sounds like the perfect danny from laser tag. Lazer Base | Breaking Bad Wiki | Fandom

that’s an illusion. you think he’s not concerned about money, when in fact someone with money is supporting his entire enterprise. so your example is irrelevant to my larger point that whole industries are organized like consumption economies. maybe you intuitively felt like there are some internet points to be scored by laughing at the excesses of american capitalism, and “consumption” sounds like it’s right out of das kapital. we’ve both been trained to hear that dogwhistle from childhood.

but you are getting very much off topic, so i’ll ignore your silly navalny comment. except to say that fbk exposed raldugin, who is very much a tsiskaridze cohort, and helped proved that he was literally helping putin embezzle billions of russian dollars into offshore accounts.

what does ratio mean on the y axis? what are we looking at?

Is the last 100 years of the stock market really relevant anymore?

Since 1980 we have global markets (China) and computers/tech and it has largely been a 40 year bull run. I feel pretty comfortable not giving a fuck about anything prior.

The price of the S&P 500 divided by the M2 Money Supply (in billions)

I think it is the ratio of the S&P index number (like 4,500ish today) over the M2 money supply in billions (something like $20,000 billion in 2021). The observation is that even though the stock market trends exponentially over time, it actually moves (very roughly) in line with M2. The implication is that stock market growth isn’t real, it’s an illusion caused by pumping the money supply and having that flow into stocks. I don’t think the chart “proves” that, but it’s an interesting observation.

Ok, I was under the impression that stonks were still considerably beating inflation not just breaking even.

When I look around me, I see lots of growth and a better everything.

The increase in M2 is the increase in money supply, not the increase in consumer prices.

ok, so then why do we care?

As investors, we should probably be a bit worried if growth in stock portfolios is attributed primarily to monetary policy and not the productive power of corporations to convert capital into good outcomes for investors. That would run against the basic principles of investing in equity markets. Although obviously investors can get away with this risk for a long time, like maybe all of the decades that a person is in the market.

As people with political opinions, we probably should care if the main outcome of this monetary policy is to boost the financial outcomes of people that invest in stocks, something like 90% of stocks are held by 10% of the population. Lots of us think that inequality is bad and government reinforced inequality very bad, so this would be another problem area if stock market growth isn’t actually coming from productive economic growth.

if you take any individual net-worth, what they have in cash/checking accounts/tbills contributes to M2, whereas what they “have” invested in stocks contributes to S&P. like the chart graphs some average of everyone’s personal allocation over the time period. so it’s interesting but doesn’t really answer anything, since strictly speaking the number of people holding these assets grows over time, and it hides the far greater difference is that the 1% hold far more in stocks than M2, whereas poor hold almost nothing and entirely in M2 type assets.

/IANAE

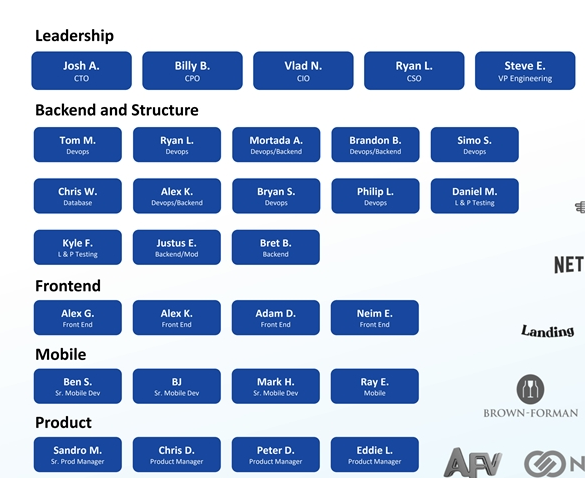

Per national treasure Matt Levine, Donald Trump’s Media Company has filed its investor presentation and it’s obviously amazing and ludicrous because the company doesn’t actually exist.

My favorite part is the org chart/leadership team:

This is not a leadership team - this is a kindergarten roster. Who’s running the company? Oh, it’s Josh A. And he’s bringing in snacks this week.

I was going to post this, too, but I don’t actually understand what it means. Is level 4 a conversion from USAian to Canadian?

That ratio has tripled in the last 40 years and doesn’t include dividends. That’s a 3% year over year increase and dividends add another two and a half percent. So not quite the 7% real return that’s advertised but that’s not exactly mostly flat.

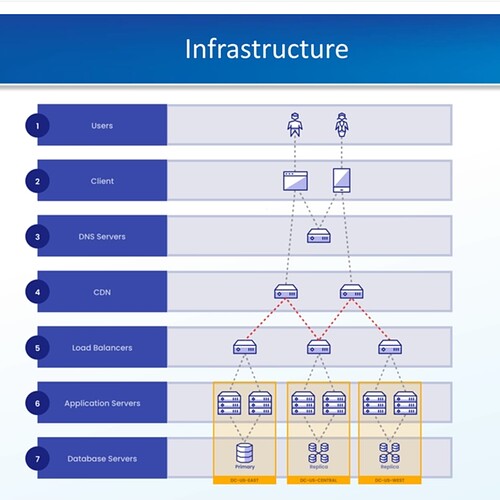

A CDN is just a server that caches static assets like images and script files so they can be served faster. It’s 100% standard for any high-traffic website.

And lol at thinking you need to show DNS servers in 2021. DNS is just how the browser resolves www.iamadumbfuck.com to the real IP address - 123.99.234.45.

This isn’t nearly as funny as imagining a machine that’s been filled with poutine and randomly replaces “-or” with “-our” at the end of words.

Why are databases always those fucking cylinders?