Aren’t those mutual funds that don’t trade intra-day, so the quote you’re seeing is yesterday’s close?

oh yeah

Weird that Reach TV on at the airport is showing DOW down 692, while every site I look at says +350. I guess they’re showing a replay from yesterday? Weird.

HODL Gang got fucked today.

Do you think owning btc or the popular crypto coins is a solid play at these prices?

Don’t use Robinhood

It fails miserably at that purpose then. It is an immutable, public leger of all transactions. That is a horrible thing for illegal transactions! It merely offers the illusion of subterfuge to people who fool themselves into thinking that they know more than the government.

I have no idea.

I know approximately nothing about crypto, so I’m sort of taking Riverman’s point (i.e., it facilitates illegal transactions, makes them harder to detect, etc) on faith. I don’t know if it is true or not, but I do know that plenty of people say that.

If, as you say, it actually is counterproductive for illegal transactions, then I’d agree that my point makes no sense.

So, I’ll just sit back and let the rest of you work out whether, on balance, crypto is better or worse for illegal transactions than conventional alternatives. I’d actually be quite interested in that discussion. It has to be one or the other.

When you buy an option you are never forced to take a later action.

Yes.

This isn’t the case for shorting options.

You can always know what your total loss will be for each call option.

Robinhood is just fine to tinker with and learn the basics of trading. Wealthier traders avoid Robinhood because of how RH compares with similar brokerages like think or swim or interactive brokers in regards to updating speed and connectivity issues. Robinhood has had some inexcusable connection failures over the years.

I guess my advice would be to buy some small ball call options to get the general idea of how it works and to study, on the side, things like volatility and time decay and how they will affect your option.

It’s best for illegal transactions the government doesn’t really care about and you won’t get in trouble for even if the government does finds out… like online poker. Also, for shit like fleeing a country or whatever… once the government finds out… it’s too late.

I thought the Chris Hayes Podcast on Crypto with one of the anchors from Bloomberg was pretty interesting.

Anchor’s point was basically that if Crypto doesn’t work for illegal transactions, then that means it’s a shitty currency.

This might be relevant to the crypto thread, but I only care about it from the perspective of STONKS.

The accounting for bitcoin and other crypto assets is so weird, and I’m starting to see really misleading headlines as a result. For example, Square, Inc. is popping up in the news today, with stories like this:

The company, which was one of the first ones to jump into the bitcoin bandwagon, is holding 5% of its cash holdings in Bitcoin. Square, whose CEO is big Bitcoin proponent Jack Dorsey, bought $50 million worth of bitcoin last October, and doubled down on its bet this February, spending $170 million in Bitcoin this time. During its last earnings calls, Square accounted for a bitcoin impairment loss of $20 million on its bitcoin investment during the first quarter of 2021.

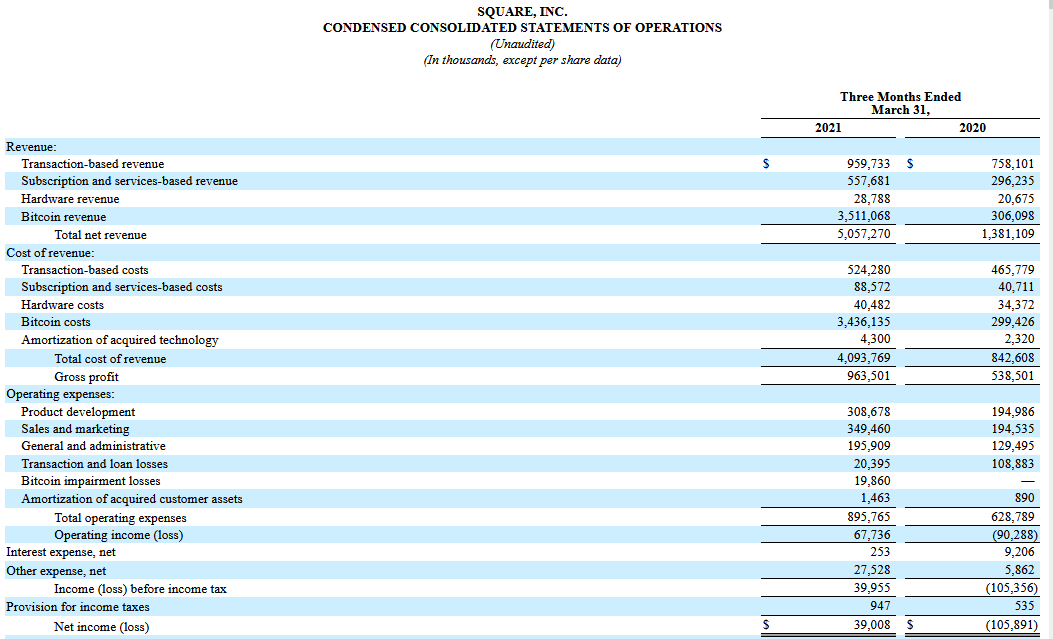

This makes it sound like Bitcoin was a very bad investment - Square purchased $220 million, and as of 3/31/2021 they had to record a loss of $20 million on that investment. You can see that right on their quarterly income statement (“Bitcoin impairment losses”):

