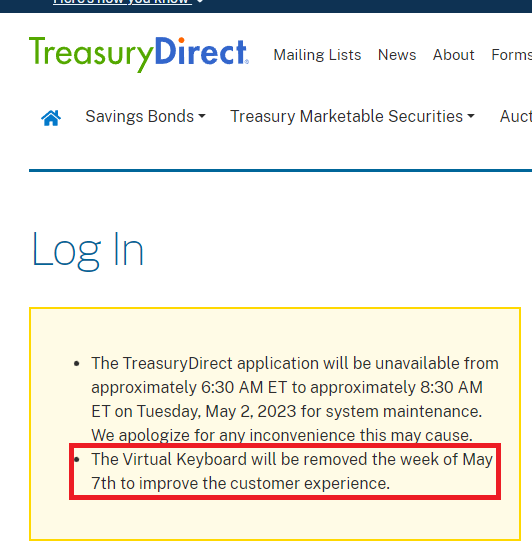

New Ibonds rate is out. It’s only 4.3%, but any bonds purchased between May 1 and October 31 get a fixed rate of 0.90%. That is the highest fixed rate since 2007 and is obviously better than the 0% fixed rate I have in my two tranches.

Is there an easy way to cash opt old ones and buy new ones with higher fixed rate?

I don’t think there’s any issue with that at all - just a simple sell and buy, with maybe a few days of settlement time required (I’ve never sold, so I’m not sure) and the following caveats that you probably already know:

- That doesn’t let you increase the total amount of I-Bonds, because that exchange would count towards your 2023 limit.

- You can’t sell any that you’ve owned for less than 12 months.

- If you’ve held for less than 5 years, selling now loses 3 months of interest (which, based on current rates, is probably really high)

Yeah nobody should be selling until at least 3 months after may 1, that way only the 4% gets wiped out instead of the current 6.9%

1 in 7 dollars invested in the S&P 500 is an either Microsoft or Apple!

Doesn’t seem like this will end well?

https://finance.yahoo.com/news/apple-microsoft-never-held-more-100156014.html

Ugh I just bought into two large-cap funds last week in an attempt to “diversify” more and looked at where their holdings are and, sure enough, the top two in BOTH are Apple and Microsoft

VTSAX and chill!

In theory, if you’re indexing, you want to buy the market, and you want your holdings to be in proportion to their market caps. At this particular time, AAPL is about 7% and MSFT is about 6% of that total and I don’t think there’s any inherent theoretical risk in this.

If it bothers you, it’s possible to find a product that uses some different weighting other than market cap. The most obvious is something like RSP (Invesco SP500 Equal Weight ETF). Equal weight just means they keep each of the 500 stocks at 0.2% of the total. They claim this gives you a slight improvement in historical performance through the increased diversification but you’ll also pay a slightly higher expense ratio compared to something more basic.

Apple and Microsoft are unquestionably the #1 and 2 best companies to invest in. They really aren’t in the same category with anything else. And everything has and will contiinue to get more cominggled in the future anyway, I think.

There is a huge risk increase in holding the runner ups like Google and Amazon compared to the two former.

The mutual fund or ETF? or does it matter?

ETA looks like the main difference is it’s 3 large to buy into the fund

VTSAX is a specific fund.

Pretty sure if you setup reoccurring transactions the minimum doesn’t apply. At least that’s how it was when I first bought in.

I was on the Vanguard page. It looks like if I am reading correctly they have a mutual fund which is VTSAX and they have an ETF which is I assume based also on the whole market which is VTI

https://investor.vanguard.com/investment-products/mutual-funds/profile/vtsax

https://investor.vanguard.com/investment-products/etfs/profile/vti

It says the minimum investment is $3k for the fund (VTSAX)

So if they’re both “large blend” based on the entirety of the market are they functionally the same thing? Other than the obvious differences between the way the trades are executed etc

Vtsax and the etfs Voo and VTI are essentially identical. Other than an initial minimum for vtsax, the only difference is really how a broker may offer auto deposits into those funds. Whatever is easier and simpler for you would be the one to do. Everything else is just splitting hairs.

Whatever allows you to invest in it and to get you to forget it is going to be best for you.

It’s not that they are not good companies, but they are not cheap and not without risk.

Apple has a large dependence on china built in to it’s supply chain and Microsoft’s legacy business’s haven’t been the growth engine of the company for a long time.

Amazon is still by far the leader in cloud computing and the growth in that business for both Amazon and Microsoft is deaccelrating post the covid recovery.

At what multiple should single digit growth mega cap companies trade?

Microsoft is all in on AI and I suspect it’s because of the deaccelration of the growth in cloud. It’s a very risky strategy, pushing out these large language AI systems to the public with out knowing how they work, what they are capable of, how dangerous they are, how they will be used by bad actors, the race to AI is incredibly dangerous and irresponsible!

This video is worth a watch. If you don’t have time, make time. Prepare yourself. The next few years are going to be a crazy ride.

Lol no its not. The savings will be $0.

We were clearly ok paying 6.99 a dozen. Prices arent coming down from there until we stop buying them

Turns out I completely misremembered what happened when I started my IRA. I’m pretty sure you could setup automatic transactions and bypass the minimum investment at one point, but that wasn’t the case when I opened my account in July of 2017.

I opened my account and initially setup automatic contributions into a target date fund so that I could get the ball rolling with $25 a week. Then I was able to up that to $50/week, etc. Then in November 2018 I finally had over $3k and sold all of my target date fund shares to buy VTSAX. As far as which target date fund to pick, just pick the one that is furthest out since it will be higher weighted in stocks.

Sorry for misleading you. Also, +1 to everything Formula72 is saying.

I probably decreased my egging by at least 50%.