How much would it have to go up before you cover?

lol dude just buy puts

SMCI is now at 990.27 WHEN WILL YOU BUY IN?!?

DKNG should pump on solid earnings imo

It’s basically the same thing

Wat no

If you buy puts on a stock you think is headed downward, your risk is limited to what you pay for the put(s). If you sell short, your risk is (theoretically) infinity to the up side. And selling short requires exponentially higher margin requirements whereas puts can be purchased with a level 1 cash account.

I get that your risk is theoretically infinite but I don’t think there’s any risk of DoorDash going like 800% up in an instant.

If his theory is that over a long timeframe DoorDash is mispriced on the high side, then there probably isn’t a catalyst event for the market to come around to that and something that might take years to manifest. If you keep buying puts over that long of a time horizon you will likely end up paying a ton in premium, especially when you consider that a lot of non-volatile outcomes cost close to zero if you just short sell it.

Exactly this. At the end of the day, stocks and options aren’t these distinct instruments that give you wildly different expected values. You can create one synthetically from the other, and you can’t get some magical expected value out of one that isn’t present in the other.

Mentally, I’m pretty immune to the paper losses so I don’t think it’ll get to $200 or whatever and I’ll scream out, “I can’t take it any more!” and cover.

Financially, even though I’m bitching about it, it isn’t a super material position that’s going to affect whether I send my kids to college. Right now it means that I’ve had to add more cash to the account a few times to maintain the margin balance and that’s very irritating, but not crippling.

Basically, it’s not a matter of how much pain I’m willing to endure. It’s a matter of whether they seem like they’re on their way to becoming as wildly profitable as they’d need to be to justify their stock price. Right now (and for the past forever), they’ve been absolutely dogshit financially. As long as that continues, I’ll be fine staying short. If they start ramping up their performance, then I’ll start considering covering.

right but if it shoots up after a strong earnings report he could get hit with a margin call which is way worse than having a short dated put expire worthless

This is just sickening when it doesn’t happen to me

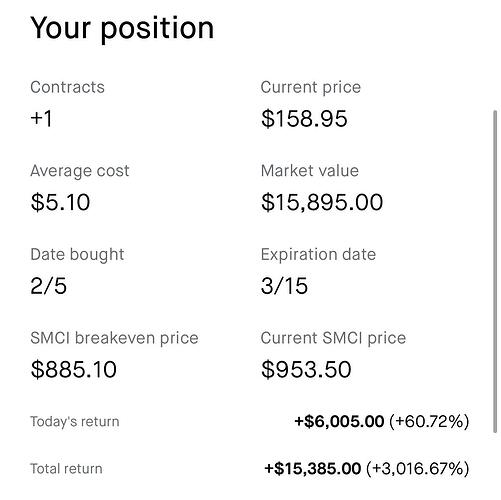

Guy bought ONE (1) call for $510 TEN DAYS AGO on SMCI. It’s now worth almost $16k. Actually the stock hit $1000 at one point so it was worth even more than that at some point

This is true.

Also true is that if the earnings report comes out in line and the stock is unchanged, your put option plummets in value while your short sale is unchanged in value.

I’d also hazard a guess that if someone like me who has traded options professionally for 12 years looks at the DoorDash Options Board and has zero idea how to assess the volatility pricing of those options, that most Robinhood investors also don’t.

Obviously there’s a ton of premium baked into the event, but DoorDash’s options for next Friday are priced at a 96% Annualized volatility. That means we’re expecting one standard deviation of movement per day from today until next Friday to be $6, or expecting DoorDash to have a $12 trading range on the day.

the premium on calls and puts for individual stocks is super high.

Editor’s note: They do not seem like they’re on their way to becoming wildly profitable.

@bigt2k4 @zimmer4141 since you guys seem to know a lot about options

-

are options a zero sum game? like when you buy a stock/index and make money it doesn’t necessarily mean somebody else lost money, but when you make money on a call/put option does that mean that somebody else on the other side of the trade had to lose the same amount?

-

somebody who has no idea what they are doing takes 10k and throws darts at random options, would their EV be positive, negative or neutral? higher or lower than if they took the same 10k to a casino and played basic strategy blackjack

Oh man, you absolutely love to see it

In February 2024, our board of directors authorized the repurchase of up to $1.1 billion of our Class A common stock.

If you’re short a stock, the absolute worst news is that the company is taking advantage of the overpricing by issuing lots of stock for cash or in an acquisition. The very best news is that the company chooses to burn cash buying back overpriced stock.

Not sure DoorDash can stand up to this level of competition tbh

-

Technically yes they are a zero sum game. In order to buy an option, somebody has to sell you that option. The person selling you the option (let’s say call options) might be long the stock already, so they don’t necessarily lose money but the options trade overall doesn’t create or destroy any value (other than the value taken in the form of fees by the trading exchange)

-

EV is negative as they are paying a premium to the Options Market Makers for the order flow. In the example of the option whose premium is $5.00, the Citadels and Prop Trading firms of the world are willing to sell it to you for $5.10 and buy it from you for $4.90. So you will always be executing at prices worse than firms that have incredible experience and technology are pricing the options. That spread aside it’s neutral EV if you’re purely throwing darts, but I would guess that the biases of a complete inexperienced trader combined with a lack of any understanding of options valuation or greeks would lead them to make more -EV decisions.