https://twitter.com/ballaban/status/1555331115954708485?s=21&t=OpbyH0u789omvy0X82teWA

Figured I’d drill down on this and see what people think.

So inflation is up, in particular on stuff like food and gas. This is:

-

Impacting the budgets of the bottom ~50-60% of Americans pretty significantly. → Reduced retail consumption → Reduced profit for retailers

-

Increasing the logistical cost of getting goods from A to B and the cost of some supplies → Reducing profit margins in some industries

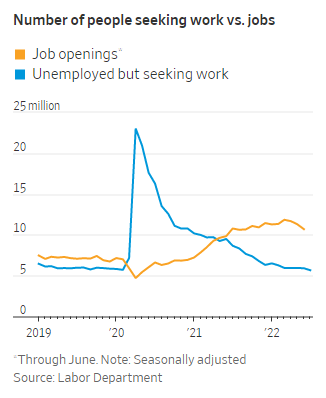

These factors are causing a recession. The typical response of companies would be to cut costs by cutting back on workers’ pay and hours, laying people off, and trying to control supply costs. They can’t do much about supply costs in this environment. Business hasn’t dried up entirely in most cases, margins are just being cut, so laying people off would be cutting off their nose to spite their face. In some cases it’ll make sense, but as long as the layoffs aren’t massive, well, the labor market is tight and other jobs abound. It could just be a reshuffling. I think we’ll see stores cut back hours and reduce staff on some shifts, though.

So the result seems to be that there isn’t much that can be done to the bottom 50-60% at this point. It’s kind of like getting blood from a stone. Most of the growth in the last 20 years has gone to the wealthy, and there’s just not much they can do to make this recession impact the poor more than the wealthy. That’s what’s happened the last few times.

I guess there’s an Armageddon scenario where some retailers go out of business and the layoffs there are significant enough to not just lead to a reshuffling, and we actually start to get a spiral of layoffs worsening the recession, which leads to more people moving back in with their parents and taking on roommates, which eases demand on housing, which causes a housing market crash, which causes more economic pain and we get “the big one.” But I’m fairly optimistic that’s not what we’re headed towards.

I think your outlook is too pessimistic, for a couple of reasons.

-

The two bullet points that I quoted seem internally inconsistent. If (as in point 2), companies are experiencing higher costs that shrink their profit margins, that implies that they aren’t passing those costs along to consumers. But your first point takes for granted that the higher costs are being passed along to consumers. So there’s a real limit on how much both of those statements can simultaneously be true.

-

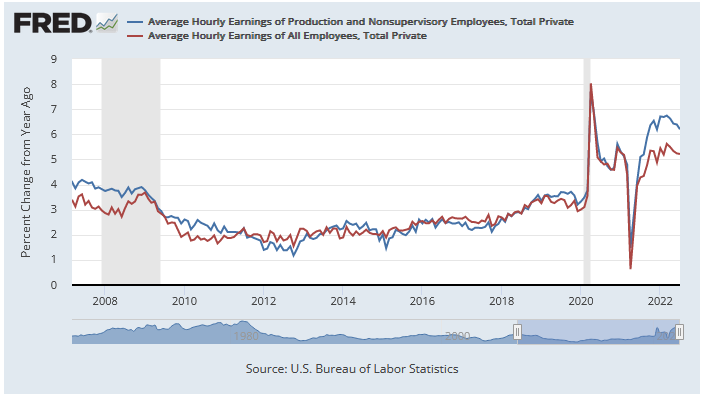

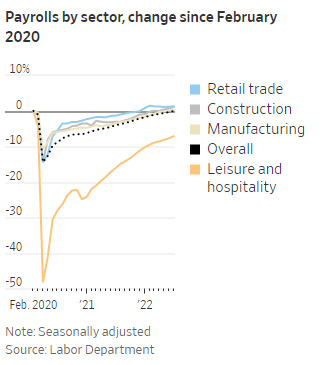

This isn’t a case where employees are watching prices increase without experiencing any wage growth. We’re experiencing strong wage growth (average hourly earnings up by 5.2 percent as of July), and there’s no indication that the wage growth is concentrated in the upper part of the income distribution. In fact, the opposite seems to be true in 2022 - you can see that in the sectors listed in the NY Times article, and the annual change in hourly earnings for non-managers has been above average for at least the last year (focus on the blue line being significantly higher than the red line for the past year):

I don’t want to pretend that high inflation is great, or that workers’ real earnings are rising, but I think you’re assuming an outcome that isn’t obvious.

I am so sick of COVID related charts.

99% of charts I’ve seen in the last 3 years have a some kind of spike in 2020 dwarfing all other factors.

Everything at work has it, every economic or health related chart has it.

I think we should just agree that all charts exclude 2020 from now on. It’s going to make the axis scale easier to read too.

Can’t tell you how hiw tilting this is for me.

Even the COVID charts are like this. The wastewater prevalence charts are unreadable because this massive Omicron spike wrecks the rest of the chart.

Interesting thread about what Uber has been up to

https://twitter.com/doctorow/status/1555557002834841600

https://twitter.com/doctorow/status/1555557010728443905

https://twitter.com/doctorow/status/1555557011487690752

I don’t know who is going to want to drive for them:

https://twitter.com/doctorow/status/1555557018232147969

lol Uber

This was what I was thinking of: 80% of the stock market is now on autopilot

It wasn’t a good piece, but googling turns up similar results from 2019 based on JP Morgan: "60% of assets in US stocks are in passive products.” I guess that meant 60% of retail assets.

