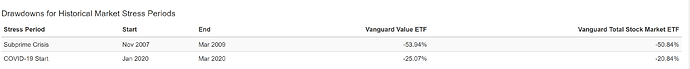

Vanguards value ETF only down 2% YTD, that might be the way to go if you are worried about a crash but dont want to be holding cash

Versus (Fairly Recent) All-Time Highs:

S&P -8.8%

DJIA -7.3%

QQQ -3.8%

AMZN -24.4%

DIS -32.4%

TSLA -24.1%

MRNA -67.8%

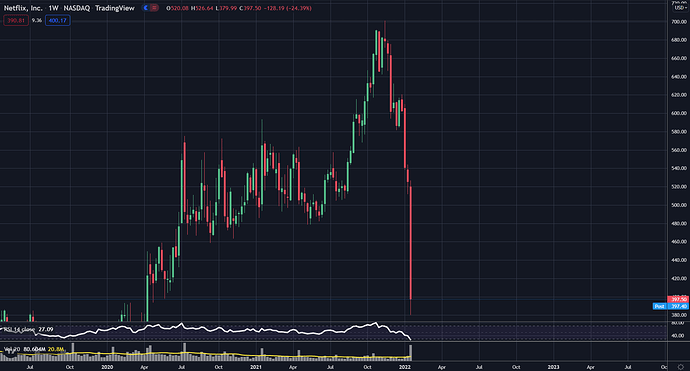

NFLX -43.3%

AAPL -11.3%

It’s happening?

Why?

2 HOURS AND 18 MINUTES?!?!?!

in the event of a crash i think the companies with P/E of 15 would drop less than the ones with a P/E of 300. i could be wrong though.

Yes, you are wrong

On average I’d say he’s right, though it’s not universal and they aren’t immune to dropping. But they should drop less. Whether that’s 25% vs 35% or 70% vs 90% or 25% vs 90%, who knows?

They should also bounce back quicker, again lots of variance there but broadly speaking.

During the crash in 2020, KT dropped 30% vs the S&P dropping about 33%, and made it back by early June vs early August.

But also if a value stock trades at a P/E of 15 with a dividend yield of 2-5% and only goes up 2-5% a year, even if it crashes at least the dividend is going to be unchanged if their business is unchanged.

So there’s a few ways value can protect you in this situation.

There is no theory backing up a statement that a value ETF will or “should” perform better in a drawdown. At a bare minimum, we can look at the exact ETF he is recommending to protect in a drawdown versus total stock market for the entire duration it has existed. There have been two major drawdowns and it performed worse both times.

The theory tends to actually run in the other direction. Value stocks’ future cash flows are discounted more heavily because they are more uncertain and their capital structure more precarious. Periods of economic distress can therefore be harder on these firms.

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.386.738&rep=rep1&type=pdf

I fucking loved tradesports/intrade. It was the best thing Americans ever had for political markets.

the fed is committed to raising rates slowly, with the plan known well in advance. i think they must feel confident that market data they are collecting is well within their model and they don’t have to cause a recession, if they can just gradually slow it down to some target. presumably target x% growth and y% inflation.

it used to be much more flying blind exercise, but now it’s an almost live minute-by-minute analysis of bond trading, so they must feel QE being phased out isn’t spooking anyone into making a tack. at least so far.

raising rates .25% per quarter upto 1% isn’t really game-changing for either side, credit is still cheap, growth shouldn’t be constraint either. historically, those are fairly light touches. of course, inflation could surprise again, but there really isn’t any market expectation that it will stay above 6%. like, fox news pundits are screaming for double digit inflation, but i have not seen any “sharps” take a wager on a correction happening.

we’ll see next month, when inflation numbers are released again

Lol going with the Gamestop model I see.

Here are some ideas for the Netflix NFTs…

Although they may run into some licensing issues with that last one.

Historically, movies and other cheap entertainments do well in recessions. Kinda wonder if markets tanking might actually be good for Netflix in the long run.