Basically.

Not Berkshire, but Google brought in a billy in interest last quarter

Ultimately, I don’t know. But it’s a pretty interesting and hard-to-answer question for a few reasons:

-

BH has (and has had) a very large and variable cash position. Some of that is truly operating cash (i.e., needed to satisfy even the upper ranges of possible insurance claims), but much of it is discretionary and opportunistic. Should BH’s equity performance be dinged for the large cash drag that could have been earning S&P 500 returns? I lean towards yes. So even if the actual stock picks beat the market, the combination of discretionary cash plus those stock picks might not have, and that seems like the more relevant comparison. That is, if my choice is between holding 100% of the S&P 500 vs. holding some blend of BH stocks and underperforming cash, it really matters how big that cash portfolio is.

-

The magic of BH has been the combination of zero-cost leverage provided by the insurance business with high-quality investments funded by that leverage. If I were managing (or regulating) an insurance company, I’d want to make sure that the capital I held to support that company was fairly safe, so I’d be tempted to hold safer-than-average companies even if it meant that those investments earned somewhat lower than average equity returns.

-

Overall, I’m happy with a world where Berkshire’s investments might underperform the market, but where the company is levered up with zero-cost float. (I’d be even happier if the company’s investments outperformed the S&P.)

As to the answer of your question, my best guess(es):

- Over the last 20 or so years, the equity investments have probably underperformed the market.

- The Apple investment makes that a closer call than it would have been 5 years ago.

- If you adjusted for the safety/risk of the investments, it would be a closer call.

There have been attempts to answer this question before, but I don’t think they’re very good. Here’s one by some AQR people:

https://www.tandfonline.com/doi/full/10.2469/faj.v74.n4.3

Warren Buffett’s Berkshire Hathaway has realized a Sharpe ratio of 0.79 with significant alpha to traditional risk factors. The alpha became insignificant, however, when we controlled for exposure to the factors “betting against beta” and “quality minus junk.” Furthermore, we estimate that Buffett’s leverage is about 1.7 to 1, on average. Therefore, Buffett’s returns appear to be neither luck nor magic but, rather, a reward for leveraging cheap, safe, high-quality stocks. Decomposing Berkshire’s portfolio into publicly traded stocks and wholly owned private companies, we found that the public stocks have performed the best, which suggests that Buffett’s returns are more the result of stock selection than of his effect on management.

Basically, I think the best argument for Berkshire as an investment right now is that it’s able to get zero-cost leverage and is now using that leverage to earn a risk-free 5% or so on a huge chunk of cash in a world where overall market returns are likely to be quite poor for the next 5-7 years.

But that doesn’t strike me as a super compelling reason to be overweight in it, at least for someone like me who’s staring at college tuition for 3 kids in the very near future.

The “zero cost leverage” idea needs some poking at. Is every insurance company just a free money machine? Does BH have some underwriting magic that keeps their losses low?

It’s a fair question to ask. Obviously insurance is not a free money machine. But I think BH has–through whatever special sauce–established a pretty remarkable record on that front. From their most recent annual report:

Our P/C companies have meanwhile had an excellent underwriting record. Berkshire has now operated at an underwriting profit for 18 of the last 20 years, the exceptions being 2017 and 2022. In 2017 our pre-tax loss was a whopping $3.2 billion. In 2022 the loss was minimal. For the entire 20-year span, our pre-tax gain totaled $29.2 billion.

And, this was surprising to me, they actually present this as an expectation going forward:

Except for retroactive reinsurance and periodic payment annuity products, which generate significant amounts of up front premiums along with estimated claims expected to be paid over long time periods (creating “float,” see Investments section), Berkshire expects to achieve an underwriting profit over time and that its managers will reject inadequately priced risks. Underwriting profit is defined as earned premiums less incurred losses, loss adjustment expenses and policy acquisition and other underwriting expenses. Underwriting profit does not include income earned from investments.

So I end up sharing your general sense of skepticism that of course the insurance business isn’t a magic money machine, but at the same time have some degree of faith that maybe BH is?

I think there is a legitimate case to be made Berkshire is basically the only insurer for lots of really catastrophic shit that can actually be counted on to pay out claims, which has to generate pricing power.

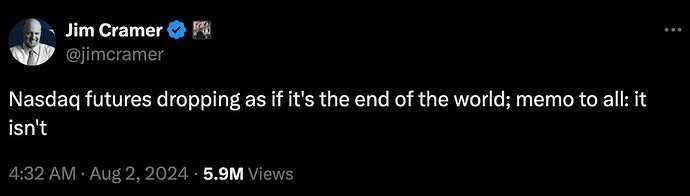

Japan is crashing hard.

Oh fuck, down 6%? That’s not good.

Wild confluence of events with a huge wave of economic uncertainty hitting right as Israel and Iran are ramping up provocations.

Australia is also not stocks today. Down 3%.

Meh. Buy and hold baby!

Just got back from a modestly positive weekend trip to Cherokee for the WSOP Circuit event.

I was all excited to take whatever I could set aside, and pile a little chunk into VOO, my favorite ETF that tracks the S&P.

After seeing what the markets have done last week, and my FUD in the short term, I think I’ll park it in my high yield savings account for at least 2-4 weeks instead.

I admit I am a totally emotional retail investing fish, trying to time the market. I’m gonna hold it long term when I do buy it… but we’ll just see if I can get it for a better price in a few weeks.

Can somebody shut the market off before it goes to 0?

Bitcoin - definitely where you want to be in a sell off. -15%

It’s just money you can use for super illegal shit.

Already a type of day in my market we haven’t seen since COVID.

Our standard daily range is around 16-18 futures ticks. Today we’ve already had a 37 tick range and stocks aren’t even open yet.

The straddle that expires in 3 weeks went from being priced at 100.3 ticks to 123.3 ticks

Very smart people ITT

Wow considering the market movement over the last few days Berkshire pivoting billions to cash seems really timely