https://twitter.com/lucyprebblish/status/1310336661608378368?s=21

Another good attack angle is he pays more money to foreign governments, like Turkey and Philippines, than he does to US government.

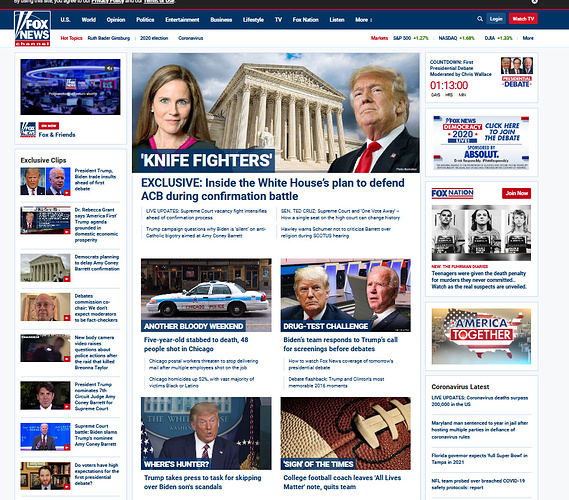

That’s the thing about this and every other bombshell that is coming. There is no chance Fox or AM radio give it a shred of time or credibility. That way their rube audience can just call it fake news. Problem solved.

More like: „Donald Trump is so poor all he owns is the Democrats“

Election betting odds seem to be holding pretty steady. That market thinks this story doesn’t matter.

I do think the initial messaging hasn’t been framed right. I am seeing lot of interpretation of the content of the returns, but the Dems really need to frame this not as an intellectual analysis exercise but an emotions based exercise. Everything needs to be framed as “this is what Trump has been HIDING and now we know why!” People will not have a response to this if its presented as a list of facts, they need to drive home the narrative that this is the revealing of a big dirty secret. People will get drawn into that. Under no circumstances should anyone actually say “this is proof of what we’ve been saying all along”. Proof is boring!

To quote my Tax professor in Law School “Tax Evasion is illegal, Tax Avoidance is smart.”

Yeah my experience is that almost nobody understands how marginal tax brackets actually work. Even smart people.

I had to explain this to several staff when giving them a bonus and the majority had at least masters degrees!

Yeah I’m seeing +124 to +130 but that’ll dry up rapidly I imagine.

Part of the problem is that there are stupid financial things that should be marginal that are not, which further confuses people. For example, the NY state current retirement system charges a percentage of your salary each paycheck. Under a certain amount (I want to say 75k), it’s like 4 percent. Over that amount it jumps to like 5.5 percent. But it’s not marginal, so somebody getting a tiny raise to like $75,200 could actually end up making less overall (This actually happenned to my wife one year). There are other examples, but the fact that people have this experience confuses them when thinking about taxes.

In semi-related news, I was looking forward to taking a deduction because I’ve been working from home all year. However, the Republican tax bill in 2017 eliminated this deduction for anyone who is an employee of a company.

Wouldn’t be a bad thing to campaign on…

Predictit went from 56 Biden / 47 Trump yesterday to 58 Biden 45 Trump today. But yeah, not a huge move.

Usually if this is the case the pension plan would also pay you more benefits. So its not like a tax exactly, if you pay more you would typically receive proportionally more at retirement.

Even if you scroll all the way down through their entire page, it isn’t mentioned anywhere. Not once.