TIL poor people dont buy things.

Well of course they don’t. They can’t even afford to click an ad.

Wait until the crypto bros realise these paid NPCs could also do valuable work talking to people about things like banking, your internet, or your electricity bill.

This podcast describes exactly what happened to my friend with T-mobile SIM-swapping.

You get a insider at these companies, normally a – what we call a ‘manny’ or a manager to give you their login or to just do swaps whenever no one’s looking for an imaginary customer. So, these insiders are frequently paid about $10,000 per swap, and this is the beginning of SIM-swapping. This is how SIM-swapping started.

$10k per swap. For a store manager at T-mobile. Yeah that’s not gonna be a problem.

Also a crazy method I never even imagined:

So, it starts at the fact that you’re not calling the phone company; you’re actually – the new way is called remo snatching. Remo is short for remote tablet. So, you are going to T-Mobile. T-Mobile is the easiest place to hit right now. You go to a T-Mobile, you run in, [MUSIC] you take the store manager’s tablet from his hands; you run out.

So, they pay $200 for someone to go in and grab the tablet and bring it back out to them. They have to be set up nearby, because they only have ten minutes to do this, remember? So, the person who ultimately has the tablet in their hands is particularly skilled at navigating the T-Mobile software to do the SIM-swap. Maybe that’s because they worked in the store before or they saw a video on how it’s done. But still, the person who’s actually typing on the tablet doing the SIM-swap isn’t the same person who’s gonna steal the cryptocurrency from Coinbase users. That’s a whole ‘nother group of people who have collected all those Coinbase logs and are waiting for someone to do a remo. They all get organized inside a Telegram chat room, and people are willing to pay a person to do a remo swap sometimes $10,000 per number. I’m just trying to confirm that when they’re in this Telegram channel and they’re like okay, I hope somebody gets a remo tonight; I’ve got three accounts I really want to do, all you need to do is provide that phone number to the person who did the re – who got the remo, right?

And confirms my suspicion they’re mostly going after crypto holders:

The most popular database I’ve ever seen in my years of being here is the Ledger database. [MUSIC] Ledger is a company that provides physical cold wallet storage for Bitcoin. Well, what does it say about someone if they buy a Ledger wallet? It means they have Bitcoin. So, thereby, that’s your perfect target for crypto.

And of course lol coinbase:

I don’t even know if you’re gonna believe me whenever I tell you this, but there was an exploit in Coinbase for about one month where you could check the balance of any valid password and username. You could – no matter what. You didn’t need to have any sort of access except username and password. So, you didn’t need to SIM them to see their balance. So, people just ran millions upon millions of combos, combo list through Coinbase, and just found the millionaires of Coinbase. There’s obviously millions of those.

JACK: The reason why they transfer it to Coinbase Pro is because there’s a higher daily withdraw limit there. But there’s a safety check there, too. Before you can withdraw funds from Coinbase, there’s one more 2FA check, so you need to get another text message from the holder to initiate the transfer. But there’s still yet another security hurdle; Coinbase has a maximum daily withdraw limit, and sometimes people have more than that. But Drew says that’s not a problem.

DREW: Yeah, there’s a few workarounds. People use exploits I can’t talk about, but there are ways to withdraw $250,000 or a million dollars. You can withdraw massive amounts of money. There are – one way that everyone knows that I can say to you is there is a certain bot out there on a forum that is able to spam request all at the same time to overwhelm them and allow them to withdraw a bunch of batches of smaller transactions. But there is other ways as well that are more directly exploits.

And once again lol T-mobile. Nice fraud protection:

So, I’ll break it down to you based on carrier. So, T-Mobile at the moment costs you about $5,000 per swap. If they’re a fraud victim, then it costs you $7,500. A fraud victim has special protections on their account, but they’re still bypassable. Verizon is going to cost you upwards of probably $50,000. Verizon is extremely well secured, but it’s still possible if you have the right equipment. Like, you need a branch manager login which is a very high position. So, you need to be able to pay off that Verizon manager a lot, and you can’t hack them. You can’t – it appears, right now. I could be wrong. Maybe we’ll find new findings. But they pretty – you literally just need a insider. You can’t rat him or anything. For AT&T, I think that people are starting to decrease their prices down to $4,000, $2,000…$2,000 to $3,000 because their opus tool is not too secure.

The whole thing is a great read. As is this episode:

Major “I independently confirmed this by thinking about it” energy here.

When I read down, I thought it was maybe down 2-4 hundred, not 10%

Lol, that’s some serious copium.

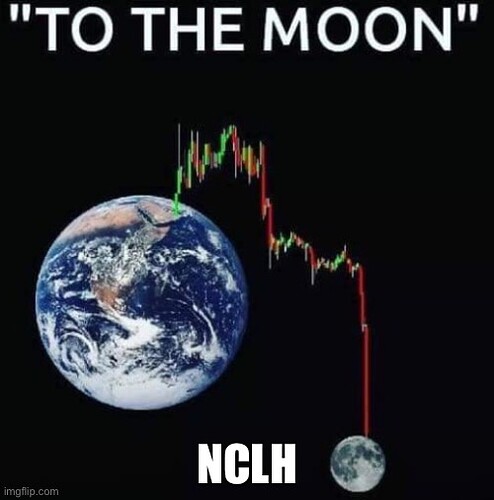

You know what significantly beat the market today? Cruise Stonks. Y’all need to give up on Crypto and GME and go all in on cruise stonks. NCLH is the new GME.

hahahahah oh wow

guys ITS PROPERTS DICTACTE YOU SHOULD PAY MORE NOW WHY IS LINE GO DOWN

If that dude thinks the price should have gone up he probably should buy some more. He’s a whale he could make it go up 5-10% in a day. There isn’t that much volume.

Great looking chart

Lol

Line go up? “look! Inversely correlated to inflation”

Line go down? “look! It’s inversely correlated to inflation, just not yet because we’re still early”

This guy should stop shitposting about bitcoin and start bragging about his twitter handle. “@tyler” is pretty elite.

He did invent facebook you know