Depends on the stock, IV, and expiration though. Like you can buy long-dated, far OTM calls on most any ticker for a few bucks, and a volatile meme stock will generally trade for more than like Ford.

-

Zero sum game is correct.

-

Very negative, the premiums are often super high because those writing the options are taking on a lot of risk, and are getting paid to write them and make money for their employer.

I work in NCIBs in Canada, only half of the NCIBs we are chosen to do are active. Some companies renew every year and never buyback a single share.

Fair. I should have posted the whole quote:

In 2023, we repurchased a total of 12.0 million shares of our Class A common stock for $750 million ($62.66 per share), which completed the share repurchase authorization we announced in February 2023. In February 2024, our board of directors authorized the repurchase of up to $1.1 billion of our Class A common stock.

I suspect they’re actually going to do it.

DKNG expected eps $.08, actual $.29

Also the majority of options (over 60%? 70%?) eventually expire worthless and, even if ITM, it is almost always better to sell them than to exercise them.

If you want the complete lowdown on trading options I highly recommend this guy’s videos. He’s comprehensive and explains it like you’re 5. He uses the Tastyworks platform

Thanks, I was mostly just looking for confirmation that they were indeed zero-sum/minus EV for non-professionals and not some money making tool that I was missing out on. I don’t envision any scenario where I would need to buy options unless I was purely looking to gamble

but how much did he lose?

What do you mean?

Lololol DoorDash still has a market cap of 50 billion dollars LOL GTFO

most people who brag about hitting longshot sportsbetting parlays/options plays also have a bunch of losses on those same bets that they are omitting. Not true in all cases, but most.

It comes from poker where back in the day students would say I made $200k playing poker last year and 90% of people would always ask"but how much did you lose"? Thus it became common in poker forums to always respond to any money with the same response.

Nvidia market cap is now bigger than Alphabet!

Ohhhhh gotcha lol who knows but I’d bet he’s still down a lot lifetime. the thread responses are mostly a mix of “congrats and fuck you” and “WTF DUDE YOU ARE UP OVER 3000% SELL YOU IDIOT” and he’s all like “nope, gonna let it ride some more.” but shit, it went up like 60 more bucks after he posted that! I would have sold long before it got to that point. some of those guys are bigger degens than 2p2 ever came close to seeing

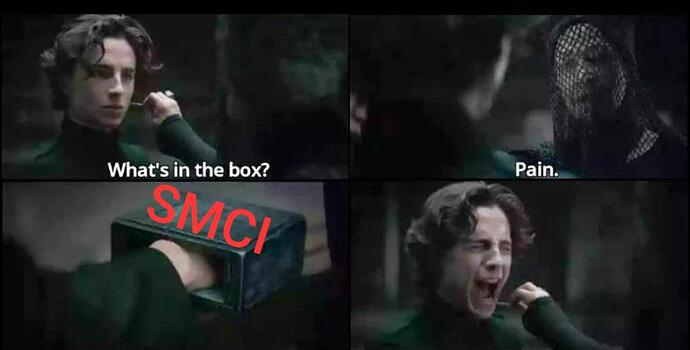

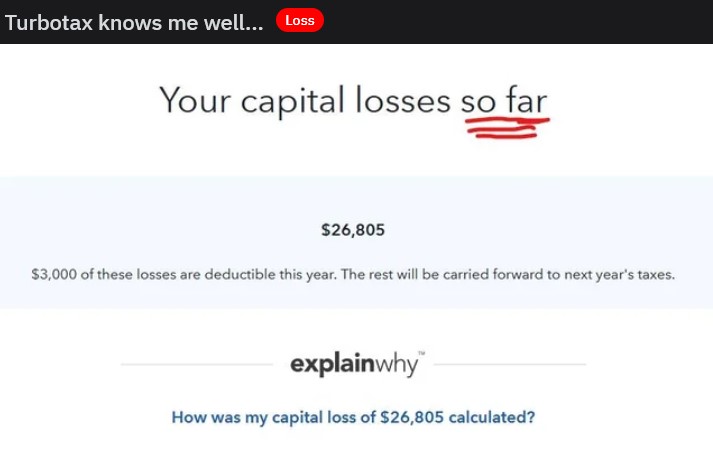

lol SMCI

blood in the streets today

wait what? it comes from telling normal people about poker winnings, and them responding with “but how much did you lose?” because they think you’re not telling them about losing sessions or don’t understand you’re talking about net winnings, or maybe they lie about their own winnings and assume everyone else does and want to know if you’re hiding something.

I’ve got to say that we’ve really come a long way from 22, if “But how much did you lose?” needs an explanation.

Also, I don’t think bigt2k4’s explanation is wrong. I think he was saying that it was a common joke question when used in 22. You explained the origin of the phrase and and it’s not incompatible with his explanation of it. You just gave more detail.

I’ve heard it before obv but yeah it’s been so long that i completely whooshed at the time i responded heh

I agree that he does a good job explaining the information from scratch.

I think the biggest difference between amateur/retail traders and professional traders is that as a professional trader, I’m almost always Delta neutral or hedging to Delta Neutral. I’m Trading based on how I think the options values will change in the near future, not where I think the underlying is going to move.