It also said:

while quantitative funds, those which rely on trend-following models instead of fundamental research from humans, now account for 20% of the market share

AMC had another bad quarter, stonk accordingly dropped >10% in Thursday after hours. Making matters worse, they announced an elaborate plan to engage in more share dilution:

But apes read that as bullish, so the stonk has pumped >37% since Thursday night.

The Company has applied to list its AMC Preferred Equity Units on the New York Stock Exchange (“NYSE”) under the symbol “APE” starting August 22, 2022

Aron continued, “As a show of appreciation of our shareholders, and to celebrate this AMC Preferred Equity unit dividend, AMC will be issuing an exclusive “I OWN APE” NFT.

“Stupid” tattooed on your forehead, but in the form of an NFT!

That’s the most ridiculous PR I’ve ever read. It’s just a stock split?

This post on WSB says it’s worse than that:

they are unable to issue any shares because retail investors have blocked off any common stock dilution

Well here comes their fix. With these preferred shares, retail traders will not have a choice in the matter when share issuance comes up for a vote the next time around.

I do interpret this line of the announcement to mean dilution:

This new AMC Preferred Equity gives AMC a currency that can be used in the future to strengthen our balance sheet, including by paying down debt or raising fresh equity.

ETA - a commenter quoted the following but didn’t include the source (possibly WSJ):

AMC raised billions of dollars during the pandemic by selling new common shares, though last year it ran out of more to sell. The company tried to obtain shareholder approval to enable it to issue more common shares, but had difficulty corralling its investor base to support the initiative, in part due to some investors’ fears of dilution.

The company’s new move to instead offer preferred equity units is a workaround to that constraint, and frees up a substantial number of units that it could sell as it continues to face challenges due to the continuing Covid-19 pandemic, a person familiar with the matter said.

There are already 5x as many shares as there were in June 2020, plus insiders have been selling like crazy yet apes can’t take a hint.

Soooooo no public company will ever go bankrupt again? We live in a world of perpetual value creation?

I took in uber to the airport the other day. My fare for uber xl was 91$ for a 40 minute trip. The driver received 55 of the fare. How do they not make money?

Is it the case that businesses like uber, Doordash and caravana actually increase cost with scale? And attempts at monetizing are just billion dollar value traps?

![]()

Is that similar to a permanently high plateau?

might’ve hit $100/share at some point if they said NFT a year ago

now it’s just a sad desperate thing to fool the idiots

it’ll probably work right

if you’re wondering about ATMD, it’s $750 now, hope they sold

chinese financial services company I’d run like hell from that phrase alone much less that quoted bullshit in this thread

we need unstuck company with someone creating better sounding bullshit than I could do and then we dump our shares and learn the glory of capitalism

grats to whoever the hell bought at 7 and pumped it to 2k and dumped it tho wish I could do that

I’ve been wondering this about AMC and GME. As long as you have a literal cult that will keep buying your newly issued shares, you’ll never go bankrupt no matter how bad your business is. The question is how long you can maintain a big enough cult. How long can their brains suspend reality at the expense of their personal finances and relationships? How long until they shoot up a synagogue? These two stonks are a psychological experiment and free-thinking neckbeards are the unwitting subjects. Both stonks will go to $0 eventually, but I’m starting to think the only path might be an instantaneous jump from $7 or something. There will still be devout believers up to the very moment $AMC gets delisted. Even then, some apes won’t believe it actually went to zero, but will instead cling to some kind of conspiracy theory and blame CRIME. These people are incapable of admitting they were wrong about anything ever.

However, my impression is that the phenomenon of people believing something more strongly after being exposed to contrary facts applies to more than just meme stonks. That’s how I interpret big bounces after a brutal short report, or SAVA investors being unfazed by everything they hear (including a recent DOJ probe which caused that stonk to plunge from $21 to $11 before quickly being bought back to $20).

It worked for GME, and now AMC is copying their playbook. Adam Aron even stole an idea from the GME cult reddit, tweeting about how this will force a share count and might expose the presence of criminal naked shorts. So now there are apes who believe this move will force shorts to cover, just like GME apes believed their stock split would do.

AMC apes are eating all this up despite witnessing how it’s been going for GME. The thing is, these days AMC apes and GME apes are two separate factions who both think the other side is delusional and “regarded” (in current reddit lingo), if not outright bots and shills hired to distract people from the one true stonk.

I do feel like AMC will continue pumping to $25-30 and maybe continue until the 22nd, and I’m sure insiders are salivating to dump their remaining shares. I’m still short AMC, so I’m tempted to cover now for a profit and re-short higher. But there might not be shares available to borrow when it’s higher, and I plan on riding this ticker down to $2.

It might pump some more, but I highly doubt it will pump like last year. Whether / how much more it pumps probably depends on what GME does. BBBY is a thing again thanks to gme apes’ lord and savior Ryan Cohen buying a stake. But the avg person on WSB doesn’t care about that.

WSB doesn’t really pump things anymore, though I think it still can if the right one comes along. I think there was one good pump there this year, but I forget the ticker and the % gained. I vaguely remember ignoring a bunch of posts with the same ticker, then seeing that it actually did pump for once.