Oh it works 100% of the time. All you have to do is identify the correction and you’re gold. Piece of cake!

My retirement accounts are in Vanguard Target Retirement funds, which I think have something like a 30ish% allocation to international stocks.

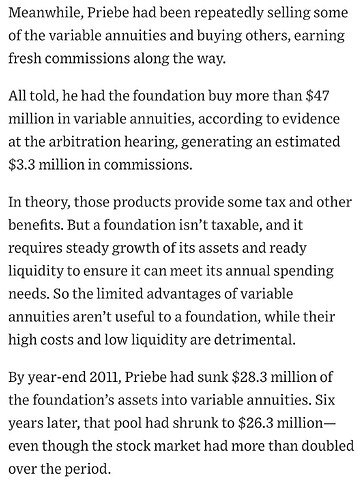

Sickening story of a financial advisor taking advantage of clients (free link):

Market timing in this thread …

But maybe it will work for us!

All that work to rip them off and then he kills himself.

sure did ![]()

What did he do, charge thousands to put them all in bonds and SPY? That just makes him typical. I’ll read the story now

Heh right?

But seriously doesn’t anyone use stop losses? Or trailing stop losses even? Those take a bit of monitoring especially with volatile tickers, But I don’t even need to use TA with them. On my long holdings I just set them to “correction” ie somewhere between -10% and -20% from most recent high. This I determine based on a no-so-complex formula based on a combination of Something I Heard On Squawk Box That Morning and Some Other Arbitrary Statistic I Feel Is Important This Month and Some Shit Pulled Straight From My Arse. They are closer to -20% than -10% at the moment because I’m still bullish af.

If the gods will that they should pop off, I do what the pros do and dump it into the standard safe havens,like treasuries, bond funds, MMF’s, and WMT shares. Once I’m convinced that the shelling has ended and the cease fire will hold, for which I will once again turn to The Squawk for guidance (they’ll constantly show the current treasury yields onscreen for, like, the entire show. I mean, really guys? It’s like you’re obsessed or something. It can’t be healthy Talk about something else you dumb can of hairspray, Like how WMT never stops GOATing no matter how shitty things get. But you won’t.)

Then the circle of life begins anew…

Terrible story.

I was able to learn a lesson though. Alarm bells should be going off in your head any time you find yourself on a private plane to Des Moines so you can talk to a financial adviser.

You can’t predict the market, just pick a diversified asset allocation that fits your risk tolerance and stick with it.

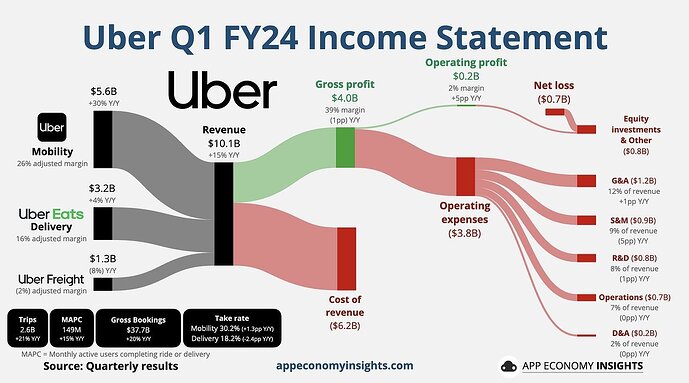

I can’t tell exactly what you mean, but there’s an argument that for some reason, private equity investors funded a bunch of money-losing companies with the optimistic hope that someday those companies would become profitable. But as long as those PE investors were willing to incur persistent near-term losses, customers were arguably getting the benefit of too-low prices. So maybe good for customers?

I’ll admit, I honestly can’t understand how Uber and Doordash have been so resistant to generating profits. (To be fair, Uber was profitable last year.) They’re ostensibly commissions businesses with no real capital needs!

all in on trump media monday at open

I had the same thought. Probably gonna’ pump 20% premarket though.

Can someone ELI5 how trading premarket works? How would I go about doing it on my ETrade account?

I have no interest in actually doing it, I’m just curious about the process.

Door dash and Uber operate on the same principle.

Basically free labor of the drivers. The 1099, self employed status allows the drivers to leverage the mileage deduction tax credit so they pay basically pay no tax on almost all of there income. So u have the driver’s providing most of the expense of a taxi business, car, gas, insurance and all Uber has to do is run the app and they still struggle to make money.

And the drivers are all low income workers who are never going to get audited so I’m sure they all just inflated there milage to basically break even and pay zero tax. Not even payroll taxes. And to be fair the value for most Uber and doordash drivers is just cashing out equity in there car as they depreciate it away running happy meals and airport runs.

So it’s not just private equity funding the show it’s also the taxpayer.

That’s quite the leap from point A to point B.

Jerry, all these independent contractors, they write off everything!

It’s not an irrational argument. How many Uber drivers are paying quarterly estimated taxes?. How many Uber drivers are looking at there tax bill and decide to themselves, I can just keep adjusting the milage and presto I don’t owe anything?

How much overlap is there between people who earn six figures and people who drive for doordash?

It you could quantify how much was paid out in wages to gig worker drivers and how much of that income actually gets claimed as taxable income I would guess that it’s a surprisingly low number.