I’m not really sure to what extent the current period is an outlier. From 1926-2016, the top 4% of stocks accounted for 100% of returns in excess of 1 month treasuries. I find it to be a tremendously important concept that the median return of a randomly selected stock in the S&P (for example) is much less than the median return of the S&P itself.

It’s been at least a decade since I worked in a building without access control. YMMV of course. Have you been working a traditional office job recently?

What you are describing is more common when a company owns the entire building. But if you have a building with lots of different businesses (especially if not in a major metro) I think swiping in and out is not the norm.

In big NYC buildings, this is pretty common. They will be owned by one company, managed by another company that run security, etc., and may have several tenants, all who use the same security badge to get in

Yeah, I’d imagine it’s the norm in NYC. I suspect in flyover country it’s much less common. There is a lot of shitty office space out there.

Same in the Seattle area. Every building has access control on the front door, and additional access control into the individual offices. The access control cards are easy to program to open multiple doors.

We leased space in a building with many different business. Just before COVID hit, the building had upgraded the elevator calling system so that you tap to call it and it already knows your floor. I usually just walked up the 6 floors but still had to swipe into the stairwell and the door to my company’s office space.

I just took my kid to the pediatrician yesterday for a routine annual visit. It’s in a 3 story bldg. There are a couple of other medical offices, an accountant, an attorney, and some other stuff I don’t remember. It seems like anyone could just walk in and out.

I guess it’s possible such a building doesn’t count as “office space”, but that’s what I’d call it.

A space where the public comes to receive services is different than a space for office workers to work without an physical customer interaction

Yeah, I get that. I guess my question is whether they count as “office space”. A law office and a doctor’s office, are most definitely offices. Are they just excluded from the “office space” stats?

Next time you’re their try and get out of the lobby space back into the non-public areas of the building and you’ll start to run into access control.

Definitely possible that medical and medical office buildings are excluded from the stats. “Medical” is often categorized as a separate asset class from “office” in the real estate industry. I would think it’s also not subject to the whims of WFH vs. RTO.

Also, I could be wrong about this, but I would suspect the failure/default of large urban office buildings that absolutely have access controls is more likely to cause disturbances in the overall economy than small class B stuff in flyover country with some lawyers and accountants offices.

I was kind of on the lookout for it since we were having this discussion. Nothing that looked like a card reader to get into the building, or into the office, or from the lobby area to the exam room area. The nurse did swipe a card to login to her computer though.

very reasonable P/E of 97!

Yeah Jim you’re gonna wanna look for a more reasonable P/E ratio, someone in the 61 range.

Warren Buffett’s darling Occidental Petroleum (OXY) closed today around $54 per share.

This company’s stock, however, has gained $54 per share since the market closed at 4 pm today

Thanks for posting this and sorry for responding to such an old post but I missed it before:

I will have to dig it up, but I read an article just recently noting that this is starting to (somewhat) bite (some of) these companies in their asses (relatively speaking). Like, for example, PepsiCo (PEP). They had a great Q4 and topped eps street predictions, but sales did not meet expectations. This was blamed primarily on the fact that, lo and behold, sales volumes are dropping because consumers are seeking out cheaper alternatives. So even after a mostly strong ER, PEP’s share price tanked.

It’s mostly cold comfort, granted, and it really sucks if you bought calls on PEP expecting shares to rise on a solid ER ( ![]() ) but at least some guys in the C-suite will be getting fucked out of their bonuses.

) but at least some guys in the C-suite will be getting fucked out of their bonuses.

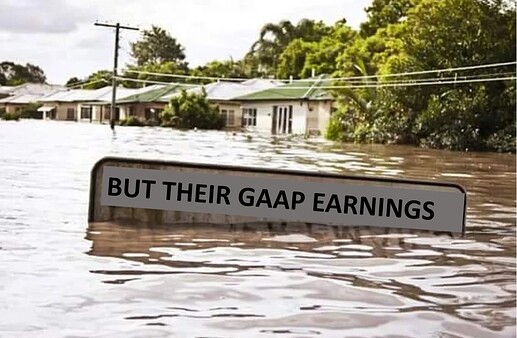

Welp DoorDash will report quarterly earnings today. I continue to be short and am convinced that I’m right, but facts are facts - I have lost an assload of money shorting this stock.

Can’t wait to see the garbage results they post this afternoon, followed by a 19% increase in stock price.

@Formula72, you have clearly been more right than me so far.

When did you short?

Looks like June of 2023 (up 71% since then) and again in November 2023 (up 40% since then).

Not ideal!