I dig that but lol I probably wasn’t as clear as I could’ve been. I meant when you see the volatility, say, a bitcoin going from 6k to 60k to 36k within a year, how are you not tempted to sell at the highs?

How do you know where the highs are? Back in the day, early holders emptied their bag when the price shot to $100, $500, $1000, etc.

Oops.

bitcoin 1 million

My only real crypto score was buying a bag of ethereum @ $22

Yeah, but… You’re allowed to buy back in if you sell your bag at $100. In fact, if it falls to $50 you’re allowed, through the power of math, to buy back twice as much.

But seriously, that’s what I meant by volatility, in that there’s a lot more room for error in picking the tops and bottoms.

If it doesn’t interest you then that’s an answer. Not every form of gambling interests people even if they’re gamblers.

Ding, ding, ding, we have a winner.

Many years ago I read everything about trading I could get my hands on. Day trading, swing trading, momentum trading, trend trading, TA, fundamental analysis, etc.

Then I concluded that none of it suited my temperament, and that I’d be better off just buying and holding an index fund.

You and I are playing different games. And neither of us will probably ever fully understand the other.

And that’s OK

If you’re still holding, that’s quite a score.

You and I are playing different games. And neither of us will probably ever fully understand the other.

And that’s OK

Lol yeah I know, that’s why the topic interests me. I hope I’m not coming off as antagonistic. For example, Josh is also mainly a buy and hold guy, but he sells when he feels it’s high. We have the whole spectrum here and I realize I’m on one end.

My only real crypto score was buying a bag of ethereum @ $22

I’ve got you beat at $13 but umm don’t ask how big the bag was. I’m not sure it even qualified as a bag lol.

https://twitter.com/GiganticRebirth/status/1395069016952217600

Perspective. If you’re still alive, haven’t been liquidated, and never bought XRP, XVG, coughtopshotcough, etc. you’re already way ahead of the game.

TW: Thousands and thousands of gambling addicts and stupid children ruining their families.

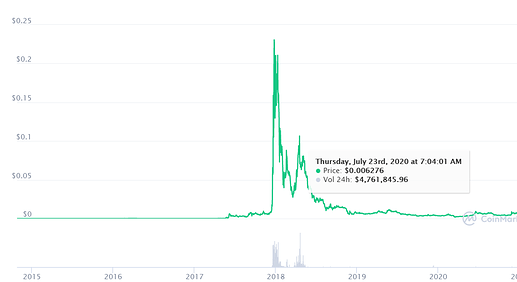

XVG

I 50x’d XVG in 2017 and made another 10x or so doing arbitrage between exchanges. I made 20% this year.

You might be talking about something different though.

Yes XVG was one of the first scam pump and dumps in 2017 (congrats!) and practically started the trend of PnD/bull market. It’s vaporware that does nothing based on nothing.

95%+ of ppl that ever bought XVG are under water. Ditto XRP. Me shitting on the non-existent fundamentals doesn’t mean you can’t make money trading this garbage.

The ironic part is the stuff I made the most on in 2017 (%wise) was the stuff I thought was shit and couldn’t get rid of fast enough. Sold the XRP and IOTA peak for the same reason.

https://twitter.com/GiganticRebirth/status/1395069016952217600

Perspective. If you’re still alive, haven’t been liquidated, and never bought XRP, XVG, coughtopshotcough, etc. you’re already way ahead of the game.

TW: Thousands and thousands of gambling addicts and stupid children ruining their families.

Ok, your reaction to me makes a whole lot more sense now. I’m out here grinding for my satoshis, these people are trying to leverage up a moonshot. I’ve alluded to how I look at this like online poker, it’s the same concepts. BR management multitable grinding out your stake vs taking your roll to shortstack the nosebleeds.

There’s also the factor of not having to worry about taxes when you’re not trading. It’s an asset accumulation strategy vs a trading strategy. Both can be right depending on an individual’s goals.

For me, most of my net worth is tied up in my 401k, so this gives me some diversification with extra liquidity since I can’t withdraw from 401k until 59.5 without penalty.

I keep forgetting you all are real adults.

You’re a full blown capitalist I hope you realize that.

I’m going to keep putting money into ethereum until I own one. That’s the extent of my crypto portfolio.