I’m now down to the one share of RDDT I was issued at IPO ($34). I dumped the rest. Shout out to u/Spez and the other dickhead insiders for dumping millions of shares right after the IPO. How do you not have a lockup period for these guys??

But really I bought because more and more you’re seeing stuff like “google ‘foo term’ but append ’ reddit’ to it and you’ll get the info you need”

Yeah, I do this

Won’t someone please think of the… second generation cinnabon franchisees!

Lmao it’s crazy I see this dumb story and decide to google the guy and of course everything is about how much he cares about his employees, and then he goes on fox and cries about having to pay them more

https://twitter.com/clicktecs/status/1536527731520839680

https://twitter.com/Franchising411/status/1572292010379481089

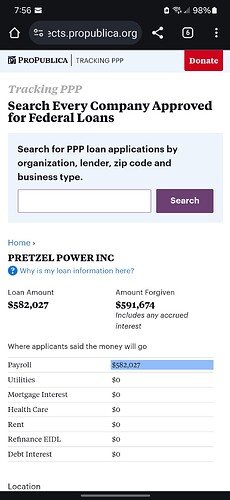

I wonder how much in PPP or whatever they are called loan he took out

https://twitter.com/RBReich/status/1775236829635137978

Corporate media definitely has their marching orders on this one.

That is $22,400 a day (!) if every employee was paid $20 per hour!!!111!!ELEVEN1!!1

How many more Cinnabons and Auntie Anne’s pretzel related material will he need to sell to KEEP UP? Maybe he should ask for a cut of the frozen food section items.

Lol “loan”.

Technically it was a loan. If it turned out you didn’t qualify like you thought you did, you didn’t get forgiveness and it was treated like a normal loan. The first PPP loans went up very fast and there was a lot of misinformation about how the loans were calculated.

I know it’s a joke around here to talk about things like PPP loans, but a businessperson has to be pretty stupid to turn down free money when it’s given, especially considering the potential future of Social Security in the U.S… It was meant to replace Independent Contractor money (calculated off of 1099s for the first if you applied right away but off of tax net for the second) and I went that route instead of being a self-employed person trying to collect unemployment (not given to self-employed people in the U.S. unless they specifically pay in to the system) which was allowed at the time of the first PPP loans. I don’t regret getting either loan even though my name was eventually made public related to getting those when people who got small loans weren’t supposed to be ‘outed’.

Some self-employed people did unemployment, some people did EIDL, and some people did PPP. Every single one of those instances was free money a self-employed person can rarely get, but PPP was the least bureaucratic, fastest, and easiest to get forgiven.

I mean, yeah, take the money.

But then kindly shut the fuck up about minimum wage increases and student loan forgiveness and other things that help non-business owners.

yes technically only 96% of PPP money got forgiven which technically makes it a Loan for Hard Working Americans and not socialism or a handout or any of those other dirty words. glad we got that cleared up.

The government, through the Small Business Administration, gave out nearly $790 billion in PPP loans between March 2020 and May 2021, when the program ended, public records show. Of that amount, $757 billion has been forgiven.

Oh, I agree, MTG got raked over the coals for these exact sentiments while taking over 1 million in PPP loans if I remember correctly. It’s pretty similar to GOP people voting against money for their state/district, screaming about how bad it is in the process, and then touting the great work that money is doing for their state/district when it gets there and they need a boost to get re-elected.

But how much of the forgiven money ended up causing fraud trials? It was probably a lot more than $33 billion.

30 seconds of googling gets me to $600k ppp forgiven for this one entity. Who knows how many more he’s associated with.

https://projects.propublica.org/coronavirus/bailouts/loans/pretzel-power-inc-8477197303

And it looks like he has another LLC, Perfect Pretzel, that had $140k in PPP loans.

Guys like that are always full of s*** about the impact of anything. Cinnabon and Auntie Anne’s are two of the most overpriced novelty chain things on the planet.

$20 an hour is $41,000 per year for a full time worker. Fuck this guy.

PPP loans were free money unless you were a complete moron and/or committing actual fraud. Even most fraudsters got away with it. The vast majority of people took them out knowing there was a 0% chance they would have to repay a dime. They were not really loans. 100% were a hand out to small and medium sized businesses.

I took whatever PPP loans i was eligible for and had to fill out a one page online form and submit it for forgiveness. They were forgiven in less than a day which leads me to believe no actual human was reviewing any of it.

Yeah, saw a different guy on squawk box Monday morning doing the same thing but it was toned way down. He owns TEN (10) MCD franchises and the hosts were just soooo sympathetic to this poor downtrodden soul. Not one question about how the dollar menu disappeared a decade ago, how combos were already in the teens in terms of cost well before now, or how his labor costs had already been cut by over a third thanks to restaurant remodeling and adding kiosks to replace workers. All of which happened well before this change that they knew was coming.

Iirc you need somewhere north of $2MM in liquidity to even be considered for a single MCD franchise

The majority of people who took the PPP loans were behaving in an unethical way. I get it though, especially when you see how corrupt our leadership is.