DoorDash been offering massive amount of coupons lately, more than I seen since started using around COVID

Like this offer seems to be permanently available so I got an order other day cheaper than if I walked into store myself (assuming I tipped at the place too).

You’re lucky Jerome Powell bailed you out on that DoorDash gamble. ![]()

Just relax

I bought puts. It drilled to the 5th circle of Hell but can it hold?

People are inexplicably bullish on this dogshit ticker between earnings calls for reasons I will never understand.

I would still continue and endorse any shorts and puts on anything in this market. I mean, anything is possible in a game where unknown info of the future dictates prices, but all else equal, this is pretty close to as good as it gets for some serious shrinkage.

I mostly agree. I think it stays mostly propped through the election before it stumbles, but we all see its duct tape and krazy glue holding it together. There are only like four tickets I’m never bearish on and even those I can see shorting under the right circumstances

I got greedy before TSLA earnings and went from 92% gain to 95% loss ![]()

I’m starting to understand why option trading can be addicting. Why do I feel like I have the inverse wall street bets voice in my head telling me to “buy puts on the fucking peak” every time it goes up?

Heh no doubt. Like right now I’m looking at Intel’s 3 month chart. RSI is so low it might as well be negative. I feel like full porting into calls. But then I’m like, isn’t this dogshit?

Well CNBC is also broadcasting the Berkshire Hathaway annual meeting for the first time, so if they’re catering to me, I’ll take it.

My wife thinks I’m a lunatic for parking myself on the couch to watch this.

Berkshire cash up to 190 billion. Not great Bob!

Wife: Do you legitimately find this interesting?

We’ve been married 20 years and I dragged her to a Berkshire annual meeting when we were dating. Is she willfully obtuse?

Peloton, man. I continue to be a very happy subscriber but would never ever buy this stock and I’m just hoping that they can continue to operate so that I can continue to use and enjoy their product.

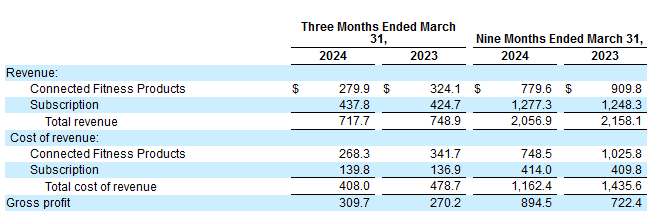

They have a slow-growing steady stream of high-profit subscription revenue, paired with a dogshit business of selling hardware. I appreciate the idea of a “razor and blades” model where you can’t generate the subscription revenue without selling the hardware, but it’s clearly not working. My best guess is that the company goes bankrupt and someone buys it primarily for the subscription revenue, which might be worth something like $500 million - $1 billion.

Which is still substantially less than the current market price, which is astonishing considering the current market price is after this:

It’s down about 90% from what it was before the COVID madness, down about 98% from its peak, and arguably still overvalued.

I know very little about Peloton, but why would any company want the cost and headaches of selling hardware when they can just crank out subscription content to a much wider customer base.

Also, how enjoyable is it for the average person to use a Peloton video while exercising on a non-connected stationary bike?

I think the hardware is mostly locked in to Peloton’s subscriptions and can’t be used with other services.

Can’t yet. It is just software, they could open the platform to other hardware as long as they didn’t do something stupid like lock it too tightly to proprietary features of the hardware.

Weren’t there rumors of an Apple buyout a while back? Could have sworn I saw that floating around Reddit a month or two ago