Have to go to the linked page to see what Rupert Murdoch has to do with the story. A clever form of clickbait?

The thing about market timing is that if you can correctly predict a big move downward due to valuations and news events and be in a risk off position for that move without making the wrong move, you can retire with significantly more money. These events come a few times in a persons life. You don’t need to be able to predict any day to day swings. You just need to predict that it will happen or that it started happening and when in a reasonable strategy to buy back in at a low enough price without missing the bottom.

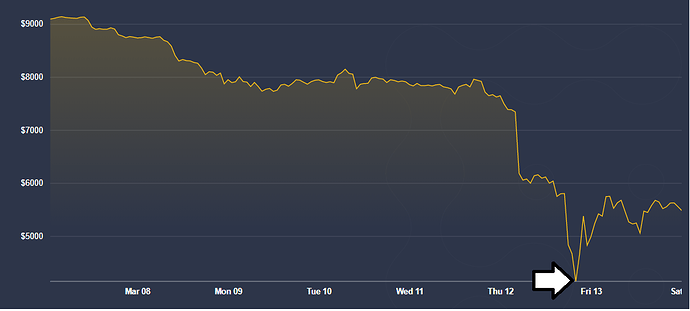

So my 1 foray in market timing went well. I only checked the BTC price a single time yesterday and it happened to be exactly at the bottom so I sold the rest of my BTC holdings thinking I’d be able to buy them back at like 3k a bit later on. To be fair, I had already sold like 80% of my holdings (not timing the market, for a different reason) before BTC took a nosedive from 7500 so I can’t feel too badly.

I was actually giving Riverman the benefit of the doubt. If missing a single day swing was actually his idea of evidence against market timing he’s much dumber than I thought. That’s literally the financial equivalent of Jim Inhofe’s snowball evidence against climate change.

You on the other hand are exactly as dumb as I thought. For a guy who claims the benefit of your strategy is reducing the “stress and hassle and worry” of following the markets you sure do post a lot about following the markets. Why don’t you do us all a favor and commit to your strategy by fucking off from this thread? It’s not like we’d be losing any insight, just constant bitching about how you’re too dumb to see obvious market moves.

Ya, this is one of the few non totally obvious effects I’ve thought about. Some businesses will also have positive effects beyond just lease costs and it won’t be trivial to go back.

Another potential play, but too much uncertainty, is credit cards and those smallish personal loan cos. Lotta people gonna need loans for next 1-6 months.

What? I’ve never said I block out news of market moves. That’s impossible, of course I know when the market falls or gains hugely. I’ve said that my strategy and mindset make it possible for those moves not to bother me at all, which is true.

Hey financial brains, can I interrupt the market timing slapfight with a new question?

What effect do you think COVID-19 will have on the market for single family homes?

Asking because my gf and I have been wanting to buy a house together for a while, and were hoping to get into it this spring/summer. Wondering how COVID-19 might make that a better or worse idea.

It seems like mortgage interest rates will slide further (right?). That’s helpful for us.

But it also seems like the gamut of people/groups we’d need to complete the transaction, from beginning to end (realtor, inspector, appraiser, loan person, title BS, etc.) might be negatively impacted and that might make the whole process way harder.

Any thoughts about the larger macro-level economic forces that might push house prices up or down, other than mortgage rates?

We’re in Seattle, one of the most annoyingly overheated housing markets around, if that makes any difference.

This is dark but it should increase the supply of 70s era fixer uppers that have thirty years of smoke coating their insides.

I’m being 100% serious too. There are going to be a lot of them.

I had the exact same thought. Problem is though that we’re not really looking for that kind of place. Looking for something that’s good to go, or with some minor (emphasis on minor) stuff that we can do ourselves.

The locations of these properties might make it worth it honestly. They are probably very nearly adjacent to the city centers in many cases.

True enough. Although around here the flippers/builders/developers swarm on those kind of properties and I’m not enthusiastic about competing with them in a bidding war. It’s worth keeping an open mind and eyes peeled though.

People could be losing their jobs en masse in 6 months - which will massively depress the housing market - at least for a while.

Yeah, my gf and I are lucky in that we have solid middle-class jobs that are secure, a chunk of cash in the bank, and a bunch of equity in our houses. I feel bad for thinking it but we could potentially take advantage of what you’re talking about.

Is there any way to go from nothing to an options account faster than robinhood?

I don’t see the housing market getting massively depressed. I could see sales slow down but I don’t think there will be drop in prices anywhere close to 2008

Massive unemployment and a high senior death toll could easily do it. And those are both in play. (Obviously, I’m rooting strongly against.)

Well I was hoping to sell my place within a couple months and become a nomad. Not gonna sell now because I’d have nowhere to live. Who knows when nomad will be an option again.

This is basically what I’ve been saying, but articulated much better.

At the risk of being repetitive, the problem with this line of thinking is that your guesses are no more likely to be right than wrong.

I’ve felt the market was going to drop 3 times in my life - dotcom, financial crisis, and now. I don’t have a false positive yet, although I did get a little spooked on the rise back up from the bottom of the financial crisis. I thought it was too fast.

I still think it’s kind of a miracle we recovered that fast. The NASDAQ didn’t reach it’s 2000 high until 2015. The DOW didn’t recover from 1929 for 25 years in real terms (I need to confirm this but I know I read it somewhere).

There are times of mass delusion when you can definitely make or save money going against the grain. If you had said that a tulip bulb wasn’t worth a house in the 1600s you’d have been right. When your uncle is calling you for tech stock tips is a good sign of a bubble, regardless of Greenspan’s “bubbles are only obvious in retrospect” BS. When your lender offers you basically infinite money at ridiculous rates, something is out of whack. That money is coming from somehere.

I think we’re currently in a mini-one in that most people still haven’t really thought through how bad this thing is going to get for the economy. DOW 23k is probably properly priced for the upper 10% of possible outcomes.

The scary thing for me is in the bottom 10% of outcomes (virus mutates like Spanish flu, becomes 10x more deadly, mass riots and wars, etc.) even cash is worthless and even if I bought gold on paper I’ll probably never be able to get it. Nor could I properly defend my gold bars if I did.