Nope. Missed out on that plunge. Are GME puts free money at this point? You can get Feb 12 puts for a relatively reasonable price right now.

GME in free fall.

Buy the dip.

I’ve tried to short gme for a few days now but Schwab doesn’t have shares available to borrow. Seems odd if there was really all the short covering.

Its not about the money, its about the movement!

The movement being down

I really screwed up by buying Carnival in my brokerage account instead of IRA. Now I have to hold onto it until 11/10 or get hit with short term cap gains tax vs. long term. It’s probably going to moon this summer then crash when they get hit with e coli or something.

The eventual TSLA and BTC crashes (similar market caps) are going to trigger a new depression that we can’t print our way out of. You heard it here first. I won’t be taking questions at this time.

the answer is straight down

curves like that always crash back to earth, I thought it’d take a bit longer but LOL WSB

I’ve lived through a lot of bubbles but this is the most blindingly obvious one ever. And somehow morons are still buying on the way down and holding as if they think GameStop is actually a massively undervalued business.

Quick tip if you all are interested. VGAC, another SPAC, will be merging with 23 & me.

Good time to buy March calls.

The wild thing is the worse the business the more insane the bubble.

Gamestop<<AMC<<<<<<<<KOSS<<<<<<<<<<<<<<<<<NOK<<<<<<<<<<BB

My buddy I posted about yesterday has now sent me a bunch of text messages saying he can’t sell becuase he has lost too much and that he “hopes it won’t go below 30”. I simply told him it is 100% going below 30 to which I got silence.

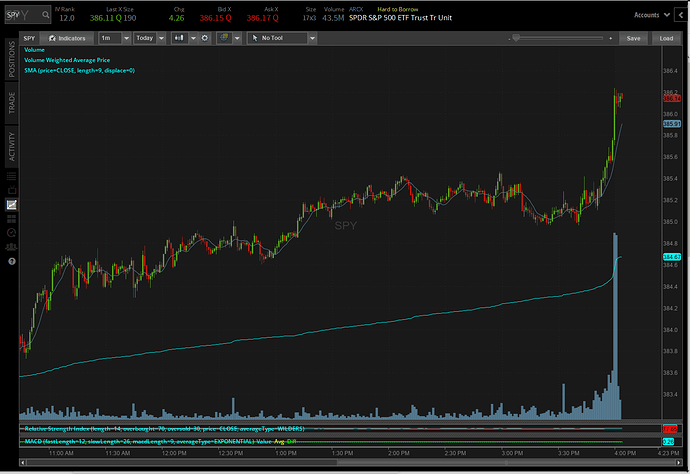

lol the 3:59 SPY candle had more volume than the entire rest of the day combined and just blew us through to all time high

What does this mean? Isn’t SPY just the S&P 500 index?

USA dragging the world along with it, Australian market (though still below pre-covid levels) seems crazy frothy

The thing about frothy is it can always get frothier.

I think the funniest thing about this whole thing is that not once did I see with any real sincerity any mention of exiting or an exit strategy. I mean what did they really, really think was going to happen? STONKS are not bitcoin, they are (maybe nominally now…) tied to an actual company. I mean all of my lols. I can’t believe it lasted until, well, Tuesday basically.