I’ll allow it

Tree hugger looks like Dids.

Simmer down children. Your awful takes are giving me an aneurysm. It’s like an alzheimer convention in here everytime there some cryptoez news.

How much money do you have

I just wandered back over to the 2p2 bitcoin thread and nothing has changed there either. Still the same people arguing when or if bitcoin is going to take over as reserve currency. You would think they are trolling each other but I think they are dead serious.

Depends what the CPI nr comes in at in a few hours…

https://www.sec.gov/news/press-release/2022-219

Washington D.C., Dec. 13, 2022 —

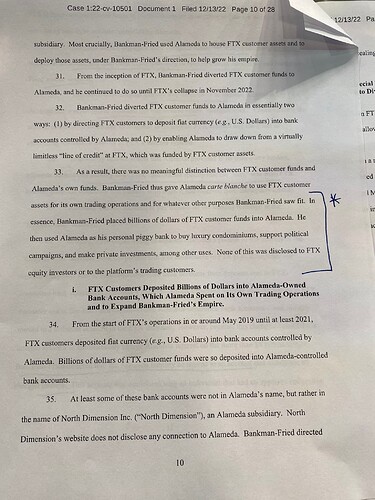

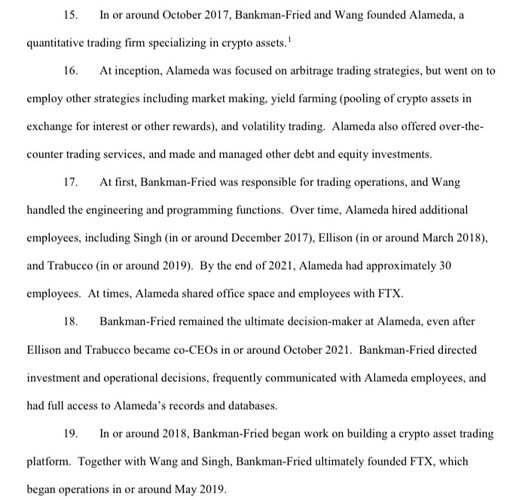

The Securities and Exchange Commission today charged Samuel Bankman-Fried with orchestrating a scheme to defraud equity investors in FTX Trading Ltd. (FTX), the crypto trading platform of which he was the CEO and co-founder. Investigations as to other securities law violations and into other entities and persons relating to the alleged misconduct are ongoing.

According to the SEC’s complaint, since at least May 2019, FTX, based in The Bahamas, raised more than $1.8 billion from equity investors, including approximately $1.1 billion from approximately 90 U.S.-based investors. In his representations to investors, Bankman-Fried promoted FTX as a safe, responsible crypto asset trading platform, specifically touting FTX’s sophisticated, automated risk measures to protect customer assets. The complaint alleges that, in reality, Bankman-Fried orchestrated a years-long fraud to conceal from FTX’s investors (1) the undisclosed diversion of FTX customers’ funds to Alameda Research LLC, his privately-held crypto hedge fund; (2) the undisclosed special treatment afforded to Alameda on the FTX platform, including providing Alameda with a virtually unlimited “line of credit” funded by the platform’s customers and exempting Alameda from certain key FTX risk mitigation measures; and (3) undisclosed risk stemming from FTX’s exposure to Alameda’s significant holdings of overvalued, illiquid assets such as FTX-affiliated tokens. The complaint further alleges that Bankman-Fried used commingled FTX customers’ funds at Alameda to make undisclosed venture investments, lavish real estate purchases, and large political donations.

“We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto,” said SEC Chair Gary Gensler. “The alleged fraud committed by Mr. Bankman-Fried is a clarion call to crypto platforms that they need to come into compliance with our laws. Compliance protects both those who invest on and those who invest in crypto platforms with time-tested safeguards, such as properly protecting customer funds and separating conflicting lines of business. It also shines a light into trading platform conduct for both investors through disclosure and regulators through examination authority. To those platforms that don’t comply with our securities laws, the SEC’s Enforcement Division is ready to take action.”

