That is the average of just 30 companies.

Ron Paul has warning everyone about imminent hyperinflation since ~1960.

Youtubers: “Hyperinflation is coming!”

Actual financial markets: “We will pay negative interest rates to hold US treasuries”

Maybe when you have billions to invest the equation is a bit different than when you have your nest egg to invest.

IE - I’d like to sell my condo soon, but then someday at least have the option to buy back into the US housing market. If I keep that money in cash I have great fear my house buying power will be drastically reduced. If I put it in stonks, which somewhat tracks the housing market, at least I know if stonks and housing both double in 10 years, I’ll be able to keep pace. If I knew I had enough cash now to buy a future house regardless, I’d be a ton more conservative.

On the other side - my sensitivity to inflation might be different if I was living paycheck to paycheck and sensitive to the price of cel service, diapers and milk - which I’m guessing haven’t gone up much.

I mean technically inflation hasn’t been bad the last 30 years, but housing, rent, education and healthcare have all gone bananas. Housing and education costs are completely fucking millennials and gen z. Call that whatever you want but it has the same effect as inflation, right?

Gas prices should be a lot higher if we really factored in all the externalities.

Also the economy has been so hot we’re finally seeing some pressure on wages at the bottom of the scale. This is a good thing. But it seems reasonable to expect goods and services to go up in price some as a result. This is just my theory but it’s why I’m a little more likely to think inflation is coming.

/random musings

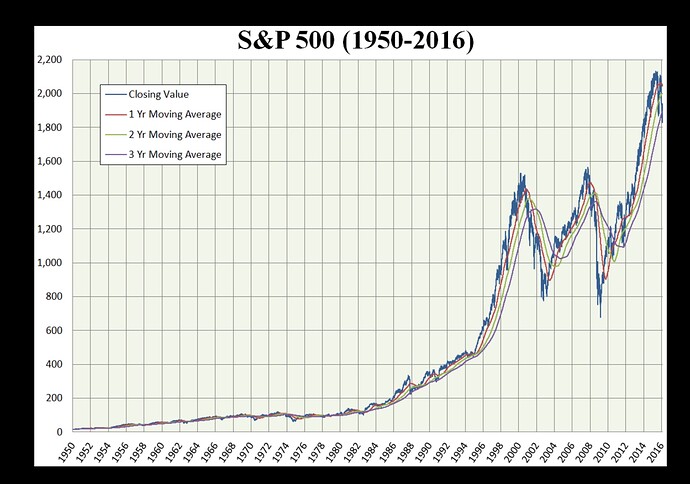

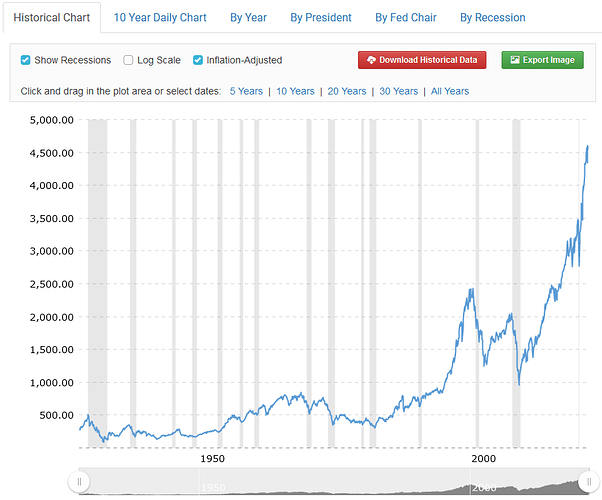

The difference isn’t DJIA vs S&P (below), it’s because your chart isn’t adjusted for inflation.

I don’t know how anybody can look at that and feel confident predicting what the next 10 years are going to be like.

How is the cost of these things skyrocketing not literally inflation, and why are people so reluctant to call it such (not aimed at you but the people whose job it is to call a spade a spade)?

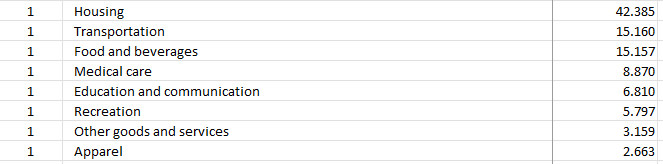

All of those things are included in the most widely used inflation measures

Nasdaq and S&P500 will outperform other indexes because you can handwave tech “growth” into existence as long as you can get enough people to believe your woo-woo shit (and we might be at the end of the rainbow for actually making tangible shit), and as capital trickles up into fewer and fewer large players they will have larger footprints to vacuum up inevitable free money bailouts and regulatory capture themselves into permanent dominance.

I’m aware of that, but eliminating such things does not paint an accurate picture of inflation IMO…is what I’m trying to say.

