These things on the road in southern California?

Imagine bonds returning 43% in a year.

I’m just trying to imagine the broader economic conditions that would facilitate a 43% return on bonds. Seems brutal.

1990 or so? Inflation was coming down massively and there was a recession so interest rates came down a lot too I would assume. Was only 4 so I don’t remember.

One of them at least

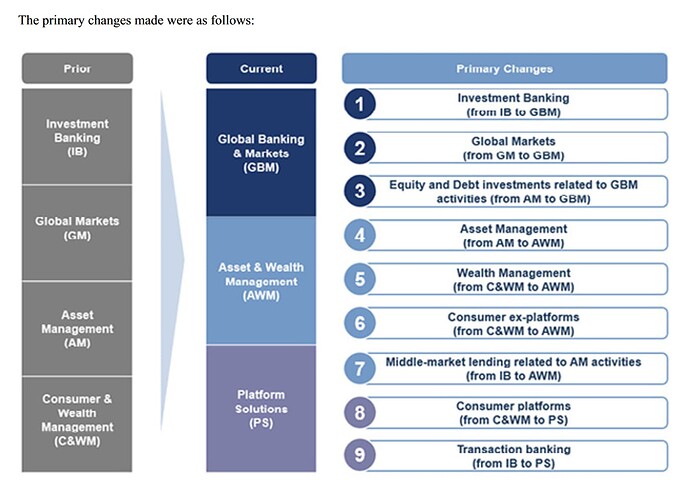

This Goldman Sachs thing has been bothering me, and I think I understand things a little bit better. GS filed an 8-K recently that reveals they’ve changed the way they’re going to report their business segments going forward. Graphically, here’s what the change looks like:

So I think they’re going to be providing more detailed information about Marcus, Apple Card, and related business in their Platform Solutions Group starting with their 2022 10-K (which they’ll file in about a month). What they do report in this recent filing is that this new Platform Solutions segment has lost $3 billion over the 2020-2022 period (where the 2022 period is through 9/30). But it’s hard to know exactly what lines of business that relates to.

Looking back at their 2021 10-K, they report an aggregate provision for credit losses that’s really volatile. In 2021, that number was $357 million, but it was $3.1 billion in 2020. They mentioned that 2021 included $185 million of provisions related to the acquisition of a General Motors co-branded credit card portfolio, and that 2020 was shitty because of COVID. Hopefully they’ll provide more detail about these provisions in their upcoming 10-K.

It had to be the early 80s. The only thing that could make bonds rise that much would be to be issued when rates are like 20% and then rates start dropping rapidly for new debt but without huge increase in default risk

Seems like it would’ve been. Reminded me that this was in my feed the other day. I have to think I’d be emptying any available dry powder if we see rates approach anything like that. 30 years is along time though…

I think this is one of those things that’s easier said than done, it’s like when people say I’ll empty the clip when spy gets down to this level, but then it gets down to that level and they never do because the conditions that lead to the market dropping to that level make them hesitant to buy. People in the 80s would have been very worried about interest rates continuing to rise even further, because that’s the only direction it’s ever moved in their lifetime, and having to take a huge loss if they ever wanted to sell those bonds before the 30 years is up. They would have been very perplexed if you told them interest rates would one day be 0% in their lifetime.

Because inflation was tracking above 10% in the late 70s and early 80s those 15% returns didn’t seem so high. People at that time had no way to know that inflation would be so much lower through the next 30 years.

Yeah it’s really not much different than saying why didn’t people in the past time the stock market and go all in when it dropped to this level. Someone trying to time the bond market in the 80s would have likely gone all in when interest rates hit 10%, then proceed see interest rates continue to skyrocket and the value of their bonds drop big time and would be inclined to sell before they have to take an even bigger loss.

It was truly a different time. The number of retail investors was much smaller. 401k plans barely existed for example.

I remember that my parents in the 80s would pretty much exclusively invest in CDs with 10+ percent yields. Unfortunately it was really just lucky donk behavior, because they kept going with CDs for far too long after that. It was well after 2000 before my “Hey, maybe you should consider some index funds” actually broke through. And even then they would still buy at least some CDs.

My parents replaced their CD player this weekend, and they made sure to get one that also had a tape deck.

If I were you I’d be anticipating a sweet mix tape at the next gift exchange.

If it doesn’t have an 8 track player then I’m not interested.

My mother’s father invested through a stock broker who basically took his money through fees, while her mother only bought government savings bonds and GICs. In the early 90s the risk averse grandmother had been very successful and the equities grandfather had lost money overall.

I actually inherited in 2013 a 30year government bond that was paying 14% and only expired in 2019 or 2020.

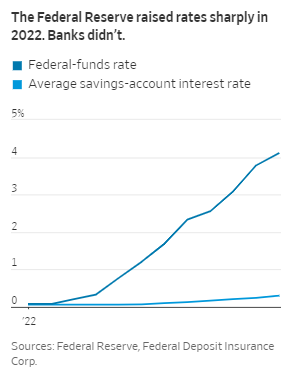

That scam has been going on forever. Schwab’s lol advisory business has like 15-20% of everyone’s portfolio in cash at Schwab yielding nothing.