“FTX operated behind a veneer of legitimacy Mr. Bankman-Fried created by, among other things, touting its best-in-class controls, including a proprietary ‘risk engine,’ and FTX’s adherence to specific investor protection principles and detailed terms of service. But as we allege in our complaint, that veneer wasn’t just thin, it was fraudulent,” said Gurbir S. Grewal, Director of the SEC’s Division of Enforcement. “FTX’s collapse highlights the very real risks that unregistered crypto asset trading platforms can pose for investors and customers alike. While we continue to investigate FTX and other entities and individuals for potential violations of the federal securities laws, as alleged in our complaint, today we are holding Mr. Bankman-Fried responsible for fraudulently raising billions of dollars from investors in FTX and misusing funds belonging to FTX’s trading customers.”

The SEC’s complaint charges Bankman-Fried with violating the anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934. The SEC’s complaint seeks injunctions against future securities law violations; an injunction that prohibits Bankman-Fried from participating in the issuance, purchase, offer, or sale of any securities, except for his own personal account; disgorgement of his ill-gotten gains; a civil penalty; and an officer and director bar.

In parallel actions, the U.S. Attorney’s Office for the Southern District of New York and the Commodity Futures Trading Commission (CFTC) today announced charges against Bankman-Fried.

The SEC’s ongoing investigation is being conducted by Devlin N. Su, Ivan Snyder, and David S. Brown of the Crypto Assets and Cyber Unit and Brian Huchro and Pasha Salimi. It is being supervised by Amy Flaherty Hartman, Michael Brennan, Jorge Tenreiro, and David Hirsch. The SEC’s litigation will be led by Amy Burkart and David D’Addio and supervised by Ladan Stewart and Olivia Choe. Additional assistance to the investigation was provided by Steven Buchholz, Erin Wilk, Serafima McTigue, William Connolly, and Howard Kaplan.

The SEC appreciates the assistance of the U.S. Attorney’s Office for the Southern District of New York, the FBI, and the CFTC.

https://twitter.com/laurashin/status/1602628918619639809?t=zY7WO4LDs_hS-4tMCJmr_A&s=19

Thread on the charges (crossposted from imjosh in discord)

More like sell NFT tickets to people wanting to slap him in the face

Admittedly this guy does have a weird hard on for binance (over loads of relatively more dodgy exchanges) but Harold.jpeg etc

The guy was busy fucking. He doesnt need to micro manage 32 billion dolars.

Hopium at this point.

When you hold so much of your networth in 1 asset, you need it to pump and every single way it can pump to infinity is considered, no matter how unlikely.

Some peeps over there sold their real estate and bought in at 55k bitcorn. Ouch.

SEC complaint is recommended reading

One of the things that struck me the most is how quickly this all happened. FTX has only existed since May 2019

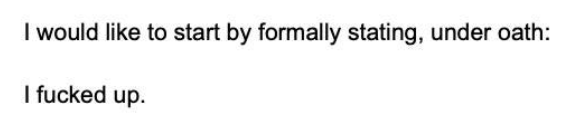

Wow. This dude seems to think that by saying he’s sorry for this accounting oopsie, it’ll keep him out of federal prison

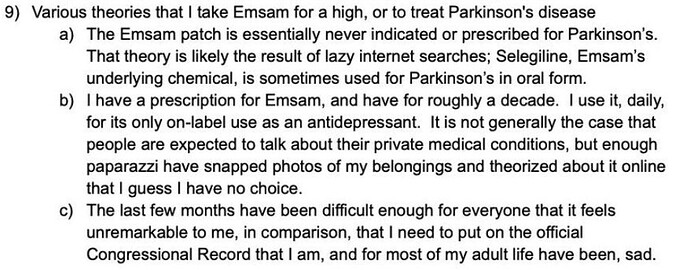

True. The reason I posted that excerpt is because it is one of several public statements, including interviews and tweets, that SBF made about doing the crimes and that are now incorporated into the SEC’s complaint.