I started my trip into BTC as a maxi… but now it makes up only about 60% of my total crypto holdings. Last summer I thought defi was mostly just a buzzword… but the more I learn the more I’m starting to see things differently.

A lot of eye-opening stuff in this video podcast related to crypto. Balaji is a brilliant polymath who has a propensity to accurately predict things unfolding long before most others. He was the among the first to identify covid as the global pandemic it later became. It’s long, but interesting and informative.

Assuming this is your day job, would you say this has an impact on the way you “play”?

The pandemic has kinda made terms lose all meaning, but I suppose in a sense it’s now my day job. More like a seasonal job during the bull market. I was playing a lot more poker online since the pandemic but then got burnt out, so the time devoted to that switched to this. I wasn’t actually sure how much trading I was gonna do but Predictit actually gave me the bug again; before that I thought I’d just do some more casual buy-hodl-sell, trade the bigger swings.

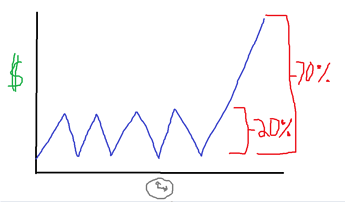

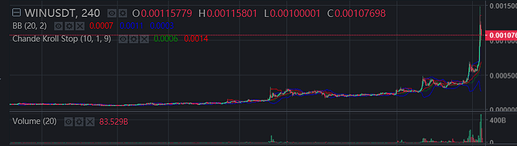

As to the second part of the question I’d say yes. I’m less worried about things going up because I’m actually watching the markets and, bear with me because this is the most hi-tech graph I’ve posted,

trading those swings is more profitable than buying and holding until the top. Ideally I’d want to do both and not trade the last one before it moons but you can’t always get what you want.

Personally I’m surprised by how much FOMO gets to me,

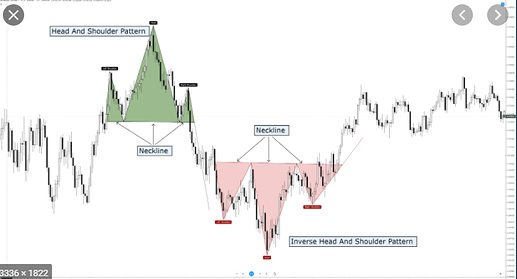

Everybody FOMOs because FOMO isn’t even inherently a bad motivator. A bunch of trading strategies pretty much rely on some degree of FOMO, like when you hear about ‘breakouts’ or ‘reversals’ from ‘wedges’ and ‘head and shoulders’ and what not. The strat is waiting for a confirmation of the trend and then being the first one to FOMO. In this sense the average person is just doing a less sophisticated version of that, seeing something already going up and buying, or going down and selling. Trying to buy true dips or sell true peaks (like a boss?) is higher risk higher reward.

But that’s why price action patterns happen, because everybody has a different motivation and strategy. Like,

some people are waiting for the pattern to confirm and others, like me, are trying (keyword: trying, lol) to hit the absolutes of the peaks and dips. Along with everything in between.

Essentially, unless you’re holding forever, like, passing your bitcoin down to your children’s children, the family bitcoin heirloom, you’re doing some form of FOMOing.

A lot of eye-opening stuff in this video podcast related to crypto. Balaji is a brilliant polymath who has a propensity to accurately predict things unfolding long before most others. He was the among the first to identify covid as the global pandemic it later became. It’s long, but interesting and informative.

Dear Balaji,

WEN MOON

Cliffs?

On the video?

- BTC/ETH to the moon

- Crypto economy/society is inevitable and unstoppable in ways that go far beyond HODL BTC

- The US is f***ed

That’s as far as I’ve gotten so far.

A lot of eye-opening stuff in this video podcast related to crypto. Balaji is a brilliant polymath who has a propensity to accurately predict things unfolding long before most others. He was the among the first to identify covid as the global pandemic it later became. It’s long, but interesting and informative.

When Ferris said “1729” I was like “oh, one of Ramanujan’s numbers” and some guy sitting nearby looked at me like I was a nerd so I murdered him in front of the entire coffee shop to keep my street-cred intact.

I hope people know I’m lying because I wouldn’t be in a coffee shop during a pandemic, not because I wouldn’t murder a man in cold blood.

Also, Ramanujan was way smarter than Einstein and it’s not even close. Like wat.

Also one last time, there totally needs to be a trigger warning that one is gonna hear Tim Ferriss talk before the interview. I know it says “The Tim Ferriss Show” but still.

lol apologies if anybody is a fan

I came for Balaji, not Tim. And yeah, the rule of any TF podcast is just to jump about 10 minutes ahead to when the actual interview starts.

He started shilling his miracle supplement and I wanted to die.

We in the middle of a multi day epic Bog vs Sminem battle right now at the cusp of 60k. Feels like it’s about to rip past and just go full stupid mode to like 70/80k

At ~$140, so I think just before. I’m sure he was chasing the pump, fortunately for him it wasn’t done yet.

So in principle I’m HODLing my ETH/BTC, but I still had some ETH on coinbase. I’ve just sold it to put in ONE and CKB, which have had a bit of a traceback recently. I think it’s the right play, but it feels weird to decrease my ETH bag.

I was about to make a post last night telling everybody to sell everything. Well, not actually, but explaining why I was thinking about it. But I didn’t want to panic anybody.

Basically, the way the cycle work is first BTC, then then other big caps, etc, until the last phase is every small cap, small denomination coin does some silly pump. So I was looking for some of those and that quickly turned to looking for ones that hadn’t done that, and I couldn’t really find one.

Etc. However, I realized this was only limited to the very small denominations and not every random thing, so I was/am chalking that up to the “wow I can buy a cool million of these” effect. I had four million Holochain at one point. It was like 20 bucks. (well not really but low 4 figures)

The other super bearish thing, and I used to think this was some best-kept-secret before I remembered that people just don’t know anything about anything, is everything dropping even as a ratio of BTC when BTC drops, down to the second.

Basically it’s like this: everybody has heard the sentiment “everything goes down when BTC goes down” right? Well, that didn’t always happen, and still doesn’t always happen. But, if you were to program an algobot with a set of protocols, and you knew that the average idiot thinks that sentiment, then you’d want to beat them to it. You’d have every technical indicator take a backseat to BTC’s price action, and have your bot snap sell (and buy) based on BTC’s movement and momentum. So it becomes a self-fulfilling prophecy and feedback loop. In super bullish times this doesn’t happen as much because of so much upwards pressure and subsequently people deciding this is a good strategy for their bots. But, in the last week we’ve seen it twice where bitcoin when parabolic downwards, though only 2%ish, and a lot of things crashed similarly yet harder, like what @anon3530961 posted. But, they rebounded, and that’s the flipside of a strategy. Causing a crash is great if you can pinpoint buy the dip.

It’s what I alluded to a while back in the thread, how the crypto markets are basically the conditions of the 1987 stock crash but 24/7/365.

I’m far from convinced though, there’s too much other bullish stuff. I’m just sharing some observations.

So in principle I’m HODLing my ETH/BTC, but I still had some ETH on coinbase.

My LINK and ETH and a few others are on coinbase and I don’t look at them as real, mainly because with the ridiculous fees there are less trading opportunities aside from the big swings. This is probably all a leak.

At ~$140, so I think just before. I’m sure he was chasing the pump, fortunately for him it wasn’t done yet.

Nah that’s fine if he was watching the market. Bad would be chasing the pump then going camping in the woods with no electronics for a week.