If by diamond hands you mean instantly emotionally bonding with any crypto I obtain and never ever wanting to let go because I don’t want to betray their trust, then yes I have.

spoken like a true diamond handed boss

Speaking of bosses, buying the absolute bottom like a boss presents its own problems. Mainly, you sell before the real gains happen:

I had cascading buy orders in place in that last blue circle to the right. This is a 4 hour chart so I had plenty of time to pick it back up, but I kept the orders where they were and only picked back up 1/4.

Ok, sure:

Sold the rest, that’s gotta be a local swing top, right?

Lol ok, sure Bogdanoff, sure.

This must be a regular occurrence, right, the way you trade? Assuming this is your day job, would you say this has an impact on the way you “play”? Personally I’m surprised by how much FOMO gets to me, while back in the days in poker my mindset was much more even keeled and calibrated, and much less affected by swings. The reason of course was that I had a much better fundamental understanding of poker and variance, and it goes to show how much of a noob I am at trading/crypto.

Look at it gooooo!!

Much colour blindness.

Yes and no, but I see what you’re getting at. The different cryptos I have are grouped, like TO THE MOON, or hold for a little then sell, or trade them up and down while the choppiness is high then exit, etc. This is what I meant by ADA earlier, how it was just on the cusp of TO THE MOON and hold for little then sell. I sold (which is essentially a non-option non-leverage ‘short’) and put in a buy order, but I didn’t FOMO and chase it down (taking a ‘loss’ on the ‘short’) when it looked like I ended up selling the bottom of a breakout, even when I could’ve changed my buy order to only take a tiny loss(again, oops). I was just like, hey, godspeed ADA holders.

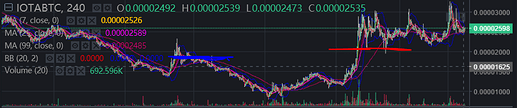

It comes down to the plan you have going into a trade. For example, IOTA was another one where a bought with the plan for a 3%ish swing/daytrade. As soon as I bought it thwomped down though, but because it was a smallish position I didn’t stop-loss (this could be a whole separate post, but I believe a lot of traders lose or lose value because they get fancy play syndrome and place aggressive stop-losses and they end up taking a loss during a microdip; if you’re not leveraged and trading in a bull market I don’t believe you should even use stop-losses; just hold the bag and rethink your strategy for the next trade if you have the instinct to place an aggressive stop loss, like, open a smaller position or don’t open it at all…) and just held the bag for like two months until it broke back up. So I ended up with a decent $ proft but a very small BTC profit. I considered the possibility that I was selling at a breakout but opted to stick with the original plan, only a short daytrade turned into a long swing trade.

(to be continued lol)

that dude needs to get a rug that covers more of his floor… ON THE BLOCKCHAIN

I’m reading this as a parody account, yet that I can’t be sure speaks to the age we live in.

Haha, I saw that, where the hell did that come from? Earlier tonight FIL did the same, but without the bounce back. Fortunately my younger brother, who I kinda feel responsible for since I got him into this game, bailed in time.

BTC parabolically dropped 2.5% so, you know, supernova time.

I have a facepalm prepared… When did he get in to Filecoin?

What % of Americans do we think are paying within 20% of their proper taxes owed on Crypto mining income/investment gains?

Actually he bought a few days ago, sold half at peak, and the rest on the way down, so he made 50% profit. He did well really, and it more than offset his loss on buying ADA at the Coinbase launch for 30% above market price…

Less then 2%

Fresh all time high for ETH

everytime bitcoin goes up i wish i had more bitcoin and everytime eth goes up i wish i had more eth. Obviously, the only correct allocation is both 100% BTC and 100% ETH