He cashed out 13m or something so no matter what he’s set.

Yeah, the only stories you generally see of people who have held for more than like a 100x on their investment are people who lost their keys and found them later.

That being said - there really is no reason to 100% exit any position completely. Even if you just sell like X% of what you have every time it goes up a certain amount, you’ll always have SOME skin in the game. Presumably whatever reasoning you have behind buying XYZ had some logic behind it (other than meme stonk buys), so there’s some value in trusting your initial hypothesis and just keeping some small amounts IMO. Like if Bitcoin goes to 1MM, you better believe I will still have some, just a LOT LOT less of it, because of selling a lot on the way up.

The other thing is that you likely would have bought your Bitcoin from Mt Gox and lost them all anyway.

its like in poker how you only remember the bad beats but not the times you suck out on someone else. for every btc there are hundreds of other stocks/shitcoins that you sold out of that are worth <$5 now, you just don’t remember those ones.

Yeah already regretting unloading 100% of my SPCE shares on the pump last week. That was a bit of an emotional decision based on the meme overload. At least I put all the profits from that immediately back into crypto.

Ethereum up ~120% in '21 and don’t think has even been mentioned on this forum. Write off the crypto markets at your own risk… sure looks like they’re on a growth trajectory to me.

I mined for a bit but at best have a few hundred dollars in my wallet I bet. That’s when they were $3-5k and it wasn’t profitable so I stopped bothering. Now, my password is in my filing cabinets somewhere and I’ll need to dig through them to find it lol.

It seems like the risk-adjusted return is baked into the option prices, and so you have a high risk of losing lots of money. Maybe selecting the high-beta stocks based on a more reasonable filter than number of  's is to look at the beta for all S&P 500 stocks, and pick the highest ones, then filter from there, looking for the highest risk-adjusted return.

's is to look at the beta for all S&P 500 stocks, and pick the highest ones, then filter from there, looking for the highest risk-adjusted return.

Or, look for lowest beta stocks, so that the downside risk is much lower. I think this is the the traditional strategy of buy blue chips and write covered calls.

I found this by googling options strategy for high beta stock, and came up with this site. It shows Clorox as the lowest beta, scoring a sweet 0.4% option premium for a call expiring in 2 days. Do that 52 weeks/year, and you’ve got a 20% return, exclusive of the underlying stock valuation. That’s a Treynor ratio of 0.63, which is good I guess. AAPL’s Treynor ratio is 0.67, so maybe 0.63 is not that good. More research is needed.

Edit: site is stockoptionschannel dot com

I should have done this. Bought some bitcoin at like 7k and sold at like 28k because I absolutely could not think of it going any higher and was expecting a big crash like before. Was only a couple hundred bucks iirc so wasn’t a big deal but still lol.

It’s going to be stories like this times a million. Lol at anyone who thought that the rich hedge fund investors were going to be the ones to lose money on this.

How can you be a true Elon cultist and only get in after this latest moonshot?

He wanted to get in early last year. I forget why he said he didn’t.

Told you guys Cinemark was going to bounce back today.

Back testing: CONFIRMED

I got one right! Posted this on Jan 7th when ETH/BTC ratio was 0.03 (now it is 0.044)

Well sure, I still have some of the NEBLio I bought for $1 in 2017, held through it’s pump to 60, back down to 0.30, and now is… 1.25.

Profit baby. Sign up for my masterclass.

But srsly, I was thinking in swing trading terms, where if I sell my bitcoin I’m immediately eyeballing when to jump back in (or in these current conditions it’s cycling btween bitcoin and alts). For people not wanting to bother with that bullshit then as they don’t find it fun then yeah, holding some position of what you’re longterm bullish on is obviously good.

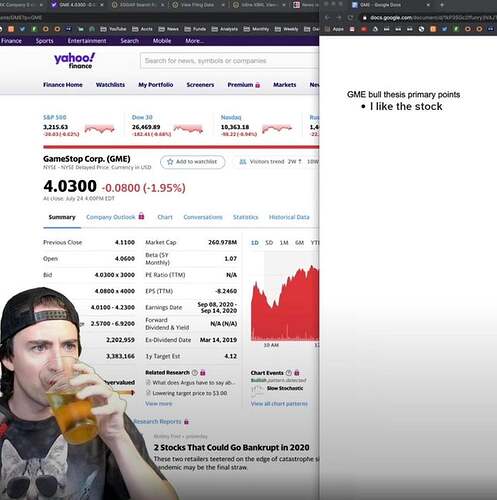

Apparently DFV held? I’m not seeing that in this pic but reddit is acting like he is still holding which is really stupid lol

I thought this dude was pretty smart for his initial analysis of GME, but apparently he’s just an idiot who got super lucky lol.

I was actually kinda getting the impression that there’s No Cryptocurrency Talk In The Champagne Room and felt bad about starting some. We can start a separate thread.

I would be down for a separate thread, don’t wanna muddy up the stonk thread with crypto memes

Chances are you would have been hacked and lost them all anyway. Didn’t the majority of those early exchanges get hacked at some point?

Just curious, what is the bull case for ETH over BTC given ETH supply is uncapped?

BTC is big and slow and clunky. BTC doesn’t have cryptokitties.