There is a suspicious correlation between the things where the price has gone up a lot over the last 30 years (education, houses, stock market) and the things that rich people like to buy and perceive as assets. If I didn’t know better, I might guess that we are on a 30 year run of government actions designed to systematically put more purchasing power in the hands of the of rich people while eroding the purchasing power of everyone else.

I’d say you do know better, and I suspect the reluctance to include such assets in the CPI is likewise systematically designed to hide the fact of this ongoing transfer of wealth from the unsuspecting masses.

I think the extent to which housing and education costs are reflected is complex. I know that once upon a time there was some attempt to mimic housing with deemed rent or something like that.

I think the bigger issue is that colloquially no one talks about inflation until some dipshit gets on CNN to bitch about their family’s insatiable demand for milk and how Joe Biden made milk cost $47 per gallon.

Prices have definitely been raging out of control because the economy is on fire. You have a labor shortage + supply chain issues + a low interest mortgage rate fueled housing bubble + stock market bubble + crypto bubble and every parking lot space everywhere I go is filled with people YOLO’ing and ready to spend their money. Once other businesses saw that consumers don’t give a fuck about higher prices, they went ahead and jacked up their prices as well.

I think there’s a simpler story in the case of education - it’s not actually that relevant for most people at any given time. Fewer than half of all high school graduates attend a 4-year college immediately after graduating. Roughly 11 million students are enrolled in 4-year colleges (<5% of the U.S. population). If you’re trying to calculate an overall rate of inflation for the average American’s expenditures in a given year, it’s not clear that the cost of a 4-year college should affect it that much.

(I say this as someone who is planning to pay for his kids’ college education, so I think about the price all the time. I just don’t think mine is the typical situation.)

There is $1.5 trillion in outstanding U.S. loan debt that I imagine is quite relevant for those who carry it.

I’m sure it is!

I thought the original question was “why aren’t the effects of education inflation showing up in CPI?” And I think a reasonable answer is that the annual cost of education (the actual tuition charges experienced in a given year, not double counting that by adding all of the subsequent student loan payments) aren’t a very significant amount of total annual expenditures.

To be clear, the cost of education definitely is included in inflation. If you’re really curious, there’s a lot of detail here:

https://www.bls.gov/cpi/factsheets/college-tuition.htm

College tuition and fees has about twice the impact of child care and nursery school on annual inflation numbers.

College tuition and fees falls within education and communication, and has a weight of 1.569.

you should expand your view of entertainment industry, or even just artists. making art as a full time job is a grind. talk to any painters or gig musicians. 90% aren’t so much maximizing views as they are just hustling to not have to do minimum wage shifts.

take any entertainment venue like a old proper theater. its economics are batshit crazy. it’s usually hundreds of people on the payroll, plus orchestras and troupes that need funding. without someone consuming it all, there’s no cute little kids taking ballet lessons, no touring music, possibly no band tshirt culture, or niche markets for about a thousand different implements.

you are describing a very unique fraction of the entertainment economy. like 0.001% of the total that society apparently needs to exist. there’s a much fatter tail of people working to entertain you, including regional ballet schools from which tsikaridze harvests his pupils.

given that the guy is in st. petersburg, i’m going to say his ballet likely isn’t as concerned with views, as it is with funding from the government. oh and keeping a nice steady invoice stream to an llc on the isle of mann that buys stradivarius violins for one of putin’s residences. tsiskaridze surely doesn’t even know anything about it, but every good money laundering operation needs a danny.

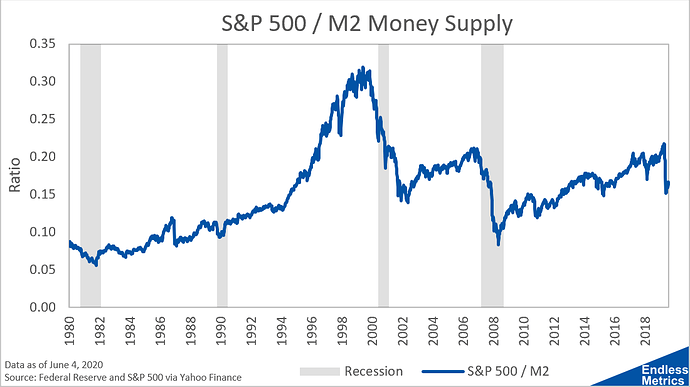

The stock market is mostly flat vs the M2 Money Supply. You basically need to be in stocks or riskier to protect the value of the dollars you’re earning or have. Stonks are going to keep going up because the US is going to keep printing money because the US is going to keep going further in debt. The upper class is only going to get further and further ahead of everyone else so copying what they do to protect their dollars is the only way to not fall further behind.