The sentiment is right, but I think the actual numbers are something like 2/3 of earnings announcements meet or beat the officially published earnings estimates, and about 1/3 of observations experience immediately-subsequent stock returns that are directionally opposite to the earnings surprise.

estimates are just a scam then

why bother, they’re all in cahoots

The average investor should continue to couch potatoe so they don’t fuck up.

If you had a limited purpose time machine and knew only that inflation will be much higher than expected what you would do to optimize that is borrow as much money as you can and invest in assets like real estate and commodities. Those assets should increase in value and the real cost of your debt will go down.

Stocks are a decent hedge against inflation so yeah just keep indexing

Posting this in case anyone is tempted to listen to this guy based on his (legitimately exceptional) investment performance:

https://twitter.com/modestproposal1/status/1392100648443842561?s=21

A year ago, we were lolling at the idiots who were buying stock in a bankrupt company. It’s in the previous locked thread, but we had things like:

I also saw Hertz is up infinity percent despite being bankrupt. Maybe the existing shareholders can flip their shares for some liquidity.

and

What in the ****ing world, a bankrupt company (hertz) is trying to issue NEW SHARES. A BILLION WORTH. These shares are currently worth zero but some morons on robinhood pushed the stock from nearly worthless to like 5 bucks a few days ago so here we are.

Like, are you joking? (no, they’re not, they just saw all these stupid people and went, well why not? #YOLO)

with this news, hertz stock went up initially before people who aren’t fucking idiots knocked it back down, it’s at 2. Still 4x what it was a few days ago. STONKS.

Hertz said it would warn any potential buyers “the common stock could ultimately be worthless.”

That’ll be front and center on the disclosure I’m sure.

and

Is there a reason we’re not all buying Hertz puts?

and

Hertz is currently worth slightly over $0, and it’s trading at around $2.20, and you’re telling me that it’s not smart to try to capitalize on the stupid people who drove it up to like $6 per share?

and

Hertz, donut?

But it turns out that buying shares in bankrupt firms can pay off? From Matt Levine’s newsletter:

In a deal that hands a huge victory to shareholders of bankrupt Hertz Global Holdings Inc., the car renter picked Knighthead Capital Management and Certares Management to buy the company out of Chapter 11, capping a dramatic brawl for control of the company.

The deal, which gives a reorganized Hertz an enterprise value of $7.43 billion, was picked over an offer from a competing group led by Centerbridge Partners, Warburg Pincus and Dundon Capital Partners, according to people with knowledge of the matter, who asked not to be identified because the plan hasn’t been made public. The Knighthead-Certares plan would give equity holders a recovery of about $8 a share – a package that’s made up of about $240 million in cash and warrants for nearly 20% of the reorganized company, the people said.

STONKS

Good year for index funds in general? I don’t have immediate access to them due to logistics (longish story). I think I remember two of them but don’t remember the exact day I invested (some at end of 2019, some at end of 2020).

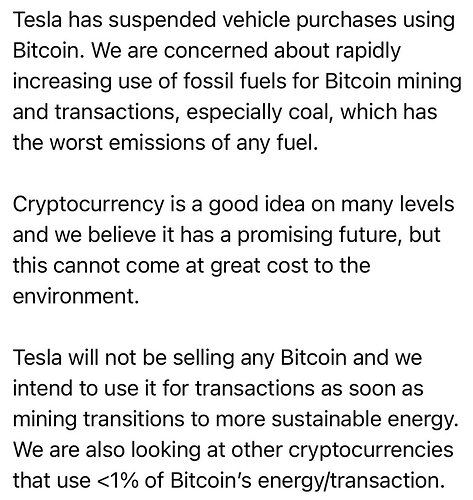

I know basically nothing about crypto, but based on Elon’s past, it’s bullish for whatever the next cryptocurrency he’s obviously going to pump.

Twitter finance bros are speculating Bitcoin payments create an accounting problem. Lol anyone who thinks this piece of shit actually GAF about anything but himself and his net worth.

Lol cryptocurrency. It serves absolutely no legitimate purpose other than facilitating illegal transactions.

I think it’s going to be more of a function of current disposable income levels than Elon’s tweets.

When the market is going berserk, crypto follows. If the economy took a severe hit and people ended up tight with cash, Elon wouldn’t be able to tweet anything to convince folks to start investing their ravaged portfolios into speculative crypto currencies.

also tesla’s been going down lately too, if the hodl’ers aren’t rich anymore they’re not gonna keep following

That’s potentially a legit purpose, imo.

I’m sure there are illegal transactions that even you would agree should not be illegal. In those cases, it would seem crypto is doing some good.

Feels like the ultimate purpose of crypto is tax evasion and avoidance of the redistribution of wealth.

Stonks are back on the menu.

What the hell just happened?

how does vtsax and vfiax being down 2% and voo being up 1.5% make any fucking sense?

It make sense because HOLD

Btfd?