Sir, this is the crypto thread

This month might not seem the perfect moment for an institution such as Goldman Sachs to be championing the benefits of “blockchain” or “tokenisation”. After all, these buzz words first shot to fame in the cryptocurrency sector, which has lost two-thirds of its value during the past year. And the recent implosion of Sam Bankman-Fried’s FTX empire is likely to leave many traditional financiers shying away from digital assets — if not deriding them as a fraud. Yet when green activists, politicians and scientists assembled at COP27 this month, Rosie Hampson, an executive director at Goldman Sachs, was happily talking of both. In recent months the Wall Street bank has joined forces with the Hong Kong Monetary Authority, Bank for International Settlements and other financial institutions, to launch a capital markets initiative known as “Genesis” (a name it unfortunately shares with the struggling crypto broker). This Genesis aims to use blockchain and digital tokenisation to help investors who purchase climate-related bonds track the associated carbon credits in real time. “[With] Genesis we are thinking about how you can use blockchain, smart contract technology and IoT devices to support green bond contracts,” Hampson told a COP side event. She noted that this could change the process from “book building all the way through to primary issuance, asset servicing and . . . the secondary market component.”

Or as Bénédicte Nolens, of the BIS, echoed in a recent podcast: “It is actually hard to sell a green bond [today]. But if you can attach the future carbon offset [with tokenisation] then it becomes a lot more attractive to the end investor.”

…

Moreover, these are now reaching into some unexpected places, with growing government support. The World Bank is currently developing a utility for carbon credit registries that uses a blockchain system called Chia. And in mainstream central banking, tests are under way for wholesale (ie bank-to-bank) central bank digital currencies.

The HKMA, for example, is currently working with the People’s Bank of China and other central banks on a so-called mBridge project to enable them to swap assets instantaneously. In Europe, the Banque de France and the Swiss National Bank have unveiled Project Jura, a foreign exchange CBDC pilot.

And while these initiatives are still just pilots, they represent “a completely new architecture”, as Ousmène Mandeng, an Accenture consultant, recently told a meeting of the Euro 50 group in Washington. Or as Adrian Tobias of the IMF echoed: “The key things we have got from crypto are the ideas of tokenisation, cryptography and distributed ledgers. They are very important technologies and there is a lot of experimentation going on.”

…

The Genesis initiative, for example, is trying to solve the problem that the carbon credits market today is so fragmented and opaque it is hard for investors to track potential greenwashing. Thus while Chinese issuers have sold $300bn of green bonds, transparency around this is very low.

However, by using a co-ordinated distributed computerised ledger (ie blockchain), the BIS and Goldman Sachs say it would be possible to eliminate double counting and verify the carbon credits at source. Similarly digital tokenisation should make it possible to simplify bond distribution and pull retail investors into the market for the first time, by breaking bonds into tiny fractions. Or so the argument goes.

How is a blockchain solving greenwashing? The issue is not that different people both claim the same carbon credit. The issue is that the carbon credit is issued for trees that don’t actually get planted or carbon that is not actually captured at the power plant. A blockchain doesn’t solve that. If we trust whoever issues the carbon credits then they can just run a standard database anyone can access. If we can’t trust the issuer than any distributed trust a blockchain adds on top of that is pointless.

And this is why crypto is not a thing irl and probably never will be. It’s a too clever by half engineering solution to problems that already have better solutions.

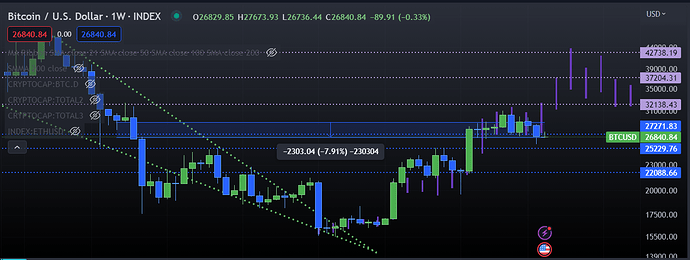

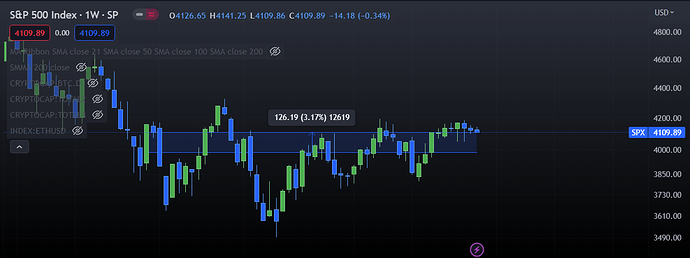

And the winner is… S&P 500

Bored Apes are still worth more than any painting privately sold in history adjusted for inflation.

WTF is a crypto thread?!

From the book Understanding DeFi

The borrower has to deposit collateral, which is generally one of the approved coins, and generally an amount far over the value of the loan. This is called overcollateralization, which is necessary because of the extremely volatile nature of cryptocurrency—even stablecoins. Collateral generally ranges from 150% to 200% of the loan amount. If the loan is not repaid, the collateral is transferred to the lender, which removes the risk of nonrepayment.

Now, why would you take out a loan and pay interest on what you borrow if you already have assets worth at least as much as you need? Quite a few reasons, actually, including that you don’t want to sell the assets outright, you don’t want to create a taxable event, or you want to generate value from your portfolio beyond asset appreciation by putting those assets to work. If the borrowed currency is gaining value faster than the value of the loaned asset, you can make a significant financial gain for only the price of the interest. However, note that liquidation can happen if the value of the collateral drops to 120% of the value of the loan. In traditional finance, the value of the collateral must drop below the value of the loan, and then a procedure must be followed to properly transfer the collateral. The “margin call” of these loans is earlier than those in traditional finance.

I read this a few times and still have no clue why you would put up $20,000 worth of coin-X as collateral to borrow $10,000 worth of coin-Y

I don’t know. But I’m imagining a situation where token A (the overcollateralized token) is only “worth” $X because the market for token A is a liquidity pool with not very much liquidity in it. If you have $10 million worth of token A, if you tried to swap it in a liquidity pool protocol with $3 million in the pool, it would destroy the market for that token, maybe forever.

Fungibility is Web4 functionality.

Two more reasons I can think of.

-

You deposit a crypto you think is going to go up and borrow a stable-coin to cash out and pay bills.

-

You decide to deposit a crypto to earn the interest from the DeFi, and think that you can earn more with the coin your are borrowing than the interest you have to pay.

To gamboooooooooool!

I think that may be a scam. The normal site is .com not .org.

edit - looks like woj was hacked. Apologies is that’s what the lol was for.