Rollover to trad ira?

It’s a Roth but the guy at Merril says it’s not treated as a rollover I just get the after-tax funds transferred to the 401k. I’m over 50 so I guess the only advantage of moving it now is if taxes will be higher for me come retirement time is there anything else?

Let’s say it’s 5 years and the 401k grows and you’ve made more pre-tax contributions. How do they know how much of it is still after tax?

Well in my specific case, I cannot make any more contributions to this 401k because I don’t work for that company anymore. It can keep growing, or shrinking as was the case last year, right where it is as long as I don’t touch it, but I won’t pay taxes on any of it until I retire/withdraw the funds because they were pre tax contributions. Either way, none of it is after tax so all subject to tax when the time comes under current rules.

Ok, bond geniuses. I’m committed to running this experiment. I want to try to do it for less than 1K total and something more than one year but a lot less than 10.

What bond and bond fund should I buy?

based on that explanation it doesn’t matter as long as it’s the same one in both transactions

because MATH

UTWO

Single bond should do a little better because of expense ratio.

Sick return:

Fox News agreed to a $787.5 million settlement for Dominion Voting Systems’ defamation lawsuit over the network’s 2020 election broadcasts regarding its voting machines.

The biggest winner from the settlement is probably Staple Street Capital. The New York private equity firm acquired a roughly 76% stake in Dominion in 2018 for $38.8 million. Assuming it has made no additional equity investment since, its share of the settlement would be $598.5 million.

Despite all the recent dilution that sunk BBBY to the pennies, they’ve now filed for Chapter 11 bankruptcy. Shareholders will be last in line to get anything from the proceeds, meaning they’ll likely get a big fat zero.

The apes, of course, are saying this is all BULLISH. The stonk dipped to $0.14 but they’ve bought the dip and now it’s trading >0.22

There was recently a short report against FOUR by Blue Orca. The company’s reply was so good that I’ve gone long:

For those betting against us, keep in mind May 4th is just around the corner.

If that’s a bluff, well played sir!

Most company replies to short reports are the opposite and often increase my confidence in the short.

I didn’t read the rest of the exchange on this ITT yet, but the only difference is that a ‘10 yr bond fund’ is doing constant reinvestment so that you are always holding the equivalent of a 10 year bond. So your term risk always reflects 10 years. If you buy a 10 year bond, then you only have 10 years of term risk at the beginning, and it goes down over the time that you own the bond. Therefore the bond fund should have a higher expected return to compensate for the risk.

Levine:

I don’t know what to say? All of this was quite well disclosed. Back when Bed Bath did the Hudson Bay deal in January, it said in the prospectus that it intended to use all the money it raised to repay debt, and that if it didn’t raise a billion dollars in that deal (it did not) then it “would not have the financial resources to satisfy its payment obligations,” it “will likely file for bankruptcy protection,” “its assets will likely be liquidated” and “our equity holders would likely not receive any recovery at all in a bankruptcy scenario.” All of the legal documents were pretty clear that Bed Bath was raising money by selling stock to retail investors, that it was handing that money directly to its creditors, that the money probably wouldn’t be enough, that Bed Bath was probably going bankrupt, and that when it did the stock that it had just sold to those retail investors would be worthless. And things have worked out exactly as promised. No one can be surprised!

And yet it is one of the most astonishing corporate finance transactions I’ve ever seen? The basic rules of bankruptcy are:

- When a company is bankrupt, the shareholders get zero dollars back, and the creditors get whatever’s left.

- The shareholders don’t get less than zero. They don’t put more money in .

Here, I mean, Bed Bath was kind of like “hey everyone, we went bust, sorry, but our lenders are such nice people and they could really use a break, we’re gonna pass the hat and it would be great if you could throw in a few hundred million dollars to make them feel better.” And the retail shareholders did! With more or less complete disclosure, they bought 622 million shares of a stock that (1) was pretty clearly going to be worthless and (2) now is worthless, so that Bed Bath could have more money to give to its lenders when it inevitably liquidated.

I mean hasn’t BBBY been considered a meme stock for a while now though? I thought it was one of the ones r/wallstreetbets was monkeying around with a while back? No one is buying up shares of that for their IRAs and such.

yes, they were originally going to file bankruptcy in january, but knowing they were a meme stock they delayed it and put a ton of additional worthless shares up for sale so they could bilk the redditors out of a few hundred million more before they officially filed.

It started as a WSB meme but then migrated to its own BBBY subreddit of true believers, where any apes with a few brain cells to rub together were gradually banned / filtered out until all that remained were the aggressively stupid ones and the place became indistinguishable from a cult.

These are the kinds of people still buying/holding the stonk as a fundamentals play:

Ape urinating on CNBC Headquarters in retaliation for attacking Bed Bath and Beyond. Bullish !

Later that day, he went to the apartment of the former CFO who had killed himself by jumping off the roof. He was there to harass the guy’s widow, but the doorman stopped him, at which point he accused the doorman of being in on the hit job that Jim Cramer had allegedly ordered.

https://old.reddit.com/r/gme_meltdown/comments/11es9dm/after_peeing_on_cnbc_hq_in_the_morning_the/

There was also a video of him shooting at cutouts of some hedge fund people as target practice.

His theories are standard in the BBBY sub and the people there love him, his name is Kais Maalej.

who had a bunch of activision bc they were gonna get bought out by microsoft again? whoops

Cramer ftw

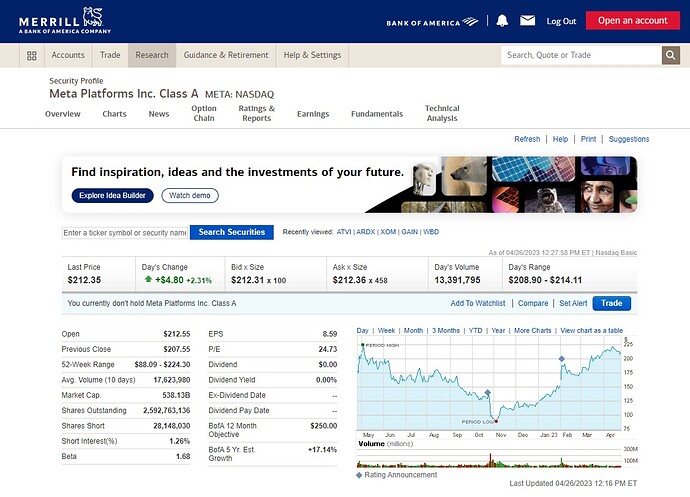

META back up! That 52-week spread tho

BOA, CFRA, MorningStar all currently rating it as Buy or Hold

Lol, some of those had them at a sell when they were at a 100 but doubling in price is certainly a sign to buy. I wonder if they changed their tune on Netflix yet.