PUTTERS! PUTTERS! PUTTERS!

Looks like their mallet putters go for $400. Hard to believe the stock is crashing.

Penny stonks are the new meme frontier; WSB is basically for boomers now because r/pennystocks is where the action is. I’ve only just started following it, but recently there has been RAD, TUP, YELL (now YELLQ), WE, TTOO, GNS (again), WETG, TIVC, GMBL, EBET, and NVOS. The shitcoin traders here would probably make a killing in penny stonks too.

Here’s the 15-minute chart for EBET:

Casual 350% pump on no news.

When one ticker dumps, they just pump another one.

60 million market cap on 300k a year sales. I guess that’s better value than the 350 million market cap it hit yesterday.

Seems like the type of thing those guys like Citadel who pay for order flow could easily frontrun.

So John Deere (DE) beats earnings and revenue estimates for Q3, and I’m like SWEET it’s one of my IRA stonks cool cool!

Butnahhh it’s down 5%, -$17+ per share because who the fuck knows why?

fears demand will go down basically

oh you thought stonks were about facts silly you

lol yes I know I know

Meanwhile they’re all like, we think demand will go uppppp herp derp

Looking at the last three months there was a massive runup in the stock. DE is a hedge fund favourite and they get killed on it. So many poorly run hedge funds spend hours upon hours getting farm reports to get ahead revenue numbers for companies that sell tractors. I remember about 7 years ago it happened with DE when every hedge fund was shorting them knowing they wouldn’t come close to hitting revenue targets… and they were right, but DE predicted that and cut costs and were profitable and the short covering in hedge funds lead to a 20+% increase in a week.

Looking at a run up I can potentially see a lot of big money betting big on revenue and maybe it wasn’t as good as expected or they want to exit their position and there aren’t any buyers.

Also, I didn’t look to see if the execs mentioned anything about the next quarter(s) or if a rival company made commentary about the industry either.

edit: It’s still up >15% from its end of May low despite the huge market selloff this week

also crop prices have been going down, kinda low right now, ie farm income is going to be a bit down, ie no money to spend on a tractor that is more expensive than their house

Tingo, the Nigerian prince company I mentioned, seems to be in trouble. They were supposed to release their Q2 earnings on Aug 10, but then postponed it because:

This is to allow independent counsel, retained by Tingo’s independent directors, the additional time it requires to complete its independent review of the allegations made in the Hindenburg short-seller report.

They postponed to today, so today I had my popcorn ready with the conference call webcast open, but they’ve postponed it again:

…the independent review is still ongoing. As such, the Company and the independent auditors require additional time to complete the preparation of the Form 10-Q and financial statements.

The stonk ($TIO) is down >30% after hours as a result. I guess investors are starting to believe Hindenburg due to how guilty Tingo is acting.

I bought a bit of this stock because the schmucks at the cigar lounge own it and were talking about it. I don’t like one of them very much and figured as soon as I bought it would tank, which it has. They own a ton of it, though.

Mission accomplished. I’ll see them tomorrow. Should be fun.

Lol you bought a few shares just to mush him, that’s fucking legend. I kinda wanna meet these guys just to put faces to who the hell invests in Tingo. How did they even hear of it? What other stonks do they like?

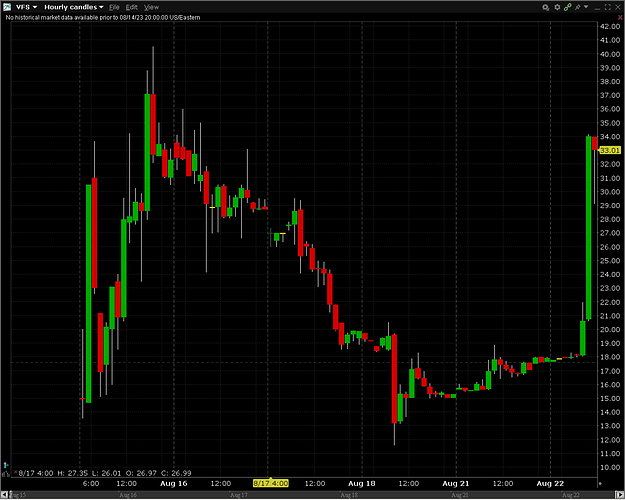

Meet Vinfast (VFS), a Vietnamese EV company that IPO’d last week and has a 76 billion market cap (making it the 5th most valuable car company, just ahead of VW):

Edit: now it’s the 3rd most valuable car company.

Such a tease, there are no locates for me to short it and there are no options contracts yet.

The reviews on their vehicles are so incredibly bad.

https://www.motortrend.com/reviews/2023-vinfast-vf8-electric-suv-first-drive-review/

Put the VF8 in reverse to back out of a spot, and the whole car shudders violently. The parking brake doesn’t release until you step on the accelerator, and once you do, there’s no hold function, so you’d better keep Creep mode engaged so it’s always sending power to the motors. Disable Creep, and the car will roll away in gear. I nearly rolled backward into another car at an intersection like someone learning to drive stick.

Yet another overvalued SPAC scam.

I don’t know how they heard of it. These guys have money and this is their ‘fuck around’ money that they trade with.

I think one of them follows all the bullshit stock sites and probably picked it up there and then sold it’s upside to a handful of other people in the lounge. I think the guy I don’t like has like 100k shares or something.

I bought some this morning and it’s up 134% WHEN DO I SELL?!???

I rented some kind of Chinese hybrid called a Lynk & Co to drive around Europe. It was a decent car.

12:04:50

an electric car stonk has a nonsensical rise at the ipo open then dies later on? NEVER SEEN THIS BEFORE

yeah I avoid shorting but this one I gotta do it if I can find a way cause come on.