Bored Apes are still worth more than any painting privately sold in history adjusted for inflation.

WTF is a crypto thread?!

From the book Understanding DeFi

The borrower has to deposit collateral, which is generally one of the approved coins, and generally an amount far over the value of the loan. This is called overcollateralization, which is necessary because of the extremely volatile nature of cryptocurrency—even stablecoins. Collateral generally ranges from 150% to 200% of the loan amount. If the loan is not repaid, the collateral is transferred to the lender, which removes the risk of nonrepayment.

Now, why would you take out a loan and pay interest on what you borrow if you already have assets worth at least as much as you need? Quite a few reasons, actually, including that you don’t want to sell the assets outright, you don’t want to create a taxable event, or you want to generate value from your portfolio beyond asset appreciation by putting those assets to work. If the borrowed currency is gaining value faster than the value of the loaned asset, you can make a significant financial gain for only the price of the interest. However, note that liquidation can happen if the value of the collateral drops to 120% of the value of the loan. In traditional finance, the value of the collateral must drop below the value of the loan, and then a procedure must be followed to properly transfer the collateral. The “margin call” of these loans is earlier than those in traditional finance.

I read this a few times and still have no clue why you would put up $20,000 worth of coin-X as collateral to borrow $10,000 worth of coin-Y

I don’t know. But I’m imagining a situation where token A (the overcollateralized token) is only “worth” $X because the market for token A is a liquidity pool with not very much liquidity in it. If you have $10 million worth of token A, if you tried to swap it in a liquidity pool protocol with $3 million in the pool, it would destroy the market for that token, maybe forever.

Fungibility is Web4 functionality.

Two more reasons I can think of.

-

You deposit a crypto you think is going to go up and borrow a stable-coin to cash out and pay bills.

-

You decide to deposit a crypto to earn the interest from the DeFi, and think that you can earn more with the coin your are borrowing than the interest you have to pay.

To gamboooooooooool!

I think that may be a scam. The normal site is .com not .org.

edit - looks like woj was hacked. Apologies is that’s what the lol was for.

Wow no i just saw it and pasted cause thought it was funny. Sorry for that

It is funny that someone would think the best use of hacking woj was to try to scam a nbatopshot.

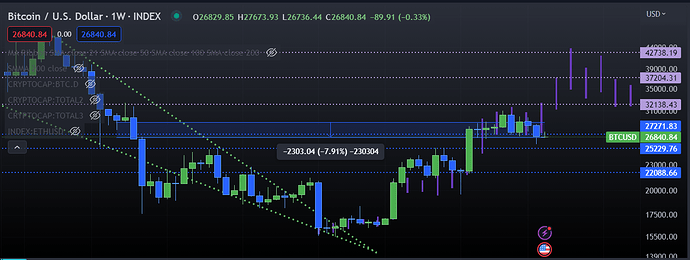

pumping, yet this thread is like ![]() seen it.

seen it.

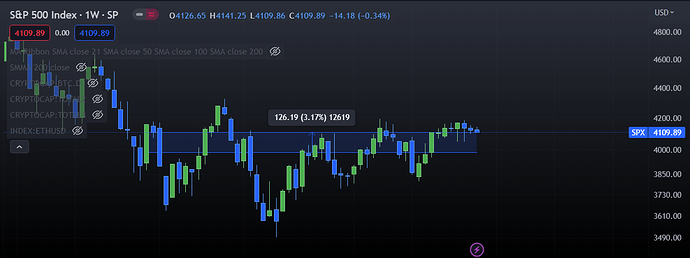

Did a lot of folks divest? I’ve been making small purchases monthly for about a year and it’s been great! Market timing works

I think most people are still involved in crypto to some extent or another but all of the chatter is on the discord. Only so much Motley Fool message board nonsense people can take. We are very much heading back into a crypto mega bull market and now is the time where fortunes can be made imo.

Oh right, I went Discord Zero awhile back and kinda forgot about that.

Smart! I increased my bitcoin holdings significantly during the past 12-18 months, was mostly in ETH because of NFTs but i figured that should change since I’m not doing much active NFTing anymore.

I’ve been buying BITO. Felt easier, happy with results.

That’s one of the new etfs right? You buying in a Roth or just a standard brokerage account?