No for at least the last 36 months the narrative has been that btc/eth is like a leveraged version of spx. Follow the crapto thread for more updates!

I know and it has been recently but one of the main key points used to be how wonderfully uncorrelated it would be. At least I think I remember that correctly.

Yes, it’s a real thing for sure. Even for, like, retirees it is a thing. A 70 year old still has plenty of years of future expenses, the PV of which would have also gone down.

It’s a tricky business for a young person to figure out what “interest rates” means to them. If they already have debt, rising interest rates might impact their immediate cash flow in a bad way. If are planning on buying a house, they will face higher borrowing costs but lower house prices (maybe). If they want to invest in stocks then maybe that will be less appealing if companies can’t borrow at low cost. But then again the prospect of investing in boring old bonds is a lot more appealing if interest rates are higher. And round and round we go. I think you’d almost have to look at every household individually to figure out if the net impact is good or bad when interest rates are higher. Boomers certainly didn’t suffer from starting their careers with high interest rates followed by 4 decades of interest rate decreases.

I just got 2x sausage egg mcmuffin and 2x beverage for $7.95 at mcdonald’s, which is notable because this same mcdonald’s advertises a $22/hr starting wage. I remember the common refrain so long to a federal $15 minimum wage is that prices would explode and no one would be able to staff fast food places etc. I haven’t seen a meal this cheap in forever, and I’m pretty sure mcdonald’s is doing just fine

But you could have had 3 McMuffins if the GREEDY workers would just suffer more like they’re supposed to.

Damn. Trolly with a killer backhand there.

That seems to be the new thing for businesses. When I bought a new car, I was given 6 months of free xm radio. A year and a half later I realized that i had been paying $69 a month when a could have been paying $8 a month.

They wear you out with this stuff and they know it.

You are remembering it correctly.

Lots of the libertarian bro theories on cryptocurrency(probably all of them) aren’t based in reality which is very on brand. The idea that crypto can possibly be a hedge against economic problems/inflation/you name it doesn’t make a lot of sense because it almost requires good economic conditions to thrive.

It’s a high risk gambling instrument. Maybe a high risk investment instrument if we want to be generous.

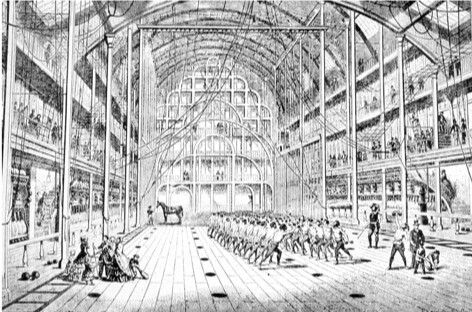

Perhaps Zikzak remembers Richard Simmons’ ‘Sweating to the oldies’?

Perhaps he remembers the health clubs of the 19th century?

well prices did explode for some things

funny to me $15 fed min wage isn’t needed; that happened anyway

It’s great to live in an era of such market volatility that a 1 day 3% dip gets a shrug.

Still time to buy stonks iko

So it turns out bitcoin is just a leveraged total stock market bet.

food prices are excluded from core inflation for a reason. although mcd’s does not adjust its menu prices seasonally, so 7.95 represents some longterm supply chain amortization.

overall, us food prices are very stable and average out pretty cheaply compared to the rest of the world. developing countries have some foods swing 5-10x based on staples being in/out of season.

Millions of americans are going to unexpectedly have 10-20k to put into the economy.

Next day: stonks

That’s kind of a false narrative though. Nobody is getting 10k-20k cash. They’re getting loans forgiven. Loans that nobody has been paying on in almost 3 years anyway.

it would be peak Biden to finally have things start turning around and then immediately go into a double dip recession

they said all along they’d raise rates powell “we’re raising rates” market WHAT???

weird, markets are supposed to be efficient