I very much doubt this is a significant factor. Most people will buy a house if a) there is any way they can cobble together the monthly mortgage payment and b) they are terrified of losing out on the opportunity to get a house as prices keep climbing. These two factors have to drive at least 90% of outcomes. Low interest rates and FOMO make people buy, stock performance (if relevant at all) would be a very distant third at best.

The supply shortage angle on housing is extremely regional. It’s for sure true in the markets that have significant population inflows, but it’s a lot less compelling in places where the population is shrinking (not CA, CA is largely shrinking because the creation of additional housing stock has been too slow for decades).

If you live in Austin it’s extremely obvious that there aren’t enough new houses being built to accommodate the demand for new houses… and prices are still low relative to similar places.

The other issue is that nationally we’ve basically ceased building smaller more affordable homes.

This is a problem for us. We want a new or new-ish house but something along the lines of 1800-2000 sf. And a high quality build with a view. Everything starts > 3000 sf and most new developments won’t build smaller even if you ask. That’s assuming you can even secure a lot amongst all the competition. We almost had what we wanted (settled on 2200 sf because that was the smallest they would go) but that development got postponed several times due to permit issues before we could lock in the price, and in the meantime the price increased from ~ $450k to ~ $700k lol. We bailed on that but I recently checked and they still don’t have the permit issues worked out.

And my area (northeast) has had a small net loss of people annually for a long time. I’m not sure if that has reversed, but we are certainly not having a large influx of people like some areas down south and some parts of Texas/Arizona, etc.

Zillow has had our current house falling in value for 4 months in a row now, so perhaps things are cooling off around me. Or else maybe they figured out that my house is truly a piece of shit.

I’m interested to see what happens with commercial property as more companies fully embrace WFH. Does any of it get converted to residential? Would it be enough to impact the market?

This is not always a distinct issue from restricted supply. If you can build as many housing units as you want to, you want to build every house you can profitably sell. But if you can only build 100 houses, you maximize your gross profit by building the 100 salable houses that you make the most money on, which are likely going to be high-end houses.

Right, I was replying strictly to the comment that we’ve ceased builder smaller more affordable homes. But you are correct, they don’t want to build the house we want, because somebody else wants a house 2x the size on the same lot, and they make more money on that house.

There has been an insane glut of commercial break estate since the 08 crash and nothing seems to happen. Buildings, properties, strip malls sit vacant for years to decades with no change. And more constantly being built somehow.

My guess for that is capital keeps selling it to each other/themselves under different corps and doing shady depreciation shit and resetting timers. With no outside pressure they have no effect other than to be ‘available’.

Home prices are rising/have risen substantially everywhere right now, not just in places like Austin.

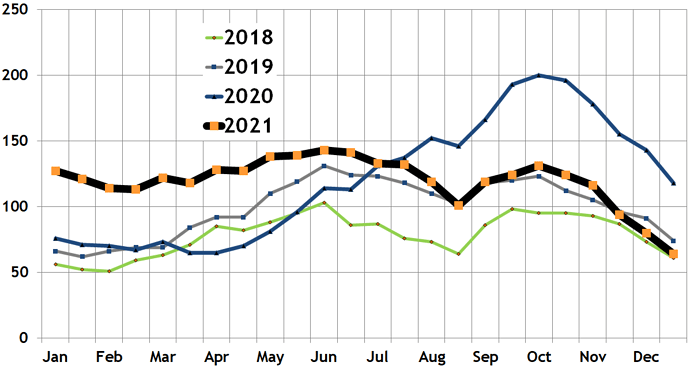

I’m looking to buy in (downtown) Boston in the next few years. One of the few places where the market is in a downturn, lucky for me. Down 10%-ish in my neighborhood YOY.

Supply is going up too (though trending down), nobody is moving into downtown areas

Where are these graphs? Curious about the data and applying it to my locale.

Each Boston neighborhood has one. Not sure about other places

There is such a severe shortage of smaller new builds. I really don’t need or want a 4,000 square foot house. Just give me more 3 bedroom 2,800 sq foot options.

Same thing in Chicago. We’re looking to buy in the next year in the city and every new-ish build is like 4k+ square feet.

I think it’s a generational thing. Olds fucking love massive houses they don’t use.

it’s driven from the supply side as well. developers in seattle and elsewhere on west coast figured out the modern boxes maximize sq feet for the lot size and materials, which brings in more money in a market that is going bonkers. people tried to stop it at the zoning board and got laughed out of the room. lol aesthetics.

I need to find it again, but for a while there was a fantastic Twitter account that would basically chart Chicago suburb and exurb McMansions and basically every one was like:

6 bed/4.5 bath house on golf course. Built in 1996 for $550k. Sold in 2001 for $950k. Sold in 2006 for $1.4M. Sold in 2010 for $1.1M. Sold in 2018 for $600k.

Very much NOT STONKS lately.

In Ohio every suburban house is worth the same as 20 years ago. Like maybe 20% appreciation or something stupid. And you’re paying high taxes, insurance, etc. along the way. To your point, the expensive ones are often worth less.

notsureifserious