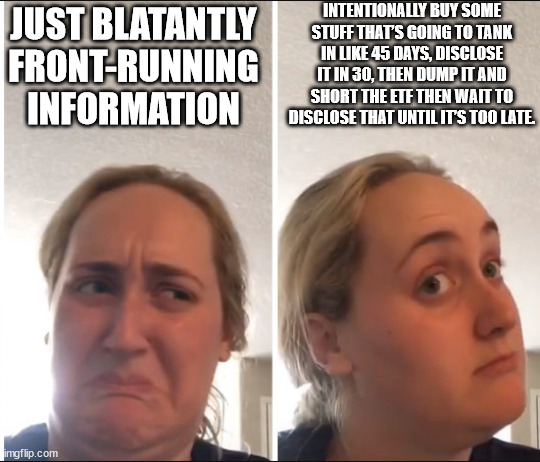

Doing the insider trading shit and shorting their own ticker is the big brain play.

Intentionally buy some stuff that’s going to tank in like 45 days, disclose it in 30, then dump it and short the ETF then wait to disclose that until it’s too late.

FTSE opened massively down, basically instantly gave up all the gains from yesterday’s Bank of England announcement.

Edit: twitter telling me Truss just had a disaster radio interview explaining their economic plans

https://twitter.com/TobyonTV/status/1575393556067393538

https://twitter.com/dinosofos/status/1575395660018368514

I know my confidence is restored.

Maybe Truss should try setting up some interviews with Maggie Haberman.

We have become way too reliant on Central Banking policy to keep the economy stable, and they have a limited toolbox that only affects the demand side of the curve with the huge negative side effect that it mainly helps rich people when they ease policy.

I’m still very curious what Japan does. They’re the furthest down the QEInfinity rabbit hole and they’ve showed no signs of slowing down so far.

Stonks gonna hate this news

Correct. Financial markets already showing real signs of stress and Fed has said they wont stop hiking until they break the job market, so, really scary time to be long risk. Fed playing a dangerous game with lots of potential unintended consequences.

Surely people other than me think it’s pretty fucked up that “we need more people unemployed” is actually a policy goal, right?

Its not the goal, but if you mandate 2% inflation as the goal probably cant have unemployment in the 3s so its functionally the same thing since you cant ease until you see the labor market ease.

If the alternative is pernicious 6-10% inflation, pain more spread around but that kind of sucks too.

As an example the Bank of Canada is expilcit that its top priority is inflation management. They acknowledge employment goals as important, but secondary.

Am I wrong in remembering that prior to Covid, the record for weekly jobless claims basically ever was like 200k? And then Covid shattered that with millions in a week and it just never came down? Isn’t this just reversion to the mean?

Just eye-balling chart but looks like it got to around 700k in 2009.

It also looks like weekly claims below 200k is super rare.

For sure, the comments about unemployment being too low and employees having too much power is a joke.

Cant bring wage inflation down if everyone is working, duh.

Partly that, partly that yesterday’s rally was based on sort of a mirage of the whiff of QE after a pretty steep selloff.

My view is markets cant sustian a rally until we can at least see a path to Fed easing. That seems, optimistically, 3-6 months away. I still dont see how we dont go through the March '20 lows, but I know thats an pretty far off consensus view.

The thing is they can’t break the job market without causing a massive recession, because there are simply too few people for the available jobs. I mean, the grocery store near me is hiring managers, ft associates, and pt associates at $15-22/hr, and has had the sign up for a few months at least.

My buddy and I keep having this circular debate. He says inflation is going to sink consumer discretionary spending among the middle class, which will lead to layoffs and a big recession. My response is that I’m not sure the inflation is going to hit the people who were buying iPhones and flat screen TVs pre-COVID, as opposed to restoring the working class to subsistence level wages. But even if he’s right about that, which is kind of a toss-up to me, if someone gets fired at Best Buy they can go get $30-44K working in the grocery store, so that worker ends up doing just as well and that doesn’t have to spiral into a bad recession.

The question becomes, then what?

If the Fed wants to break this labor market, they’re going to have to cause a shitload of pain.

Funny part is there would be one easy trick to break the labor market: more immigrants.

I think the S&P needs to drop 20-40% to hit fair value and I think if it does that it’ll drop further due to panic. -20% gets to the historical average P/E ratio, -40% gets to the Buffett Indicator.

So that’s $2,200 to $2,900 on the S&P. March 2020 lows were around $2,300.

Whack earnings by whatever x percent you want and then run it, as usual when we enter a downturn the E part materially too high to start.