And that’s not a small loss - their total net income was only twice that amount. Seemingly a very bad outcome!

But this is very confusing, even for a relatively uninformed crypto person like me, because I know that bitcoin has more or less rocketed over the twelve months ending 3/31/2021. Based on the historical price of bitcoin, it seems completely implausible that they could have lost money on those purchases as of 3/31/2021:

It was higher on that date than almost any other date in its history up to that point. How did they lose money on this crypto investment.

It turns out they didn’t, and their quarterly SEC filing says as much:

As of March 31, 2021, the fair value of the investment in bitcoin was $472.0 million based on observable market prices which is $271.9 million in excess of the Company’s carrying value of $200.1 million.

This makes a lot more sense. The price of bitcoin has gone crazy over the last year, and the bitcoin that was purchased for $220 million is now worth more than twice that amount. So why do they show an Income Statement loss on this investment? It’s because–unlike the treatment of stocks and bonds–crypto currencies are not adjusted upwards and downwards as the price rises and falls. Instead, the treatment is asymmetric - it’s adjusted downward (with a corresponding Income Statement loss) when the price goes down, but it is not adjusted upwards when the price goes up.

This is pretty goofy, and it means that companies will only record unrealized losses on bitcoin investments, and never unrealized gains. The only way they’ll ever report a gain on crypto investments is by selling.

Maybe Elon “wait a second bitcoin is bad for the environment, news to me” Musk also figured this out.

Do you have any idea why that is the accounting treatment? Based on principles of accounting I can’t see how the asymmetric can possible be considered to be better for users of the financial statements.

Edit: I figured this out, the accounting firms think cryptocurrencies are intangible assets.

That’s the reasoning, so they’re treated like goodwill (or even tangible assets like inventory) where you periodically assess it for impairment and record a loss if necessary, but never adjust upwards.

But it’s not clear why crypto assets should be treated differently from financial assets like stocks or bonds. For a long time, the current crypto treatment (effectively lower of cost or market) is how stocks were treated - they were just listed on the Balance Sheet at their historical cost. It wasn’t until like 1994 or so (SFAS 115) that financial instruments were reported on the Balance Sheet at their fair values, with the associated gains and losses going through Other Comprehensive Income (and now, as of a couple of years ago, through Net Income).

The key issue, to me, that distinguishes financial assets from other assets like inventory or property is that financial assets have observable, objectively measured market prices. We wouldn’t let a manager buy a piece of land for $10,000 and then report an unrealized gain on that land because it appraises for $100,000 - we know that the manager has an enormous conflict of interest, and we’d be extremely unlikely to trust even an arm’s-length appraisal. But if a manager buys stock for $10,000 and it moons to $100,000, we do let that manager report an unrealized gain because we can objectively observe the price of that stock.

The same applies to crypto, as well, so it wouldn’t surprise me if we see a change in accounting to look more like how we account for financial assets. I sort of loosely know one of the FASB members, so if I ever find myself talking to her, I’ll bring it up.

Traditional goodwill also gets amortized down over time but crypto does not, which is interesting.

I think the difference vs. stocks and bonds are that traditional securities confer a legal right to the owner for something (repayment of debt, equity in the company, associated dividends). Is there any “contract” behind crypto? Or do you just transfer the money to an account and some e-wallet then holds X “bitcoins” which are totally notional in value? I think that if cryptocurrencies were technically securities then you would treat them like stocks or bonds. But they’re in no man’s land - they’re neither a traditional currency that would be held based on standard FX rates, but they are not a contract with a counterparty either.

Not anymore!

I agree that crypto doesn’t meet the definition of a financial asset, but I don’t think the unique mark-to-market accounting for financial assets is because they’re financial assets per se, but rather because they have readily observable market prices. Maybe a better analogy for crypto would be holdings of gold or other commodities. I (embarrassingly) do not know how those are accounted for, but will probably get drunk and look it up this weekend.

Commodities are tangible so I think they’re treated at market value.