Don’t forget about the horrible horrible burden of Medicare and Social Security that turns that into $44,136 per year. Crippling.

I would bet this guy is getting even more in erc money.

Ppp was fine, but little franchise tyrants like this really clean up with erc cash.

I had a few companies reach out to “help me” claim the employee retention credit. They told me to write a letter about how our business was effected by Covid. I told them it really wasn’t in the grand scheme of things. They gave me ideas on what I could say.

I only employee 20 people so it probably would not of been that much anyways but I talked to my partner about how I didn’t feel right about claiming something that really wasn’t true so we decided to not move forward with it.

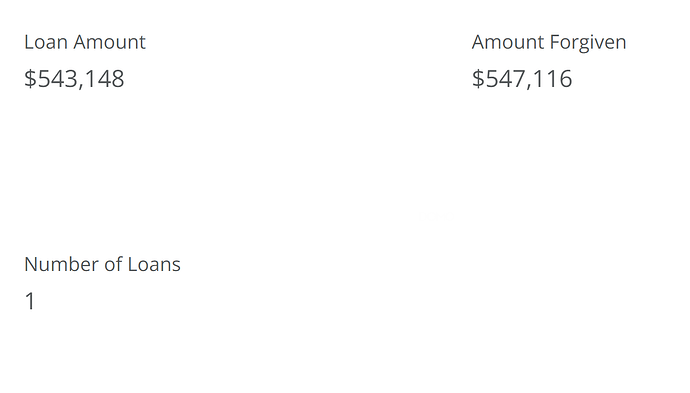

I bring this up whenever the PPP “loans” surface on the forum.The architecture firm I was working for got $500k+ in PPP “loans” during a record breaking year. It went solely to partner disbursements.

Gotta stimulate the job creators.

Pretty sure that’s fraud and absolutely not the intent of the loans. It was intended to pay income of workers and the max salary any of it could be individually based on was $100k. If they took that kind of money and didn’t give it to the workers that it was supposed to be used for that’s more of a whistleblowing story than an anecdote. If money was used to pay worker salaries during the early phases of the pandemic, it wouldn’t matter how the year ended up because that couldn’t be known at the time the pandemic started. If they took a second draw during a record breaking year that exceeded the previous year, then that would be like double fraud or something. I’m guessing they didn’t, because they wouldn’t have qualified for it.

For the first round of PPP no one knew what their years would be like (I’d had work go from being the best start of the year I’d ever had to zero work when Hollywood shut down for about 7 weeks). Hollywood started figuring out how to get around the pandemic about the time the loan was opened up to ICs. I was concerned I wouldn’t qualify for it as my work began picking up again, even though I’d lost the equivalent of 7 weeks of pay based on 2019 wages that were lower than what had gone on in the first 3 months of 2020 for me. My year ended up being roughly similar overall to 2019 but I had a major quarterly drop in income in comparison to 2019 that allowed me to qualify for the second draw and I took it.

I mean, I’m sure the PPP loan was used to “pay employees”, and then the money they would normally use to pay employees went to disbursements. It’s all fungible, isn’t it?

Yeah, pretty much, so I think either your storyline is out of whack or they didn’t use the money properly. I’m much more leaning toward the money being used properly in the early stage of the pandemic during a year where things ultimately went well when they very easily couldn’t.

This isn’t bad business unless they did try to take a second draw. It’s worse business to not take it when the future is unknown (the equivalent of a person turning down unemployment after being laid off due to pride). Like the world could have literally ended. The economy could have completely tanked, etc. It just didn’t. Millions and millions of people got completely wiped out but that was much ‘better’ than what most expected when the vast majority of the global economy shut down for roughly 30 days with no end in sight. It made the GOP use unanimous consent in the Senate to get that legislation through in probably the fastest legislation of that scale that has ever happened. People really did feel what happened was going to be cataclysmic, even Republicans who don’t generally give a s*** at all.

Probably. It depends on how long they waited to file for forgiveness. I think (but can’t remember for sure) that interest started accruing at 10 months, so if forgiveness wasn’t applied for by then it would likely have begun accruing interest. A lot of people waited a long time to apply for forgiveness for the first one because the process wasn’t good. It became streamlined maybe 6 months or so in and became essentially a one page application.

For draw 2, even though the application had it on there, you didn’t have to say which qualifying quarter you were using and I was advised not to put one in. The forgiveness for that one was just giving proof that you had 25% less gross income in any qualifying quarter in 2020 vs. 2019, in addition to the same 1 page application. Draw 1 didn’t have any of those kinds of requirements.

I’m just glad they gave money to businesses to trickle down to their employees vs just giving the money directly to the people.

That was the fastest way that didn’t create 100 million or whatever individual applications that would have many that would be riddled with errors causing tons of additional manpower needs and delays at the application level, especially considering how just processing the applications for the ones who got it was a slow nightmare.

Every employer knows how many people work for them and what their salaries were in 2019. LFS probably had a large enough business to show how this would be the easiest and fastest way. Obviously just cutting everyone in the country a check for $10,000 would have been a good idea too, but that’s not what happened. It was about trying to keep people employed when the economy was in a complete shutdown. That, unfortunately, is most efficiently done the way it was done and that money did make it down to the employees in the cases where fraud wasn’t going on.

The main reason PPP is better than giving employees money directly is if we had to reconstruct the whole economy from scratch after the lockdown and forced ~all non essential businesses to close, the economic disruption would have been much worse.

Why would that have happened?

Businesses are just people. We gave people money directly. It was just the wrong people. How does that scenario avoid economic disruption while giving everyone money somehow leads to it?

Also didn’t other countries (like Canada, IIRC), just give people money directly? Did they have to rebuild their economy from scratch?

I think he was meaning if the event ended up wrecking everything to where it needed to be built again from the ground up. But maybe I’m wrong and that’s not what he meant.

I’m not saying give money directly to employees. I’m saying divide the money up evenly among the population without any means testing at all.

Yeah surprised about people on this board making any defense of PPP at all. Bad idea, badly executed, bad economically, bad politically for Dems, a boondoggle handout mostly to the Republican base.

I think both doing nothing and anything like UBI would have been much better.

It would be interesting to see data on this. The only pushback I would give is PPP benefited the class of people on this board.

That is why you are seeing it defended here.

It could still be true that most of it went to republicans though.

I doubt there’s accurate data on it, but I see this as a handout to business owners not employees.

Sort of like health insurance, why were we tying pandemic aid to your employer?