I usually have to make quarterly estimated tax payments. In past years, I’ve set the money aside in a high-interest online savings account. This year I’m considering buying T-bills with the appropriate maturities.

Yeah, unfortunately my appropriate maturity profile now is like 5 months though given the nonsense thats about to occur in the House.

Pardon me, your majesty.

lol. it’s not uncommon in the U.S., for one thing because of how withholding on annual bonuses works.

In the Glorious Socialist Republic of Canada, we voluntarily send all our money to our beloved federal overlords, and only reluctantly accept any of it back once our benign and wise federal civil servants have paid themselves handsomely and made sure their early retirement pensions are well funded and guaranteed. We’re lucky, really.

I have always just left my overpayment at treasury for simplicity but at these interest rates it might be worth the brain damage to actually do quarterly payments.

I can’t imagine how much money we’d have to be talking about for me to do taxes four times a year.

In Canada you don’t actually have to do taxes 4X per year but if the tax authorities deem it necessary they will put you on the quarterly payment plan instead of annual. Normally when you file once per year you pay or collect your difference in actual vs. deducted taxes and then it’s all cool till next year. But if you owe a lot of taxes then tax authority will estimate what you owe for the next year and make you pay it in 4 installments. Basically they don’t want people to always be paying a year of taxes in arrears. This happens to a lot of professionals who, for example, are part of a partnership. The partnerships will often distribute compensation to the partners with no income tax withheld and leave it up to the professionals to sort out all the tax stuff.

You just do a back of the envelope estimate, it isnt the same painstaking process. The only form is filling in a number and writing a check (so to speak) and the worst case is you underestimate and pay a small penalty and interest or float the government a small amount. Would think many on this board have had to do it for poker at some point.

Anyone know how to short indian stocks?

How is MoviePass going to be a thing again?

Working hard, thank you!

BTW, does anyone know what IBM does anymore? They have $60 Billion in annual revenue. Seems like a lot for writing a program that can play Jeopardy!

Seems like they provide alot of cloud data services to companies. That’s got to be pretty lucrative. Every exec in the world knows they need their data on the cloud, even though the have no idea what that means.

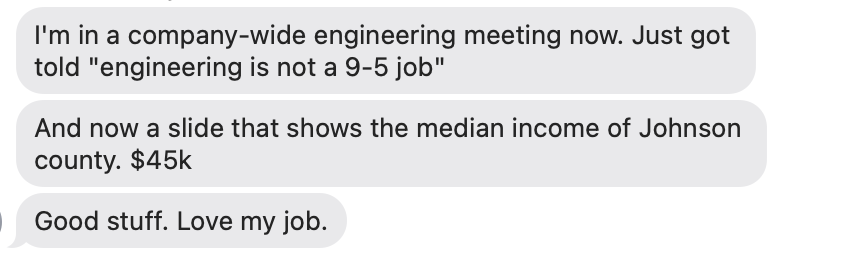

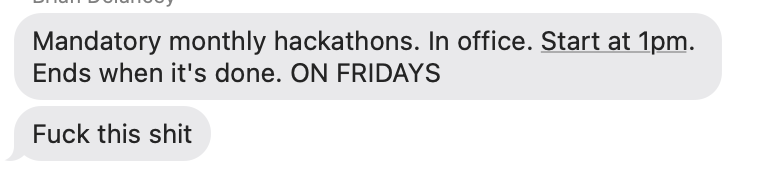

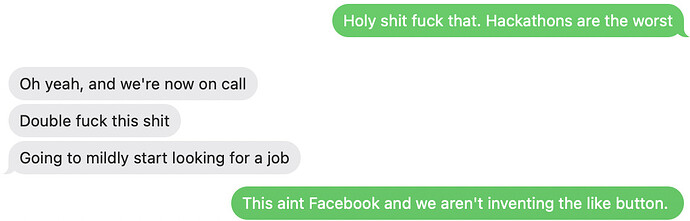

[x] pisseder

omg worked through four weekends. someone call OSHA

Looks like most IBM revenue comes from software and infrastructure which is cloud shit.

So Hindenburg takes short positions on a company then tells everyone why they suck?

Now this is a business that we should be in.

I’m aware of a number of short sellers authoring reports on various companies, such as Tesla and Herbalife, over the last decade or more. AFAIK, most of the reports are pretty well founded, but sometimes they don’t have much of an impact, at least in a short-term investment horizon. There’s the old saying that, “Markets can stay irrational longer than you can stay solvent."

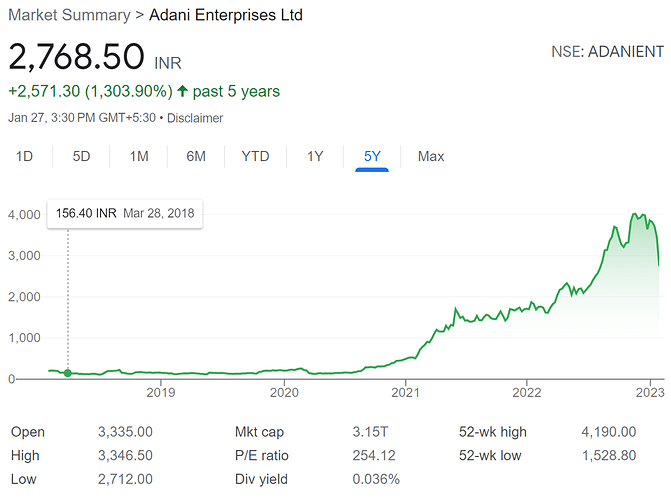

That said, Adani seems like a pretty easy target with a lot of bad facts that is ripe for a decline.

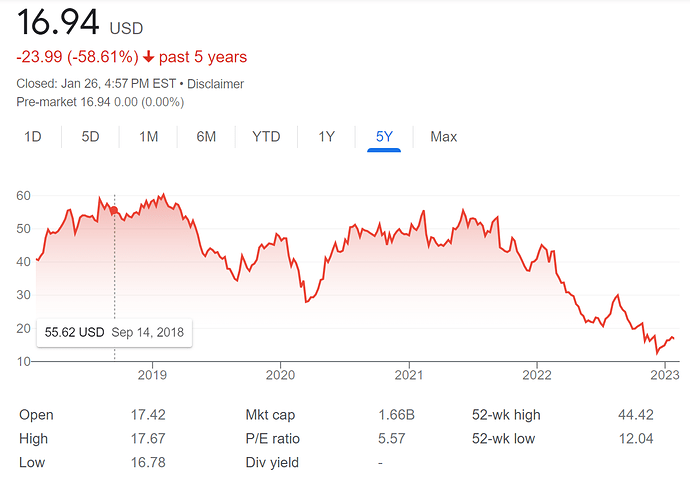

edit: rough 5 years at Herbalife.

Recent Adani performance (down 27% in last month):