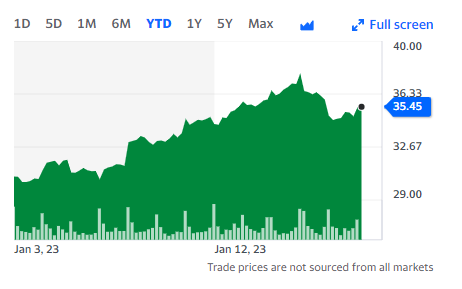

Wonder how much Cathie Wood paid for this.

Wonder how much Cathie Wood paid for this.

but it’s 100% accurate!

Fair points and it is mostly inertia at this point for me, but at the time I opened up a brokerage account on Vanguard it was because I realized I had 4 different investment accounts across 4 different platforms. I wasn’t too impressed with the platforms for 2 of them (Schwab, Fidelity) and the other provider didn’t offer any other accounts except for the company 401k. So I tried to simplify a little bit by adding another account to Vanguard since it’s still easy enough to maneuver around once you figure out how to do the thing you need to do (setup an automatic reoccurring transaction).I remember calling support when I setup my Roth because it wasn’t clear at all what I was doing and actually had a decent support experience.

I have been meaning to rollover a 401k into an IRA. etrade looks like a pretty good platform since I’m not too worried about being across different platforms anymore.

I mean I guess but I spend like 15 minutes a year making adjustments on Vanguard’s website. Maybe on etrade it’d be seven minutes a year? I’ve never had to do anything like roll over a 401k so maybe that sort of stuff is significantly harder, who knows.

Does anyone have any experience with Wealthfront or Betterment? I am thinking about giving one of them a chance.

I think they do direct indexing which seems like a complete nightmare to me relative to just buying VTSAX.

You could maybe beat their higher vig with their automatic tax loss harvesting feature but it just seems like not worth the effort. I looked into one of those years ago but bailed when I figured out there was no way to elect to not reinvest dividends. No big deal for me now, but when you start withdrawing from your accounts you want that option.

I recently saw Fidelity advertising this and it seems kind of awesome - Like, yes, I want to exactly hold the entire S&P 500 except for Tesla. I would have absolutely done that. Of course, this is exactly the attitude that leads investors to underperform the market, but IT MIGHT WORK FOR ME.

People come up with all kinds of mechanisms for dealing with euphoria about a certain stock. In Canada many years ago our largest company by far was Nortel. Nortel is famous in Canadian business history because it was just a monumental Canadian company. At one point I recall that Nortel was over 1/3 of the entire Canadian TSE 300 stock index and almost half the TSE 60 index of the 60 largest companies in Canada. For a large part of my early career, Canada had two stock indices that were tracked separately because the main index was just the “Nortel plus noise” index. We still have a “capped index” that limits the contribution of any one company to 10%, but for many years the performance has been pretty much the same between the index and the capped index.

Nortel’s ascension and bankruptcy is a fascinating story of business and retail investing. There’s a great book about the company called The Bubble And The Bear.

Never heard of this before, but just put it on my reading list. When I saw the rating of 3.75, I was initially hesitant.

So I read the single review. At first, I was like

If this were half as long I think I would find it twice as interesting.

But then I was like

Lots of technical detail in this forensic account but not all of it accessible.

I, for one, am glad that Vanguard has all the functionality of a Geocities era website

In for spidercrab book review.

Can someone explain how Goldman lost $3 billion starting a consumer bank? That’s a staggering amount of money! I’ve read like a dozen articles and none of them explain why the losses happened.

well lending money to consumers seems like a thing that can easily go very very wrong if you are too loose about it

From what I gleaned in a very cursory manner the “lost” money is just a reserve for if they actually lose money. It’s not gone, it just has to be reserved.

Unless I read it very wrong.

Like there’s no way people defaulted in 3 billion dollars of apple card. Fuck outta here.

Where are you seeing this? There’s the WSJ story here:

that says they’ve lost $3 billion since 2020. But I’m having a hard time seeing where that loss is showing up on their financials.

Holy shit. I just saw a Rivian truck in the wild. I didn’t think it was a real operating company.

I see them all the time in San Jose, you can always tell it’s a Rivian by the goofy looking oval headlights.

Ya, I’ve seen plenty of Rivian and Polestars out here. The Rivian Amazon van has a very unique amount of lights on it and also unique in that it was the first electric delivery van I’ve seen.