I mean hasn’t BBBY been considered a meme stock for a while now though? I thought it was one of the ones r/wallstreetbets was monkeying around with a while back? No one is buying up shares of that for their IRAs and such.

yes, they were originally going to file bankruptcy in january, but knowing they were a meme stock they delayed it and put a ton of additional worthless shares up for sale so they could bilk the redditors out of a few hundred million more before they officially filed.

It started as a WSB meme but then migrated to its own BBBY subreddit of true believers, where any apes with a few brain cells to rub together were gradually banned / filtered out until all that remained were the aggressively stupid ones and the place became indistinguishable from a cult.

These are the kinds of people still buying/holding the stonk as a fundamentals play:

Ape urinating on CNBC Headquarters in retaliation for attacking Bed Bath and Beyond. Bullish !

Later that day, he went to the apartment of the former CFO who had killed himself by jumping off the roof. He was there to harass the guy’s widow, but the doorman stopped him, at which point he accused the doorman of being in on the hit job that Jim Cramer had allegedly ordered.

https://old.reddit.com/r/gme_meltdown/comments/11es9dm/after_peeing_on_cnbc_hq_in_the_morning_the/

There was also a video of him shooting at cutouts of some hedge fund people as target practice.

His theories are standard in the BBBY sub and the people there love him, his name is Kais Maalej.

who had a bunch of activision bc they were gonna get bought out by microsoft again? whoops

Cramer ftw

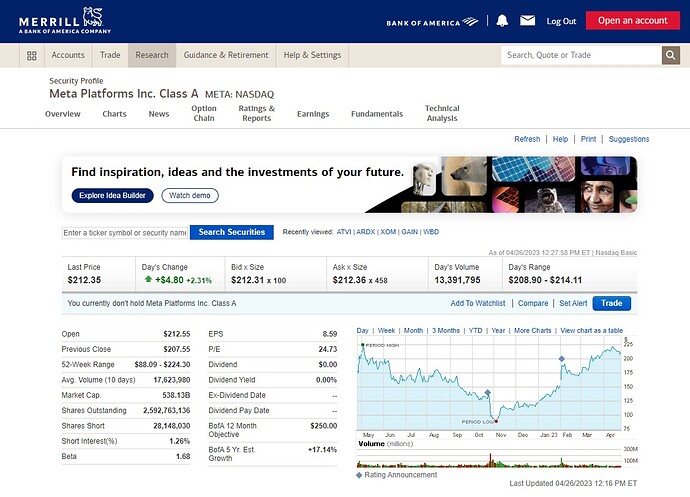

META back up! That 52-week spread tho

BOA, CFRA, MorningStar all currently rating it as Buy or Hold

Lol, some of those had them at a sell when they were at a 100 but doubling in price is certainly a sign to buy. I wonder if they changed their tune on Netflix yet.

New Ibonds rate is out. It’s only 4.3%, but any bonds purchased between May 1 and October 31 get a fixed rate of 0.90%. That is the highest fixed rate since 2007 and is obviously better than the 0% fixed rate I have in my two tranches.

Is there an easy way to cash opt old ones and buy new ones with higher fixed rate?

I don’t think there’s any issue with that at all - just a simple sell and buy, with maybe a few days of settlement time required (I’ve never sold, so I’m not sure) and the following caveats that you probably already know:

- That doesn’t let you increase the total amount of I-Bonds, because that exchange would count towards your 2023 limit.

- You can’t sell any that you’ve owned for less than 12 months.

- If you’ve held for less than 5 years, selling now loses 3 months of interest (which, based on current rates, is probably really high)

Yeah nobody should be selling until at least 3 months after may 1, that way only the 4% gets wiped out instead of the current 6.9%

1 in 7 dollars invested in the S&P 500 is an either Microsoft or Apple!

Doesn’t seem like this will end well?

https://finance.yahoo.com/news/apple-microsoft-never-held-more-100156014.html

Ugh I just bought into two large-cap funds last week in an attempt to “diversify” more and looked at where their holdings are and, sure enough, the top two in BOTH are Apple and Microsoft

VTSAX and chill!

In theory, if you’re indexing, you want to buy the market, and you want your holdings to be in proportion to their market caps. At this particular time, AAPL is about 7% and MSFT is about 6% of that total and I don’t think there’s any inherent theoretical risk in this.

If it bothers you, it’s possible to find a product that uses some different weighting other than market cap. The most obvious is something like RSP (Invesco SP500 Equal Weight ETF). Equal weight just means they keep each of the 500 stocks at 0.2% of the total. They claim this gives you a slight improvement in historical performance through the increased diversification but you’ll also pay a slightly higher expense ratio compared to something more basic.

Apple and Microsoft are unquestionably the #1 and 2 best companies to invest in. They really aren’t in the same category with anything else. And everything has and will contiinue to get more cominggled in the future anyway, I think.

There is a huge risk increase in holding the runner ups like Google and Amazon compared to the two former.

The mutual fund or ETF? or does it matter?

ETA looks like the main difference is it’s 3 large to buy into the fund

VTSAX is a specific fund.

Pretty sure if you setup reoccurring transactions the minimum doesn’t apply. At least that’s how it was when I first bought in.