Those big hedge funds just write it off

Good piece on the IM “Academy” mlm scam if you’re following

Levine endorses TBAB’s assertion that “a system that identifies losers is as valuable as a system that identifies winners”.

I think if you have a strong track record and a rigorous repeatable process of only buying stocks that go down, you really should be able to start a newsletter or get hired by a hedge fund to tell people your best ideas (so they can short them)

Doubly so, since stocks generally go up in the long run.

Louis Vuitton has to be the best business in the world. Every single woman in every freaking airport has a $5k bag, at least.

Probably only costs $100 to make the bag too.

Good read about the McKinsey-led disaster at Nike

One thing that took me way too long to realize is almost everyone in business is full of shit. The below is quite obviously nonsense. KKR claims a “year 1 yield in the low 4% range” and also an “8% unlevered return.” What a crock of shit - would love to see those assumptions!

https://x.com/untrendedyoc/status/1818782487801479368?s=46&t=XGja5BtSraUljl_WWUrIUg

Yeah I randomly checked on ASTS recently and I appear to have been a paper-handed bitch two years ago. I do think shorting or buying puts is a good idea now. What the reddit mob is anticipating in September will probably be a disappointment. Earnings on August 14 won’t be good because afaik the company still has zero revenue and big expenses. At this price, I feel like another round of dilution is imminent.

Looks like bad economic news (poor jobs report) is now bad news that crushes the market, vs. the last number of months when bad economic news was good news because it would force rate cuts. Always hard to predict when that flip happens!

Consensus is this will force the Fed to do aggressive cuts and that’s…bad for equities? Buy and hold man

I was legitimately expecting the S&P to bounce back to down like 0.1% on the day. Instead, I am deeply saddened.

I think the concern is that there is kind of a historic belief, whether right or wrong, that when the rates start legitimately getting cut, it’s time to sell. Reason being is that the odds of having a soft landing have gone down and basically the reasoning for that is that rate changes move very slowly and much slower than how the economy may react. The unemployment rate is super important and that has a high likelihood of continuing of only goin up from here.

Bank of America: Sell Stocks when Fed Starts Rate Cuts (msn.com)

Kind of a nothingburger article but it’s a belief to some extent. Also, the market factors in the inflation and the rate cuts are partly designed to prevent economic shrinkage too fast.

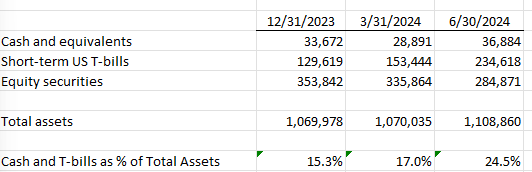

Berkshire reported 2nd quarter results today. Big news is that they sold roughly half of their enormous Apple stake. On the one hand, good news that they sold out of an oversized position that as unlikely to generate great returns going forward. On the other hand, they’ve got nowhere productive to put it. Still happy with my decision to materially reduce my Berkshire shares at around these prices.

Quick summary of 2024 Berkshire activity:

Sales of equity securities ($ billions):

1st quarter: $20

2nd quarter: $77

Purchases of equity securities for the same 6 months: $4.3

So a significant decrease in equity market exposure, all replaced with cash and cash-like holdings:

Seems pretty clear that Berkshire remains in “absolutely nothing seems attractive to invest in right now” mode. That also includes Berkshire stock itself–they repurchased virtually no shares in the 2nd quarter.

Overall, Berkshire is well positioned for a really poor economy or market-wide crash, but it’s extremely hard to be excited about the stock at this level. So it’s a continuation of “a good stock to stay rich, but not a good stock to get rich”. Of course, Berkshire’s behavior is also a bad signal for overall market returns if you believe Buffett has any kind of forecasting ability.

Has Berkshire’s equity portfolio outperformed VTSAX over the past 20-30 years?

So when BH has cash, do they get the same 5% I get?

Assuming we have a proper.sell off over the 6-9 months, I would bet that Berkshire outperforms in the recovery stage. Can’t think of a better managed fund to bet on going into and coming out of a recession. That said if we do have a proper sell off BKRB will be cheaper at the bottom then it is now.