2 weeks ago JNUG was at 105. 2 days ago it was at ~50. Today it went from 8 to 3.5 to 6 in the last 15 minutes of the day

I started 20% off ATH, so the Dow would have been around 23.6K. Pumped it in every 2% drop, and got a little better than that because it dipped overnight and I got in a little lower.

Plan all along was work it in from 20% to 50% off ATH. Still the plan, not letting myself deviate. If it never dips back down, once the crisis is over I’ll just cost-average the rest in over time more slowly.

My dumbass is over 100% equity exposure currently. Let me tell you this has not been an enjoyable experience but I didn’t panic sell anything so there’s that.

I don’t see how this rally sticks. The 10% drop earlier in the week was due the market assessing Trump’s response as incompetent. Just because the show today sounded better, we all know he is going to continue to be grossly incompetent bordering on malicious. This will again become apparent. Economic effects of the isolation are still going to be real. No agreement between Pelosi and the Republicans on legislation.

I basically screwed up because I wanted to use this opportunity to dump some stocks and forget the time difference between Germany and USA is not the usual and missed the close.

obv i don’t know your age, but assuming you’re 20-40 (even maybe up to 50) then you should be just fine.

Yeah I did the same thing last Friday sort of. Decided about 2 hours after market close to dump everything. Just a $30k haircut from that to when I did finally dump. If the market shoots up after this I’ll be the time the marker hurrr durrr poster boy.

Gold still could be a good hedge but only if the fed take massive action to increase the money supply, which is still a plausible scenario if corporate debt starts defaulting and putting pressure on the banks’ balance sheets

The thing that bugs me about gold is it only goes to the moon when people are legit scared of major societal upheval and USD no good anymore. Well if that happens I don’t have 100% faith the rich guys holding my gold are even going to let me have it. If I’m gonna go gold I want gold coins in my hand.

One lesson from touring old archeological sites like Mesa Verde - when shit breaks down the rich hoard everything and build fortresses - which buys them a little more time but that’s it.

The one silver lining of a total societal breakdown would be to see the rich people try to go to their secure compounds just to have their security staff murder them and keep all their shit. Rich people are dumb and self centered enough to think that people will still want to serve them.

Yeah like those people that bought the $100k bunkers or w/e. You really think you’re getting in while their family members, or someone with more to barter, dies?

The new world order will be a triumvarate of heavily street gangs, national guard units and regular military units. The hillbilly militias may hold a few remote mountain forts.

Once it’s clear there’s no going back - rich old feeble people will be done for.

Lol at spiking the football over a 23k DJIA. If someone would’ve told you last week that we would close at 23k today you would’ve snap sold everything. Or maybe not, gotta stick to your plan after all.

I literally put in a sell order of all my GDX last night and didn’t even know that it went down hard today until I saw this post, hope it went through in time.

Still don’t get how the DOW went up 30% in 2019. Dow has and will never make any sense at all.

There have always been experts who know where the market is headed and there always will be. Sometimes they will even be right.

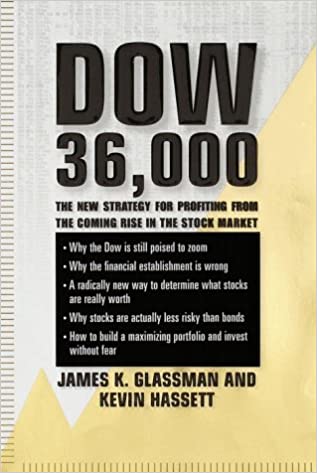

Bonus LOL: One of these authors became the Chairman of Trump’s Council of Economic Advisors because, well, why the hell not?

(Edit) In case you were wondering:

The Dow Jones Industrial Average closed at 10,273.00 on the day of the book’s publication on October 1, 1999, peaked at 11,722.98 105 days later, then declined 37.8% through October 9, 2002.

This book has literally been my target amount to scale back my portfolio out of 100% equities for years - Dow 36k. It just felt like about when the music would finally stop and there wouldn’t be enough chairs to sit in. No I cannot justify that with any science obviously.

Also because Dow 36k would get my net worth to really close that I could sort of coast until with my ultra-cheap semi-retirement plans until SS kicks in. No reason to stay greedy after that I figured.

But then coronavirus came and canceled the party early.

Don’t think @riverman was spiking the football at all.

He was just reiterating that you can’t time the markets, as much as you think you can.

FUCK. Any one of us could have had that job. We just had to write:

DOW

50,000

The new strategy for unlimited growth in the booming TRUMP economy!

33 and I’m not sweating it too hard. Seeing 30% swings either direction is a lot regardless. It’s not a huge piece of my portfolio.

Most of the capital used by Glazer to purchase Manchester United came in the form of loans, the majority of which were secured against the club’s assets, incurring interest payments of over £60 million per annum. The remainder came in the form of PIK loans (payment in kind loans), which were later sold to hedge funds. Manchester United was not liable for the PIKs, which were held by Red Football Joint Venture and were secured on that company’s shares in Red Football (and thus the club). The interest on the PIKs rolled up at 14.25% per annum. Despite this, the Glazers did not pay down any of the PIK loans in the first five years they owned the club

d10 just projecting the football spiking mindset he has on other people itt. Quite telling. Like this thread isn’t about judgement or beating other posters or dunking on folks. It’s about coming up with a plan for your financial future and then executing that plan. Some people’s plan is to just pick an investment strategy and stick with that through thick and thin. That’s what I’m doing, what Riverman’s doing, what spidercrab’s doing. Other people want to duck in and out of the market during crazy times and think they can do it. OK. That’s fine, good luck. That’s suzzer. Godspeed. I don’t think I can do that but I hope that he can. Then you have people like JT who maybe didn’t think about this stuff enough or miscalculated how much they wouldn’t like the markets falling, and they’re panicking a bit and readjusting their approaches during a crisis. And that’s OK too. Hopefully not too expensive of a lesson, and maybe it will pay off in peace of mind in the future.

Then you’ve got d10, who thinks he can slip in and out of the market profitably during times of crisis. Which, maybe. Good for him if true. And if he wants to share his knowledge with us, in his infinite beneficence, wonderful. But he doesn’t stop there. He goes on to berate people who have said that their years- or decades-long strategy is to simply decide on an allocation and stick to it through thick or thin that they are idiots to execute their long-held strategy. And then comes back to – in his own words – “spike the football” when their investments have lost 20% or more. Well my man, you can go fuck yourself.