https://twitter.com/greg16676935420/status/1568240996269408260?t=yDyUvOvuolWedOAUnrTHfA&s=19

I love that after 30 years of shows every week, nobody in WWE ever bothered to learn that

-

Somebody should hire a referee that isn’t extremely easily distracted

-

When the Undertaker is laying down in a coffin, you can observe from a distance and really don’t need to lean in for a closer look

any time anyone starts saying stuff like “web3 technologies” I call bullshit. No one can even define web3 yet. it’s a blatantly bullshit buzzword.

Padme: “That means the price goes up, right?”

Good Job Ethereum figuring out how not to be horrifically bad for the environment. Now we just need bitcoin to die so we can all add a few minutes back onto our life expectancies from the concomitant reduction in air pollution bitcoin is causing.

Tether ordered to produce documents showing the backing of USDT.

Wait… Tether only has 7 employees?

I am skeptical that tether will show evidence of a well capitalized coin.

They never have and never will. Tether is evidence that fractional banking works even in crypto. Best money making idea I have seen in the crypto world after Satoshi. They are not even legally required to have 1 on 1 backing of Tether they created. They are only required to have enough assets to match any accounts people have with them.

this

I don’t understand any aspect of this response. Fractional banking still requires full capitalization, in that banks have to have capital sufficient to cover their liabilities. It’s just that the capital might not be all in cash.

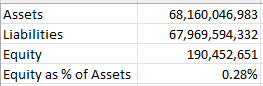

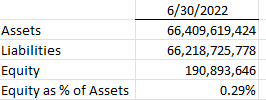

In Tether’s case, their website currently reports:

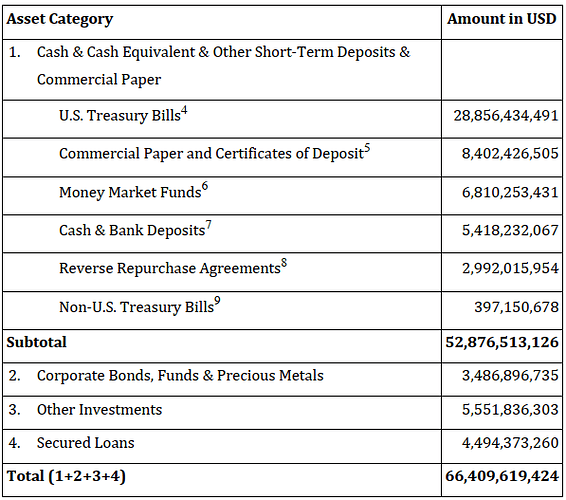

If those assets were all hard currency with no risk, then even that tiny equity cushion might not be a problem. But their assets are far riskier than that. Their 6/30/2022 reserves report lists the following:

where the asset breakdown is:

So about 8% of their total assets are in undisclosed Other Investments, including digital tokens. Their equity cushion is so small that if the Other Investments category were to drop by just 4%, they’re undercapitalized.

Why would Tether comply with the order? How does a US court have jurisdiction?